Government shutdown’s implications for pig farmers are in the numbers

Pork industry will eventually feel the loss of some information but having daily slaughter and purchases and prices for hogs and pork will allow the industry to operate more-or-less smoothly.

January 7, 2019

The partial government shutdown is now in its third week. While taking a toll in some areas, pork producers haven’t felt the sting — yet. Prices and quantities are still being gathered and published by USDA’s mandatory price reporting system. Those include both hogs and pork, and are keeping the trade well informed about current market conditions. Think of how lost we were two weeks into the October 2013 shutdown.

Those producers who question the value of the National Pork Producers Council efforts in Washington, D.C., they need to re-think those questions now. The NPPC fought long and hard to get price reporting included as “essential,” and this is the payoff. The NPPC staff deserves a lot of credit for this — and deserves the support of all producers for it and so much more.

This doesn’t mean the industry will get off scot-free from this shutdown. While we get daily prices, hog numbers, wholesale cut volumes and estimated slaughter, there already is some missing data and there will be more if the shutdown continues. Actual slaughter data from two weeks ago were not reported last week because those data run through the National Agricultural Statistics Service, an agency that is on furlough. Same for Friday’s export data that comes from the Department of Commerce through the USDA’s Foreign Agricultural Service, as well as today’s carcass weight version of those exports that comes from the USDA’s Economic Research Service.

And there is more to come. The USDA’s chief economist announced last week that this week’s scheduled World Agricultural Supply and Demand Estimates report would be “suspended.” We think that means delayed pending the resumption of government funding, but we aren’t sure.

One thing is certain: The January report that is the final say on the previous year’s corn and soybean crops will not be published on Jan. 11. That could also apply to monthly livestock slaughter, cold storage and cattle on feed reports and the quarterly grains stocks and annual cattle (inventory) reports due out at month’s end.

The pork industry will eventually begin to feel the loss of some information but having daily slaughter and purchases and prices for hogs and pork will allow the industry to operate more-or-less smoothly.

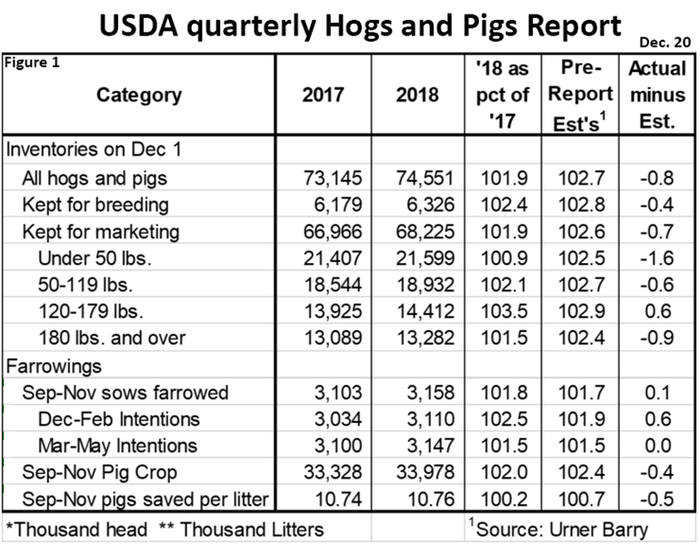

December’s Hogs and Pigs report is a bit of old news at this point, but there are some things that producers need to realize about its implication. Our table of the key national data appears in Figure 1.

We think there are few key longer-term takeaways.

The breeding herd continues to grow year-on-year but has stabilized. The herd has been between 6.32 million and 6.33 million in each of the last three quarters. December’s year-over-year change of 2.4% is the smallest of the three. A steady herd reflects lower profit expectations, heightened risk (see last week’s excellent discussion by Chip Whalen) and — some financial challenges. We have heard of several producers whose expansion plans have been slowed or eliminated by concerned bankers. A number of sow farms have been offered for sale on various internet sites. Things aren’t quite as rosy and the lack of quarter-to-quarter change in the breeding herd is a result.

The market herd was record large for Dec. 1, but the growth rate (1.9% year-over-year) is much slower than in recent quarters. In fact, the December year-over-year increase is the smallest since December 2015. The increase still leaves market inventories generally on their post-porcine epidemic diarrhea virus trend but being the lowest rate in three years and being sharply lower than expected both add up the same conclusion as in No. 1 above: Things are cooling a bit.

Some made a lot of the sharp slowdown in litter size growth. The truth is that the 0.02 pigs (0.2%) increase is the smallest in a non-PEDV quarter since the third quarter of 2003 — 16 years ago. The question is whether it is a new, slower trend or an outlier. We won’t know that for a while, but I am on the side of outlier because it represents litters farrowed almost exactly four months after the rapid run-up in temperatures last May. While modern buildings have mitigated seasonal infertility to some degree, they haven’t eliminated it and that heat wave was so sudden and so severe that I cannot dismiss it. Data from the next several quarters will tell the true story.

Farrowing intentions are still a mystery. The September-to-November farrowings were increased from their intended level last quarter, continuing a pattern that goes back four years. The December-to-February intentions appear to fit the breeding herd (up 2.5% versus up 2.4%), but the March-to-May intentions at up 1.5% appear to be woefully low unless breeding herd performance falls out of bed.

The report did little to change anyone’s mind. As of Friday, April lean hog futures were down $1.025 from their close on Dec. 20, the day of the report. Every other contract through August 2019 was $0.075 to $0.425 lower and October 2019 and onward contracts were up slightly.

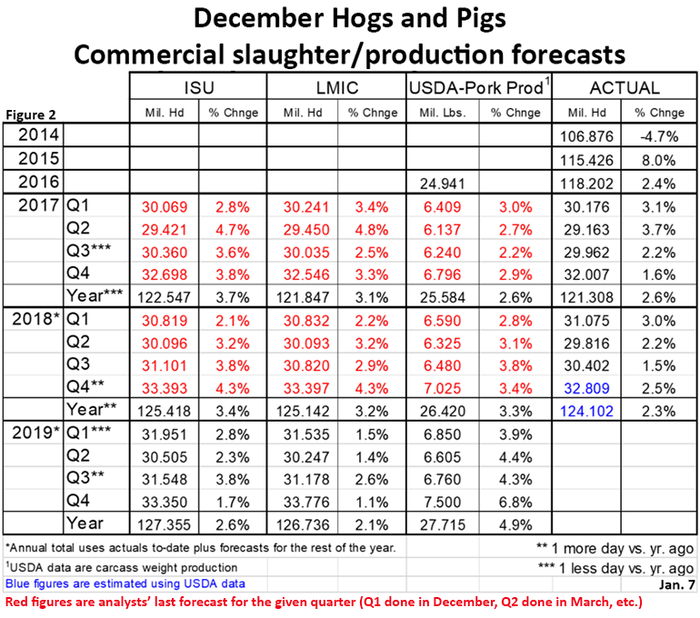

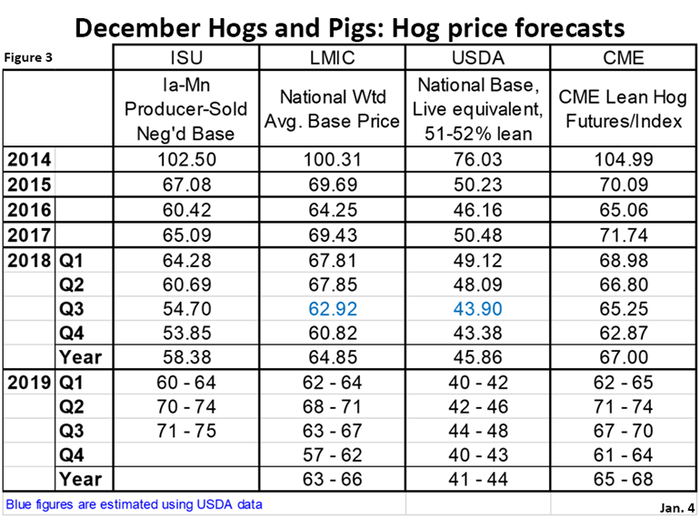

Supply and price forecast from Iowa State University, the Livestock Marketing Information Center and USDA’s December WASDE report appear in Figures 2 and 3. Note that USDA’s output numbers are production, not slaughter and that USDA’s prices are liveweight prices.

In closing, the aforementioned Livestock Marketing Information Center is an organization that gets little publicity but provides immense value to the U.S. beef, pork and poultry industries. The National Pork Board has been a member for many years and the data and services provided by the LMIC have been invaluable to my work on behalf of the NPB.

Jim Robb, the LMIC’s long-time director, has been a major reason for its success and value. He retired last week from the full-time director position and will work half time for a period as senior economist while spending much more time with his dear wife, Mary, and son Brian. Here is wishing Jim the best in his retirement! Well done. Thousands and thousands of us are in your debt.

About the Author(s)

You May Also Like