While hog producers continue to bleed red ink as December closes out, the market projects positive margins heading into both the second and third quarters of 2019.

With 2019 about to begin, U.S. hog producers are hopeful that the new year will deliver better financial outcomes for their operations than what 2018 provided. Among other casualties of the escalating U.S. trade war, the swine industry was arguably one of the most negatively impacted. The unfortunate timing of retaliatory tariffs placed on U.S. pork exports by key buyers such as Mexico and China came at a time when hog supplies and pork production were beginning to increase. A recently updated monthly study conducted by Lee Schulz at Iowa State University estimating farrow-to-finish hog producer returns showed that there were only four profitable months throughout all of 2018 — January, February, June and July.

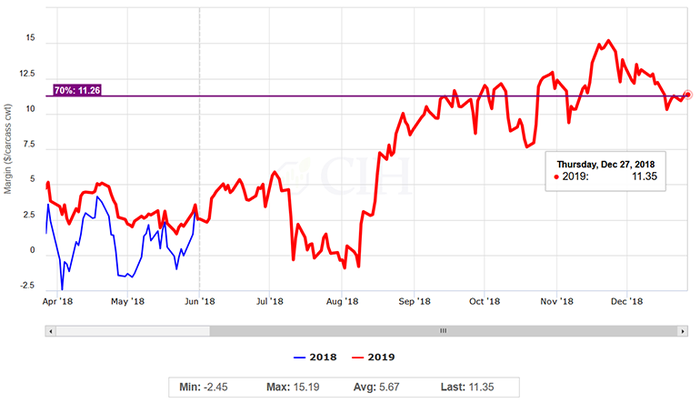

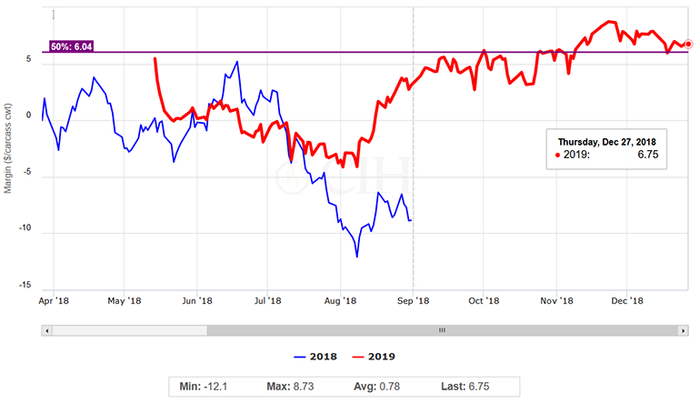

While hog producers continue to bleed red ink as December closes out, with losses expected to continue through the first quarter, the market projects positive margins heading into both the second and third quarters of 2019. Although not exactly strong from a historical perspective, margins are nonetheless above average and near the 70th percentile of the previous decade in the case of the second quarter which is much stronger than where actual second quarter 2018 margins were earlier this spring as well as those projected for the second quarter of 2019 at that time (see Figures 1 and 2).

Figure 1: 2019 Quarter 2 hog margin

Figure 2: 2019 Quarter 3 hog margin

Optimistic futures market

Part of the reason why the outlook for next year’s spring and summer quarters is looking better has to do with expectations for demand prospects despite the increased production we are seeing. In the most recent December World Agricultural Supply and Demand Estimates, the USDA increased their projection for 2019 pork exports by 250 million pounds to 6.45 billion. The verbatim text of the report states that continued strong global demand for U.S. pork was behind the revision, with China likely to be a big player in the market next year given their ongoing struggles with African swine fever. While expectations for large Chinese imports ahead of their Lunar New Year holiday have not panned out, the domestic hog industry in China is going through big structural changes with smaller scale operations being phased out in favor of larger commercial farms.

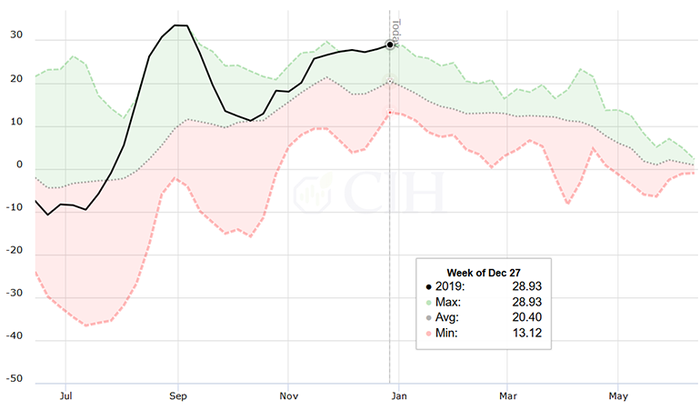

The current trade truce between the United States and China to allow time for negotiators to reach a broader agreement by March 1 is keeping hope alive that punitive tariffs on U.S. pork will eventually be lifted. However, there is no guarantee that a comprehensive deal can be struck on such a short timeline. Despite this uncertainty, the market is optimistic over demand prospects next year as summer hog futures are trading at record premiums relative to the current CME Lean Hog cash index for this time of year. In fact, the current premium of nearly $29 per hundredweight is close to a record set last year in late-August and early September of $33.45 per hundredweight for any time of the year (see Figure 3).

Figure 3: 2019 June lean hog futures minus CME lean hog index (10-year range)

Obviously, in order for this spread to reconcile by mid-June when the futures contract expires, either the value for cash hogs needs to come up over the first half of the year and/or the futures price needs to come down. While it is normal for cash hog prices to move higher from the beginning of the year to mid-June, the average gain over the past 10 years has been $17.66 per hundredweight which leaves a lot of room for futures prices to decline — particularly if current demand expectations are not met. The latest quarterly Hogs and Pigs report from the USDA does add some optimism from a supply standpoint given the smaller-than-expected inventory of lightweight pigs that will come to market in late-spring, although there is still quite a bit of risk premium reflected in summer futures prices.

Risk management considerations

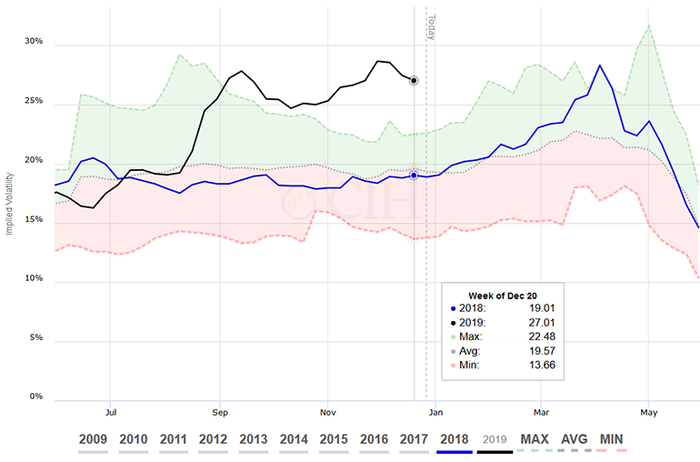

Given positive forward margins and the large premium of deferred futures prices to spot cash values, as well as ongoing trade uncertainties, it makes sense to implement a risk management plan to hedge against potential market weakness. We highlighted a couple months back that the market environment was reflecting increased uncertainties with a spike in the implied volatility of option premiums. This remains the case with implied volatility trading well above historical averages both on an absolute basis and from a seasonal perspective. Figure 4 charts the implied volatility of at-the-money options for June Lean Hog futures. At just over 27%, the current level of implied volatility is a full 8% above last year at this time, and trading at new 10-year highs for this time of year. It is also only 4.63% below the all-time high for June option implied volatility at any time during the calendar year.

Figure 4: 2019 June lean hog option implied volatility and 10-year range

We also pointed out previously that this spike in implied volatility has made it more expensive to purchase options and hedge against market risk in forward periods. Because implied volatility provides an objective measure of an option’s cost, this heightened volatility means that one is buying an inflated asset when purchasing options to protect against adverse price changes. This presents a challenge to risk management decisions in the current environment as most producers will want to initiate flexible strategies that retain the opportunity to participate in higher prices.

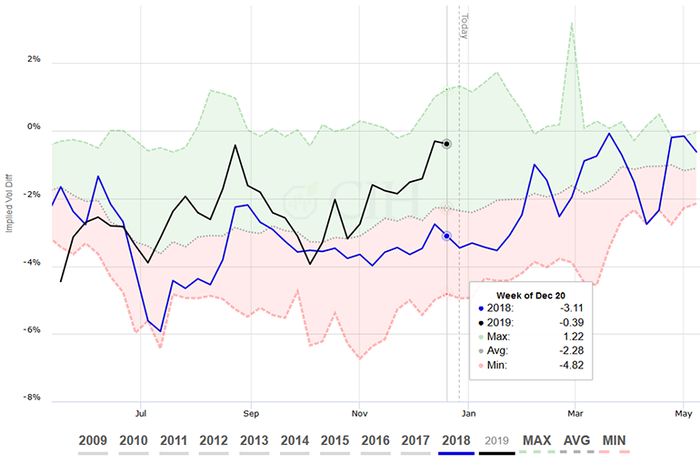

Because this flexibility comes at a high premium though, it makes sense to look for ways to minimize the cost in a risk management strategy. One interesting aspect of the current market revolves around the relative pricing between calls and puts an equal distance away from the market. This study, referred to as the implied volatility skew, measures the difference between implied volatilities of out-of-the-money puts and calls that are similar distances above and below current price levels. For certain markets such as livestock and equities, it is normal for there to be a downward skew, meaning that downside puts trade at higher implied volatilities than upside calls.

In the present environment however, the skew is nearly flat with upside calls trading at implied volatilities almost equal to downside puts a similar distance out of the money. The reason for this, of course, is that the market is concerned of the possibility of a large rally should China enter the market and purchase large quantities of pork over the medium to longer term. While this certainly is possible if a trade deal is reached given their ongoing struggles with ASF, it is important to keep in mind that deferred hog futures are already reflecting expectations for very strong demand next summer given their premium to spot cash prices. Figure 5 shows the spread or difference in implied volatilities of June hog calls compared to puts with deltas of 25 — roughly $8 to $12 per hundredweight out of the money.

Figure 5: Call put skew

One way to take advantage of this implied volatility skew while addressing the high cost of options in the present environment would be to sell call options in order to finance the purchase of put options. Since the implied volatility skew shows that call premiums are inflated relative to put premiums, and implied volatility in general shows that option premiums are expensive, this type of minimum/maximum price strategy would address both market factors.

As an example in June Hogs, buying an $80 put option would cost about $5 while selling a $90 call option would bring in a credit of approximately $3 per hundredweight. Therefore, for a net cost of around $2 one would effectively have a minimum price of $78 and a maximum price of $88 before basis or any carcass merit premiums a packer would apply upon delivery.

While some producers may not like the idea of being capped at $88, it is important to keep in mind that this is still $6 over the current market and represents an over $17 per hundredweight margin at the 89th percentile of the past decade, holding feed costs constant. For an operation that is currently open and carrying all of the risk on their late-spring/early summer hog production, this probably isn’t a bad way to start at least taking some risk off the table for the second quarter.

For more help on evaluating specific strategy alternatives or to review your operation’s risk profile, please feel free to contact us.

There is a risk of loss in futures trading. Past performance is not indicative of future results.

About the Author(s)

You May Also Like