Year-End Consumption Data is Good News for Pork

Beef and pork demand increased last year by 0.9% and 1.0%, respectively. Chicken demand fell by 0.9%. Now consider this: Per capita beef consumption, on a retail weight basis, declined by 2.3 lb. (3.8%).Per capita pork consumption on the same basis declined by 2 lb. (4.3%).Per capita chicken consumption increased by 0.4 lb. (0.5%) retail weight.

February 21, 2012

The export data highlighted in last week’s report was the last piece of data needed to compute actual domestic per capita consumption and, thus, the demand indexes for December and for 2011.

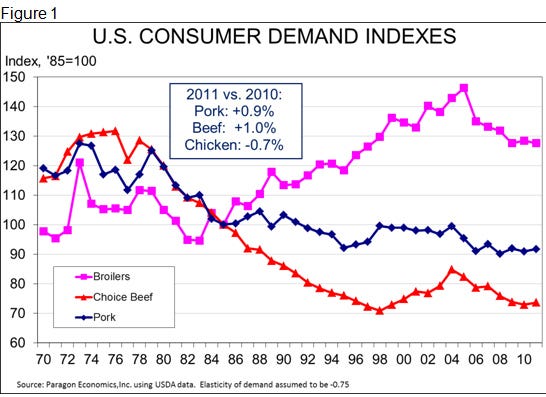

The news for pork was good indeed. Ditto for beef. For chicken, not so much. Figure 1 shows the familiar chart of demand indexes since 1970. Remember, these are indexes, so they represent status of demand for each species relative to its level in the base year, 1985. In addition, remember that this is domestic per capita demand – it does not include exports. It represents the collective demand from a stable population; therefore, the positive demand impacts of population growth are removed. That growth, historically, has been about 0.8% per year, but growth slowed to 0.7% in 2010 and 2011, primarily due to the recession.

Beef and pork demand increased last year by 0.9% and 1.0%, respectively. Chicken demand fell by 0.9%. Now consider this:

· Per capita beef consumption, on a retail weight basis, declined by 2.3 lb. (3.8%).

· Per capita pork consumption on the same basis declined by 2 lb. (4.3%).

· Per capita chicken consumption increased by 0.4 lb. (0.5%) retail weight.

Many might be thinking: “That can’t be! How can demand increase when consumption is falling?” Well, it can be because (now let’s all repeat this together) – “demand is not consumption.”

The decline in per capita pork consumption from 47.7 lb. in 2010 to 45.7 lb. in 2011 was due to higher U.S. population and robust exports. Production was actually 1.4% higher in 2011, but less of that product was available to U.S. consumers.

Demand is higher in spite of lower consumption because consumers paid more for both beef and pork than the lower consumption levels would have required had their demands been stable. The lower per capita consumption figures were accompanied by 6.5% higher retail beef prices and 6.9% higher retail pork prices.

Conversely, the increase in per capita chicken consumption was accompanied by a 2.25% reduction in real chicken price – a larger reduction than the higher availability/consumption would have suggested should occur if demand was stable.

Is Pork Consumption Sustainable?

Several people have asked: “How will consumption hold up as prices rise?” The answer is it will not because lower consumption is caused by lower availability and lower availability causes higher prices. But lower consumption at higher prices does not mean demand is being destroyed. It only means consumers are behaving rationally and allocating scarce resources (dollars) among competing uses. That is the essence of economics.

Am I concerned about declining per capita consumption? Absolutely. I am indeed concerned that people are eating less meat and poultry. But that is their choice.

My real concern is that those decisions are being made based on fear that meat and poultry is bad for you as part of a balanced diet or that meat and poultry production are, as some have alleged, a major cause of global warming or that kids really don’t need meat protein in their diets as long as they are force-fed enough vegetables. I don’t think any of those are true, but they are popular in today’s culture. So, the part of this reduction that is caused by misinformed consumers either not eating meat or eating less meat concerns me greatly.

But even more important to me is that we are simply pricing meat out of the diets of some people. The reason consumption has fallen is that production has fallen and the reason that production has fallen is that producers/processors cannot afford to deliver meat and poultry protein to consumers at the same price we once delivered it. It simply costs too much, so we deliver less product in order to get higher prices. The mechanism to get less product, of course, has been economic losses to producers that have driven some out of business and caused others to shrink.

Was it a conscious decision to drive up meat prices? Maybe. Maybe not. But the impact of the energy and grain policies of the 2000s, as well as increased regulation and regulatory scrutiny, has been to cause meat and poultry protein prices to explode. I, and many of you, have been blessed in that our consumption levels may not decline given those higher prices. We can afford what we want. But many, many people do not walk in our economic shoes and I feel bad that they will be forced to reduce their consumption of these delicious and nutritious products due, simply, to higher costs.

About the Author(s)

You May Also Like