U.S. positioned for slowdown in China's pork demand

Competitive landscape will intensify as China's demand further softens.

July 14, 2021

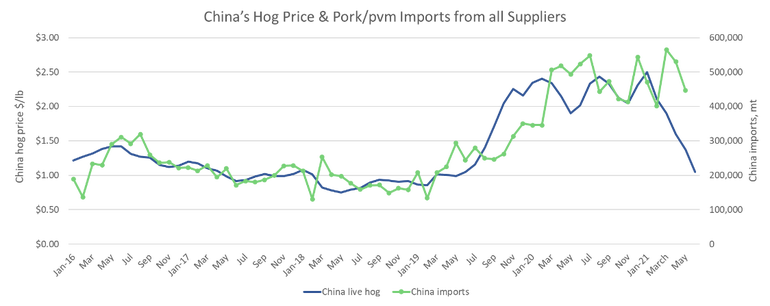

In early 2021 it was difficult to gauge the pace at which China's domestic pork production was rebounding from the impact of African swine fever (ASF). Outbreaks of ASF persisted in several regions, and reliable production data became even more elusive than usual. Government reports suggested a robust swine herd recovery, but this didn't seem to match up with the continued flow of imported pork entering China.

Late spring brought more clarity to the production outlook, as China's live hog and pork prices steadily declined and didn’t bottom until June 22. The average live hog price, which began 2021 at nearly $2.50/lb., sank to a low of about $.90/lb. on June 22 before rebounding above $1.05/lb. by the end of June. Prices rebounded further to $1.15/lb. in early July, but this was still more than 50% below year-ago levels.

Another indication of the significant swing in China's pork supply situation is that the government has shifted away from releasing central pork reserves and has begun purchasing pork as a price-stabilizing mechanism. Last year, China's Merchandise Reserve Management Center released a total of 670,000 metric tons (mt) of pork into the market in an effort to ease consumer prices. This practice continued in early 2021, with 210,000 mt auctioned from Jan. 1 through early March. But the last release of pork reserves was March 10, and on July 7 the agency held its first central reserve frozen pork purchasing and storage bidding transaction, for a volume of 20,000 mt.

The U.S. Meat Export Federation (USMEF) expected U.S. pork exports to China to decline in 2021, when compared to last year's very high volumes, but that exports would still be the second largest on record. As projected, pork muscle cut exports to China totaled 266,836 mt through May, down 30% from a year ago but nearly four times the 2019 pace. On a very positive note, pork variety meat exports to China are larger this year, up 15% to 135,000 mt, valued at $329 million (up 17%).

"Finding alternative destinations for pork variety meat is especially challenging, so China's continued demand for those items is very beneficial for the U.S. industry," said USMEF Economist Erin Borror. "Variety meat exports have also increased to Mexico, Central America and the Philippines. May exports were the largest of the year at 50,000 mt, which helped bolster overall carcass value."

For the full year, USMEF expects pork muscle cut exports to China to be down about 20% year-over-year at 584,000 mt, but for global exports to be steady at 2.5 million mt. So which markets will make up for softer demand from China?

"Keep in mind that China's post-ASF surge in pork imports drew product away from other markets – not just in Asia but everywhere," Borror explained. "With limited global supplies and domestic production challenges in many countries, this had an adverse effect on pork consumption. Rebuilding that demand is the key to offsetting the lower volumes to China."

To maintain overall export growth the U.S. industry needs contributions from many countries, none more critical than Mexico. U.S. exports to Mexico peaked in 2017 at just over 800,000 mt (including muscle cuts and variety meat). After a fast start in 2018, exports felt the impact of retaliatory duties in the metal tariffs dispute. Those duties were removed in late May 2019, but exports have not fully recovered due to a number of factors. These include COVID's impact on Mexico's economy, heightened competition from Mexico’s domestic pork production and Canadian pork and China's unprecedented demand for imports.

Demand from Mexico is showing signs of a strong rebound in 2021. In fact, Mexico has reclaimed its position as the leading destination for U.S. muscle cuts, with exports (through May) topping 275,000 mt, up 20% from a year ago, and value climbing 37% to $551 million. Pork supplies are tight in Mexico due to swine disease challenges in the winter and spring, as evidenced by record-high live hog prices in April and May. A larger share of Mexican pork is also being exported, with China as the big growth market. China narrowly edged out Japan as the top destination for Mexican pork in the first five months of the year, taking 47,750 mt (up 34%) while Japan took 47,690 mt (down 1%). A slowdown in China’s demand will also impact Mexico’s exports, but the Mexican pork industry continues to aggressively pursue growth in Asia.

Central America has been a star performer for U.S. pork in recent years, with exports setting another new record in 2020 despite foodservice lockdowns and other COVID-related challenges. Demand has surged in 2021, with exports through May up more than 50% in both volume (nearly 58,000 mt) and value ($149 million). There is room for further consumption growth in Central America and larger imports have been needed to offset smaller domestic production as well as to meet growing consumer demand for pork. Consumers are increasingly recognizing the relative affordability of U.S. pork, as well as its nutritional value, convenience and high quality. The U.S.-Central America-Dominican Republic Free Trade Agreement (CAFTA-DR) also ensures that most U.S. pork enters the region at zero duty.

Colombia's economy was hit very hard by COVID in 2020, and while those challenges persist in the first half of this year, exacerbated by widespread protests and labor strikes, pork demand has posted an impressive rebound. Through May, exports to Colombia were up more than 40% from a year ago to 41,000 mt, valued at $94 million. Colombia’s hog prices dropped in the second quarter of 2020 with the initial COVID impacts, but rebounded sharply and have been at or near record highs through the first half of 2021.

Canada has been impacted by volatile access to the Chinese market, with a complete suspension in the second half of 2019. Then several plants delisted from mid-2020 after access had resumed. Even with these restrictions, Canada’s exports outpaced production growth in 2020, leaving less pork on the domestic market and resulting in a drop in per capita consumption (or supplies) of more than 10%. U.S. pork helped fill some of this void and U.S. exports to Canada continue to increase this year, with exports through May up 4% year-over-year to more than 92,000 mt, while value jumped 17% to $378 million.

"Growth opportunities for U.S. pork are not limited to the Western Hemisphere, but this is where USMEF sees the greatest opportunities emerging in the second half of this year," Borror said. "This is our backyard, where the U.S. industry can continue to help grow and rebuild pork consumption. It's where we can best compete, considering our labor constraints and shipping obstacles."

Rebounding consumption will also generate growth opportunities in Southeast Asia – including in the Philippines, where imports are benefiting from temporary tariff relief. Other key destinations in the region include Vietnam and Singapore. South Korea has a growing appetite for U.S. chilled pork, and the U.S. industry has also capitalized on robust sales of convenience-based items in both traditional retail venues and e-commerce. Retail demand remains strong in Japan, but the foodservice sector continues to struggle under shorter operating hours and other COVID-related restrictions in major metropolitan areas.

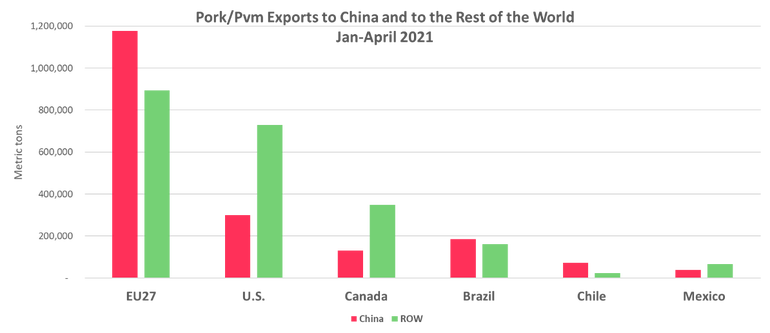

China has accounted for 62% of the European Union's pork exports this year, which reached a record 1.9 million mt through April. Shipments to China totaled 1.18 million mt, up 17%, but even with continued growth to China, EU exports to many other Asian markets such as the Philippines, Hong Kong, South Korea, and Vietnam were up sharply from a year ago.

"Achieving continued growth in Asia is very important for the U.S. industry, but as China's demand further softens the competitive landscape will intensify," Borror said. "We view this situation as being similar to 2014, when Russia closed to imports from the EU and European pork poured into a wide range of Asian markets. There will be growth opportunities in Asia, but amid a very crowded field of aggressive suppliers."

About the Author(s)

You May Also Like