U.S. pork capitalizing on trade agreement with Japan

Rebound in ground seasoned pork exports is beneficial from a carcass utilization standpoint, as the common raw material for this product is the boneless picnic.

July 8, 2020

U.S. pork exports to Japan have moved notably higher in 2020, bolstered by tariff relief provided in the new U.S.-Japan Trade Agreement. The agreement entered into force Jan. 1, leveling the playing field with major competitors such as Canada and the European Union. Imports from the United States, Canada, Mexico, Chile and the EU received another round of tariff reductions on April 1, the beginning of the Japanese fiscal year.

In 2019, U.S. pork faced an uphill battle in Japan as the Comprehensive and Progressive Trans-Pacific Partnership and the EU-Japan Economic Partnership Agreement entered into force. This was reflected in our trade data, as U.S. pork exports set new records worldwide but shipments to Japan declined by 6% to about 370,000 metric tons. Export value to Japan was also down 6% to $1.52 billion — the lowest in more than 10 years.

"At the time it was signed, I stated that the U.S.-Japan Trade Agreement was one of the biggest trade breakthroughs in the history of the U.S. red meat industry," says Dan Halstrom, president and CEO of the U.S. Meat Export Federation. "After half a year of the agreement being in effect, that feeling is stronger than ever."

Exports to Japan posted a strong first quarter this year and were especially impressive in April, following the latest round of tariff relief. Despite temporary U.S. plant disruptions and other challenges related to COVID-19, April exports to Japan soared 28% year-over-year to more than 39,000 mt, valued at $164.2 million (up 39%). Exports declined in May as interruptions in U.S. production intensified, but January to May volume was still 7% higher than a year ago at just under 170,000 mt, while value increased 10% higher to $704 million. Japanese import data (also through May) underscore the resurgence of U.S. pork, with overall market share climbing from 32.5% to 38%.

With restaurant traffic limited due to COVID-19 and children being out of school much of this year, Japanese consumers are preparing far more meals at home. U.S. chilled pork was well-positioned to meet this need, as were processed products, especially sausages, derived from U.S. ground seasoned pork. Japan's import data show a 4% increase in U.S. chilled pork at 88,217 mt. Japan is the top market for U.S. pork exports on a unit value basis and is the second largest volume market after Mexico. Chilled pork accounts for more than half of total U.S. pork exports to Japan, much of which is high-value product destined for retail.

Reclaiming a critical customer base with U.S. ground seasoned pork

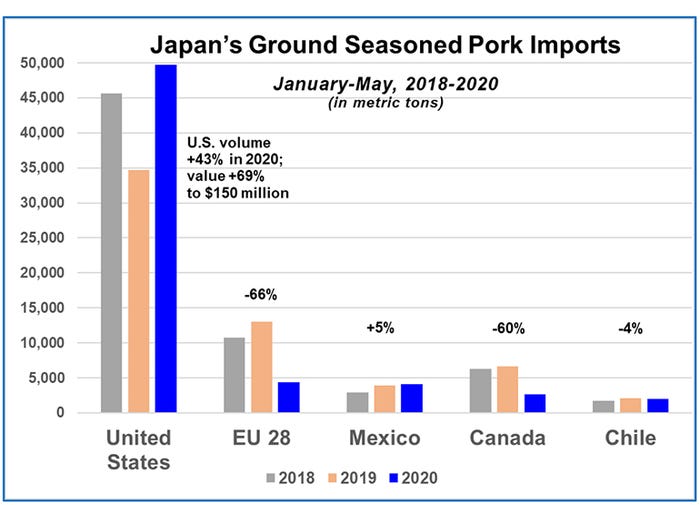

The biggest growth driver in 2020 has been U.S. ground seasoned pork, with Japan's imports increasing 43% to nearly 50,000 mt, while value soared 69% to $150 million. U.S. market share of Japan's ground seasoned pork imports rebounded dramatically to 79%, up from 57% in January to May 2019.

"If you want a case study for why a level tariff playing field matters, there is no better example than our ground seasoned pork exports to Japan," Halstrom explains. "Prior to 2019, ground seasoned pork imports were subject to a 20% duty. When Canada and the EU got tariff relief, U.S. exports took a major hit due to the price disadvantage. Now that we're subject to the same reduced rate as our competitors (now 10%, phasing to zero in 2023), U.S. ground seasoned pork is reclaiming market share in a big way."

This rapid rebound in ground seasoned pork exports to Japan is especially beneficial from a carcass utilization standpoint, as the most common raw material for this product is the boneless picnic. This cut has limited appeal in the domestic market and though it is exported to other destinations, Japan delivers outstanding returns.

"Picnics are a key export item for several markets and especially popular with processors in South Korea, Mexico, Canada and Colombia," Halstrom says. "But from a value-added standpoint, the U.S. industry benefits greatly when we are moving picnics to Japan in the form of ground seasoned pork. This is a critical customer base for a value-added product that the U.S. industry spent decades building, and which we simply could not afford to lose."

Connecting with Japanese consumers during COVID-19

While retail demand for red meat has soared in Japan during the COVID-19 pandemic, the U.S. industry has faced new challenges when showcasing products for consumers. The current environment is not conducive to traditional supermarket tastings and cooking demonstrations, so the USMEF has accelerated efforts to reach consumers through social media and other online platforms that extol the attributes of U.S. pork.

"Japanese consumers are very tech-savvy but compared to some other Asian markets, they are not as inclined to purchase food online for pickup or delivery," Halstrom says. "Most still prefer to shop in person, but right now they're spending less time in the store and are not as open to face-to-face engagement. This makes it even more important that we communicate effectively online to get U.S. pork to the top of their shopping list."

For a video update on the Japanese market, visit the USMEF's YouTube Channel.

Source: U.S. Meat Export Federation, which is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like