The end of the party or an accidental Barry Manilow song?

Reprieve in bull market will ultimately look like a blip on the radar of a steadily up trending market.

April 19, 2021

Pork producers have enjoyed a wild ride from hog futures trading in the mid-$70s during the throes of COVID to the recent peak of $110 in the June 2021 contract. This $35 move in futures represents a roughly $2 million profitability swing for every 1,000 sows of production. Those are big economic impacts and demonstrate the leveraged nature of pork economics and the role that changes in the revenue side represents.

Given this first wrinkle in an otherwise steadily firming market, participants have got to be asking the question of whether this is the end of the ride or just a temporary setback. It is my opinion that it is the latter – a reprieve in a bull market that will ultimately look like a blip on the radar of a steadily up trending market. Let’s unbundle this one a bit.

First, we are not being overrun by supply. Our sub-2.5 million head per week harvest is not putting pressure on the cash or product market. Our supply of market-ready animals will steadily move lower (perceived inventory derived from the recent “Hogs and Pigs” report) from here, with available numbers ebbing at under 2.4 million head per week by Memorial Day. We are at a time of the year when the weekly harvest traditionally slows, which normally adds strength to the cash market. This year is no different, and it may be even a bit more pronounced in the decline if the number of open finishing barns and demand for wean/feeder pigs is any indication. At any rate, this is not a bearish set up.

Second, packer interest for our commodity has not waned. Make no mistake – you are in a commodity business and the nature of the live hog trade means that the tail (the roughly 2% of the hogs that trade in the negotiated market) tend to wag the dog (the other 98% of the volume). Cash prices have moved steadily higher throughout this disruption period as the packing community continues to bid for the available supply. This is good fundamental news that warrants noting.

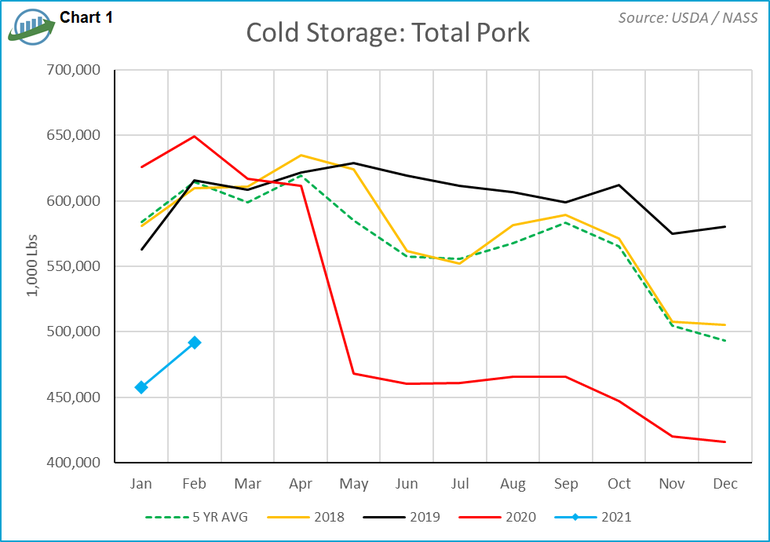

Third, there is no place to turn in the event that the supply of the aforementioned supply of hogs comes in short. Cold storage supplies of pork have been running roughly 25% lower than normal for almost an entire year (Chart 1). There are limited frozen stocks to pull in the event of an online disruption. This lack of buffer stocks will keep the stimulus/response implications of any uptick in demand in the pork market closely correlated to the hog market. More good news.

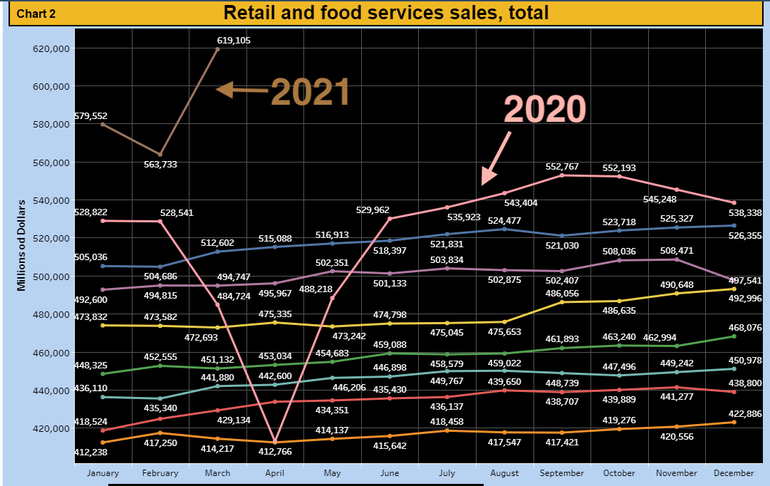

Next, Chart 2 shows that domestic sales in the retail and food service sector have not only rebounded, they are establishing new highs. Certainly, a portion of this is refilling the depleted pipeline, but the majority is likely a combination of pent-up demand meeting new stimulus money.

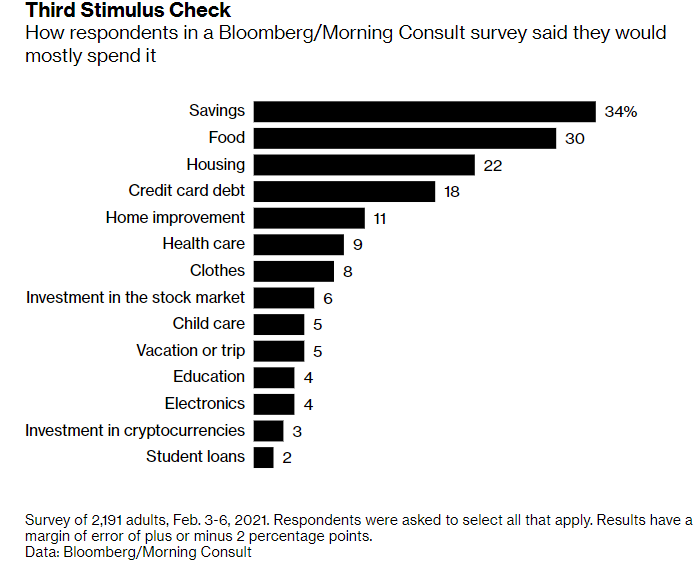

Prior to the issuance of the most recent round of governmental distribution, a poll was taken in an attempt to discern just how Americans planned on handling their new-found pennies from heaven. The top category was savings, which seems rather like a rather noble answer to me. The second category was food. I like that answer, too, as it fits our interests and correlates with our other observational data that domestic demand for pork remains robust. Make no mistake – the increase in prices we have experienced recently are primarily driven by demand. I wrote extensively on this topic last month and still firmly believe that our demand driven market is both more sustainable and has stronger underpinnings than a temporary supply disruption. This is all good stuff.

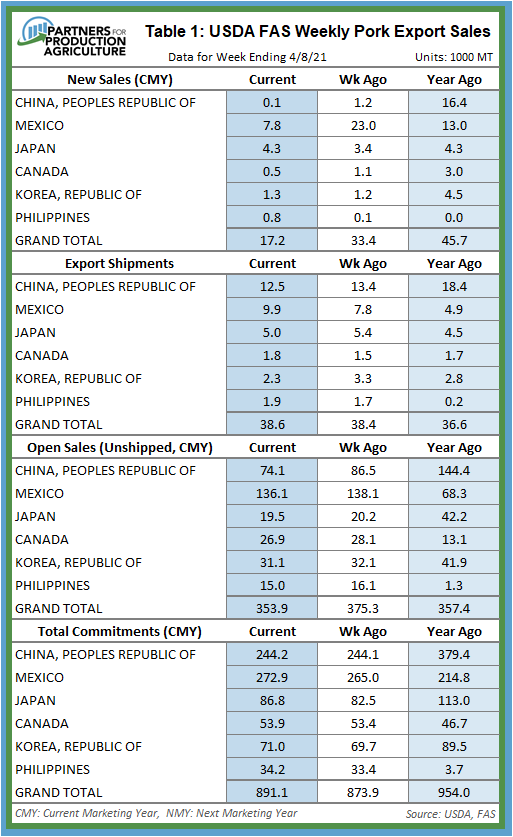

A lot of us hold our breath each Thursday morning at 7:30 a.m. when the export sales numbers are released. Exports kept us together last year and holding serve year-over-year would feel like a win. I think we have a decent chance of doing just that. Table 1 depicts our major export destinations. The positions have jockeyed around compared to last year, with Mexico picking up the slack from China and sales to the Philippines making up for weakness to other Asian destinations. The net change in sales and commitments are not markedly different than where we sat last year and that is an impressive accomplishment given today’s substantially higher prices.

I think the bottom line on price discovery is that numbers and statistics need to be understood in context, not just as a headline-grabbing item. For example, what if I told you that weekly harvest was going to be 50% higher this year compared to the same week one year ago? That would sound pronounced and on the edge of inflammatory until you considered the denominator in my example – the reduced run rates of last year – was the true story line. We are on solid fundamental ground in both the cash and the cutout market. Aberrations should be considered just that until the current picture changes.

Editor’s Note: The younger folk in our office did not quite catch the Barry Manilow reference. Here is one of his typical efforts to provide context to his party-killing genre.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. For more information, contact Joseph Kerns

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like