Tariff headwinds weigh on pork exports

November export data was released about one month later than usual due to the recent government shutdown.

February 8, 2019

U.S. pork exports in November trended lower year-over-year, according to statistics released by USDA and compiled by the U.S. Meat Export Federation, while beef exports continued on a record pace.

November export data was released about one month later than usual due to the recent government shutdown, and year-end 2018 data is expected to be available in early- to mid-March.

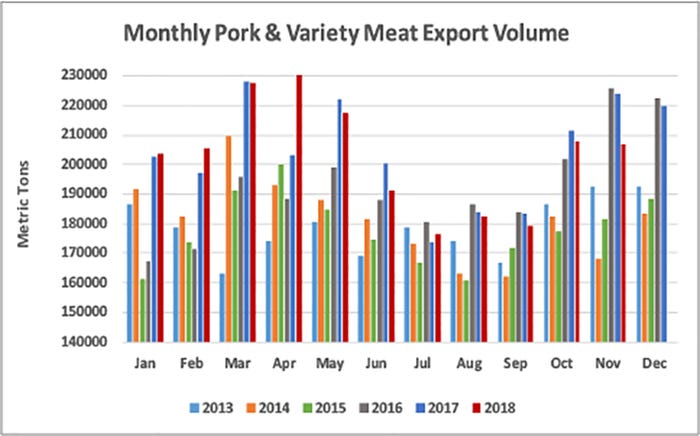

November pork exports totaled 206,852 metric tons, down 8% year-over-year, while value fell 12% to $538.7 million as retaliatory duties in key markets continue to generate headwinds for U.S. pork. For January through November, exports were steady with 2017’s record pace at 2.23 million mt and value was down 1% to $5.86 billion.

Trade barriers are also pressuring pork export value on a per-head basis. In November, export value per head slaughtered was $48.80, down 16% from November 2017. Through the first 11 months of 2018, per-head export value averaged $51.46, down 3%. Exports accounted for 24.5% of total November pork production and 22% for muscle cuts, down from 27.7% and 24.1%, respectively, in November 2017. For January through November, exports equated to 25.7% of total pork production (down from 26.5% in 2017) and 22.4% for muscle cuts (up slightly).

“2018 was truly a remarkable year for U.S. beef exports, which shattered previous records in both volume and value and reached new heights in several of our top markets,” says USMEF President and CEO Dan Halstrom. “In the first half of the year, pork exports were also on a very positive trajectory but unfortunately U.S. pork has been heavily targeted for retaliation. We remain hopeful that these disputes can be resolved soon, so that U.S. pork can get back on a level playing field with its competitors.”

Beef exports totaled 112,842 mt in November, up 1% from a year ago, while value climbed 6% to $709.2 million. For January through November, exports reached 1.24 million mt, up 8% year-over-year and 6% above the record pace of 2011. At $7.63 billion, beef export value was up 16% and has already broken the full-year record set in 2017 ($7.27 billion).

Beef export value per head of fed slaughter is also on a record pace, averaging $322.97 in November (up 5% from a year ago) and $320.72 during the first 11 months of 2018 (up 14%). Exports accounted for 13.1% of total November beef production and 10.9% for muscle cuts, both steady with November 2017. For January through November, exports equated to 13.4% of total production and 11.1% for muscle cuts — up from 12.8% and 10.3%, respectively, in 2017. These numbers highlight the strong international demand for U.S. beef as exports are accounting for a larger share of growing U.S. production and are fetching higher prices, with some U.S. cuts trading at record prices in Asia.

Report notes• Export statistics refer to both muscle cuts and variety meat,unless otherwise noted.• One metric ton equals 2,204.622 pounds.• U.S. pork currently faces retaliatory duties in China and Mexico. China’s duty rate on frozen pork muscle cuts and variety meat increased from 12 to 37% in April and from 37 to 62% in July. Mexico’s duty rate on pork muscle cuts increased from zero to 10% in June and jumped to 20%in July. Beginning in June, Mexico also imposed a 15% duty on sausages and a 20% duty on some prepared hams.• U.S. beef faces retaliatory duties in China and Canada. China’s duty rate on beef muscle cuts and variety meats increased from 12% to 37%in July. Canada’s 10% duty, which also took effect in July, applies toHS 160250 cooked/prepared beef products.

Bright spots for U.S. pork include Korea, ASEAN, Latin America and Oceania

After a very solid start to 2018, November pork exports to leading volume market Mexico were lower year-over-year for the sixth consecutive month (61,344 mt, down 14%) while value fell 30% to $97.1 million. This pushed January-November export volume slightly below the record pace of 2017 at 717,618 mt (down 1%) while value was down 11% to $1.22 billion.

“The good news is that the U.S. continues to export strong quantities of hams, picnics and other pork cuts to Mexico,” Halstrom says. “The bad news is that instead of generating positive returns for the U.S. industry, 20% of these sales go directly into the Mexican Treasury in the form of tariffs. This is why it is critical that the dispute over steel and aluminum tariffs be resolved as soon as possible.”

January-November pork exports to China/Hong Kong were down 29% year-over-year in volume (324,623 mt) and fell 19% in value ($790.2 million). This region is by far the largest destination for U.S. pork variety meat, and these exports also declined by 29% in volume (209,090 mt) and dropped 17% in value ($555.5 million) as the 62% tariff rate makes it very difficult for U.S. pork to compete in China.

The combination of retaliatory tariffs in China and Mexico contributed to sharp decreases in ham and picnic primal values (down 19% and 22%, respectively, from June through December, compared to the same period in 2017). The decrease in values for these two primals averaged $9.95 per head for those seven months. China’s retaliatory tariffs have also heavily impacted prices for pork offals and have forced some products into rendering due to the lack of alternative markets. Lost value for feet and picnic hocks was at least $1.80 per head and losses are even worse when products that have been rendered are included. The cost of these retaliatory tariffs has been lost value of at least $11.75 per head on just hams, picnics and feet, or roughly $860 million in industry losses from June through December 2018.

Other key details from the January-November pork export results include:

Although November results trended significantly lower, pork exports to leading value market Japan were up 1% year-over-year in both volume (364,114 mt) and value ($1.5 billion). Similar to beef, market access disadvantages in Japan are a major concern for the U.S. pork industry due to Japan’s implementation of Comprehensive and Progressive Agreement for Trans-Pacific Partnership and its economic partnership agreement with the European Union. The most immediate impact of these agreements is expected in Japan’s imports of ground seasoned pork and processed pork products as duties on those products are phased quickly to zero, while the U.S. pays 20%.

Korea stands out as the largest driver of growth for U.S. pork exports in 2018, with volume up 41% to 216,899 mt while value climbed 44% to $603.8 million — already shattering previous full-year records set in 2011. Unlike the situation at that time, when Korea was struggling with a widespread outbreak of foot-and-mouth disease, Korea’s domestic production was up 4% in 2018. The surge in exports to Korea is being driven by exceptional consumer demand and growing consumption. Most U.S. pork entering Korea also benefits from duty-free treatment under the Korea-U.S. Free Trade Agreement.

Led by strong growth in Colombia and Peru and a second-half rebound in Chile, pork exports to South America have already topped the records set in 2017, increasing 24% year-over-year in volume (120,059 mt) and 17% in value ($292.3 million). Colombia is an especially important destination for hams and picnics at a time when Mexico and China are imposing higher duties.

In Central America, pork exports were higher year-over-year in mainstay markets Honduras and Guatemala, and posted very strong growth in Panama, El Salvador, Nicaragua and Costa Rica. Export volume to the region was up 15% to 74,980 mt, breaking the 2017 record. Export value was 12% higher at $176.8 million, and will set a new record when December results are included.

Pork exports to the Dominican Republic have also exceeded previous yearly highs, with volume up 37% year-over-year to 39,453 mt and value jumping 29% to $85.7 million.

With solid growth in both Australia and New Zealand, pork exports to Oceania were up 12% in volume (77,336 mt) and 10% in value ($224.3 million). This region is also a key destination for U.S. hams when retaliatory duties are in place in Mexico and China.

Strong performances in the Philippines and Vietnam drove pork exports to the ASEAN region 46% higher in volume (63,978 mt) and 33% higher in value ($158.6 million). Pork variety meat exports to the ASEAN region were especially strong, more than doubling year-over-year in both volume (26,626 mt, up 138%) and value ($42.7 million, up 115%).

Asian markets set pace, but beef export growth widespread

November was another strong month for U.S. beef exports to the key Asian markets of Japan, South Korea and Taiwan, while exports to the ASEAN region also increased sharply. For January through November, beef export highlights include:

Exports to leading market Japan were up 7% year-over-year in volume (306,603 mt) and 10% in value ($1.93 billion). But market access to Japan is a major concern for the U.S. beef industry, as key competitors recently joined Australia in benefiting from an 11 percentage point tariff advantage through the CPTPP. U.S. beef remains subject to the 38.5% tariff rate and to Japan’s quarterly safeguard mechanisms. Competitors’ tariffs will decline again on April 1, the start of the Japanese fiscal year. The Trump administration has announced its intention to negotiate a trade agreement with Japan, but formal negotiations have not yet begun.

U.S. beef has already shattered the previous yearly value record in Korea, with export value soaring 45% to $1.6 billion, while volume was up 32% to 220,770 mt. Although Korea’s imports from Australia and New Zealand also edged higher in 2018, U.S. market share increased significantly — reaching nearly 50% in volume and 56% in value. Through the KORUS, the duty rate on U.S. beef to Korea is 18.7% this year, down from 40% prior to implementation.

Exports to Taiwan were up one-third from the record totals posted in 2017, reaching 53,626 mt valued at $495.7 million (a record for the sixth consecutive year). The United States holds more than 75% of Taiwan’s chilled beef market, the highest of any Asian destination.

Beef exports to Hong Kong were lower year-over-year in volume (109,082 mt, down 4%), but export value still climbed 13% to $865.3 million. Exports to China totaled 6,567 mt valued at $55.1 million. U.S. beef regained access to China in mid-2017, making year-over-year comparisons difficult. But in the second half of 2018, export volumes to China were higher year-over-year in every month except September, and November exports reached a new monthly high of 890 mt, despite an additional 25% retaliatory duty.

Led by strong increases in the Philippines and Vietnam and slightly higher shipments to Indonesia, beef exports to the ASEAN region climbed 19% year-over-year in volume (45,255 mt) and 31% in value ($252.4 million).

Although beef exports to Mexico were up just 1% year-over-year in volume (218,281 mt), export value to Mexico climbed 8% (to $966.7 million) and will exceed $1 billion for the first time since 2015. The hike in value reflects a strong year for beef muscle cut exports to Mexico, which increased 7% in volume (130,330 mt) and 11% in value ($759.2 million).

Source: U.S. Meat Export Federation, which is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like