Resolve to learn from pork market’s past

Looking back and, more importantly, looking ahead in the pork market, I think we can learn a few things and apply them to our benefit in the new year.

December 12, 2016

As 2016 draws to a close, now may be a convenient time to look back on the year that was and what we can learn as we roll forward into 2017.

Anyone who has participated in hedges or board positions for the past month is well aware of the cash flow implications associated with the market gyrations. The last month or so has been a bit of an enigma to those thinking the projections of a large hog supply would weigh on the markets. Instead, the appetite of the packing community and the good margins provided to them has resulted in firmer markets than many would have anticipated, me included.

Looking back and, more importantly, looking ahead, I think we can learn a few things and apply them to our benefit in the new year. Contained are my New Year’s resolutions for consideration. I believe they are applicable to others involved in pork production and share them in that vein. Here we go:

• We resolve to listen, and to remain vigilant of market shifts. Changes are on the horizon with the completion of the two new plants in 2017 and the prospects for additional facilities in 2018. Expansion is well under way and handicapping the timing of these new considerations is an important, core responsibility to those who wish to position themselves for success. A portion of this resolution is to investigate viable hedge tools that may emerge from a structured market or may be those of the over-the-counter variety.

• We resolve to do our part to maintain a viable and statistically relevant cash hog market. This is a key component to price discovery that has taken a substantial volume hit in the past few years. It is a key item to the orderly functioning of the CME Lean Hog futures. We knew we were going to go through some tough sledding in the fourth quarter of 2016, but it has not been nearly as pronounced as I thought and we are emerging from the record kills in good shape. Those participating in the open market are availed of market intelligence a bit quicker than mere observers and can use this knowledge to their advantage. We will continue to commit resources to this piece of our markets.

• We resolve to give more credence to the technical indicators of the market. The election of The Donald has already had a pronounced impact on financial markets. The Dow Jones is approaching 20,000 on the prospects of the future of American business and the relief of regulatory burden. Money flow — already an important component of our trade — will take on even more importance in the future. We have our Chief Technical Nerd working overtime to discern the key components that move the markets, we will listen to him even more as we roll forward.

• We resolve to commit more resources to understanding the macro landscape. Similar to the technical picture, understanding the Big Picture will help in understanding the Pig Picture. Changes in the exchange rate, interest rates, world issues, etc., will take on a new priority under the seemingly unpredictable Trump administration.

• Finally, we resolve to pay closer attention to the whisper of the market. In an arena that is sometimes characterized by noisy gongs, there are subtle hints that the market provides that will become more integral in future decision making. To me, this is akin to fly fishing. If any of you have waded up a stream in search of the illusive rainbow trout, you already know that you never catch the fish that you see. If you can see the fish, it is well aware of your presence and is suspicious enough to not hit the fly you are tossing. You have to pay attention to structure and water flow and cast your line appropriately for the circumstances if you want to experience success. Our markets are behaving in a similar manner. We saw a 2.55 million head kill (gong) on the schedule long ago. So long, in fact, that market players had plenty of time to adjust their plans to accommodate the reality and the market never “felt” the impact. I suspect this is not an isolated case and amidst the change it will be more important to listen to the quiet clues rather than the obvious. (Thank you, Dan Mueller, for allowing me to put forth this fishing metaphor.)

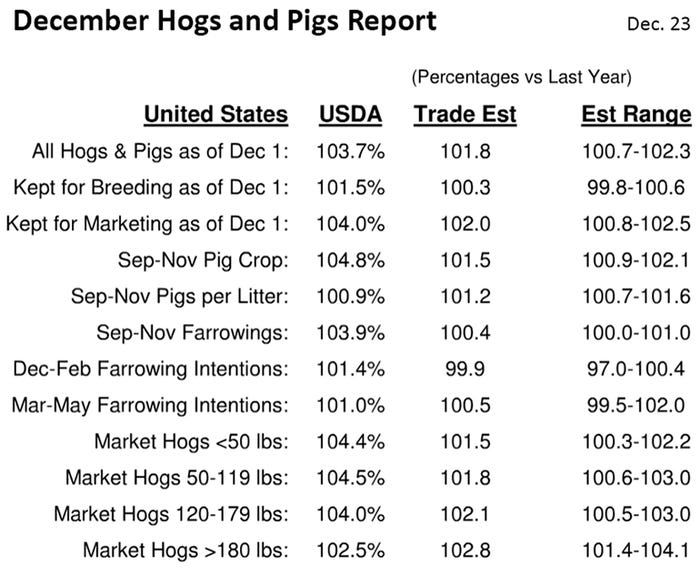

A couple of things for consideration: The Hogs and Pigs Report on Dec. 23 revealed a net gain of roughly 90,000 sows year-over-year. This report feels a bit closer to reality than the previous quarterly efforts in 2016. Projected marketings are depicted in the graph below. One thing that seems certain: we are not going to run out of pigs in 2017. If we are to see favorable pricing, it will have to come from the demand side of the equation. Demand was impressive in the fourth quarter with the cutout either side of $80 in the wake of record kills. An item of interest, note how many line items in the Hogs and Pigs recap below were above the top end of the analysts’ estimates.

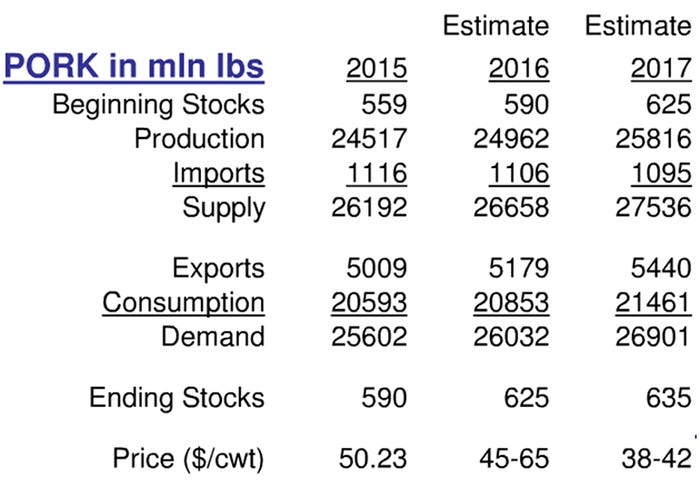

Something is “wrong.” Attached is the USDA estimate from Friday of pork prices, production and disappearance for 2017. Stay with me as we crunch a few numbers. In 2017 relative to 2016, the USDA has production up 3.5%, domestic consumption up 3%, exports up 5%.

What do you think about those values? Do you think production will only be up 3.5%? If that is the case, you have to make things balance via disappearance moving higher. The USDA’s 3% increase in domestic consumption seems sane in that environment. Exports would have to pull their weight, too. The 5% increase seems a bit aggressive to me, but it has to move somewhere so I understand the math.

WAIT! What is missing here? Price, of course. The USDA correctly assumes that if we are going to force more pork down the gullets of Americans, it will have to be cheaper. Same for exports. The insidious component of this whole equation is the bottom line of the attached table — cash hog prices at $40 live, $53 carcass. Can you make any money at those values? Nope. What if I told you that you have your choice of accepting the USDA price projections of $53 — or — selling values $30 per pig higher. Which would you choose? That is the scenario you face with the current CME values. A weighted average of all futures months on the board for 2017 is $67.50 as of this writing; representing roughly $30 more per pig revenue than the best guess of the USDA.

Coming into the Hogs and Pigs Report, these premiums to the USDA marker look very attractive to me. I still prefer options to futures. You have opportunity. That is a good thing.

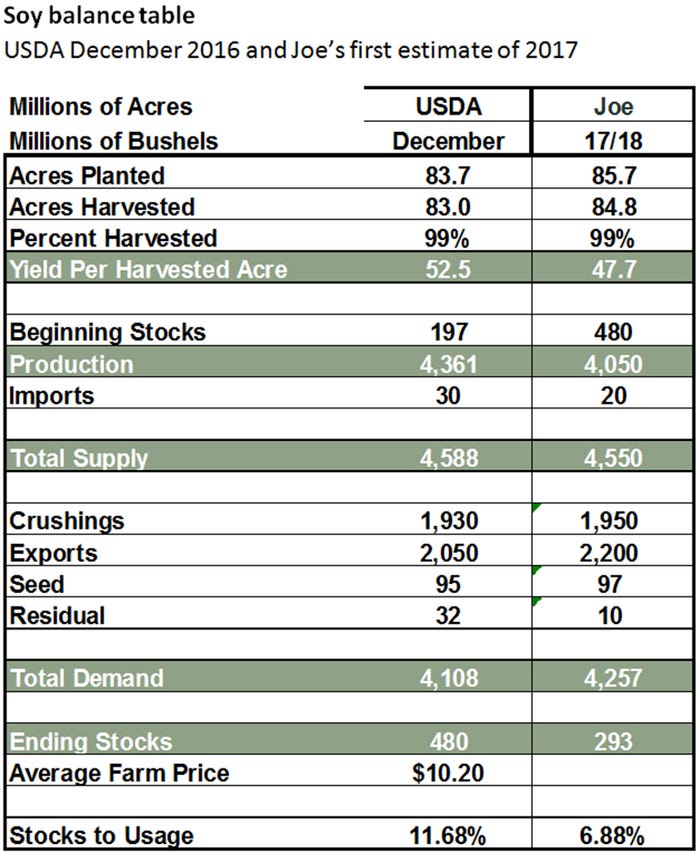

The USDA report on Friday did not tell us too much on the input side. The December report is historically a rather blasé account of the state of the grain complex and this iteration did not do anything to deviate from the trend. Production is not changed from the November report to the December numbers, the only changes we get are from the disappearance side and adjustments in production numbers south of the equator. We will get our final 2016 production numbers in the January report. I expect we will see a continuation of the trend for bean yields to improve from the 52.5 projection and believe corn yields will be confirmed at the 175+ number shown in the November report.

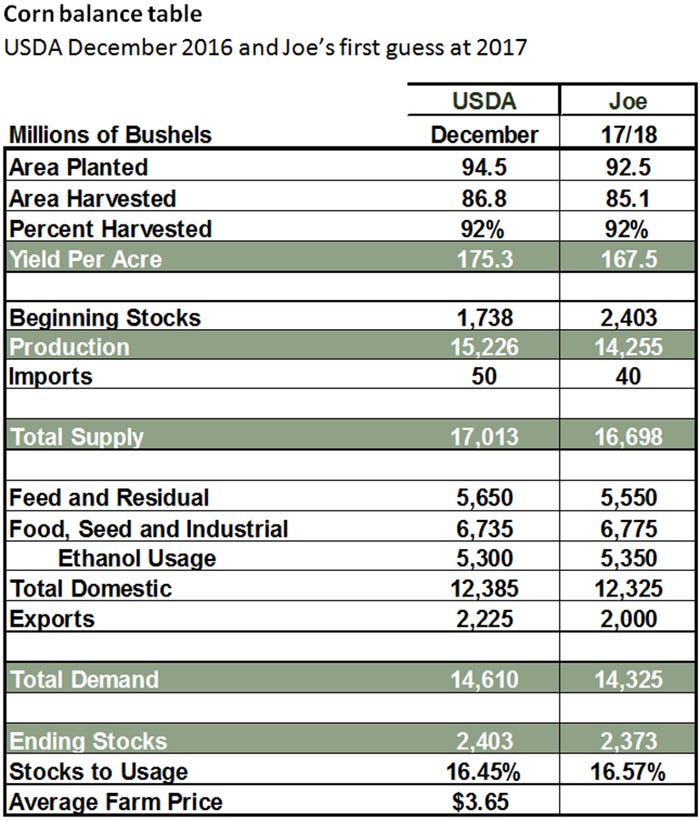

A peek into 2017 potential balance sheets (depicted below) provide the rationale why bean prices have not yet broken to levels that this year’s massive carryout would suggest. If you use a modest increase in bean acres (2 million) and take a similar level out of corn, you can see — given normal yields in the United States, not a repeat of the record numbers in 2016 — that the balance tables tighten up quite a bit in beans and remain relatively comfortable in corn. We are dealing with a plentiful surplus this year with beans at nearly 500 million bushels which may transition to less than 300 million bushels next year. A 300-million-bushel carryout is the traditional hinge point between just enough and a bit of concern. Hence, this is the tension in the bean complex that seemingly keeps a floor under prices. I think this will be the case until we get confirmation from South America. Right now, Brazilian yield prospects appear to be excellent and Argentina good with some rain needed in the southern areas. Corn, on the other hand, can sustain a 2-million-acre decrease with little impact to ending stocks given trend line yields, as depicted below.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals

About the Author(s)

You May Also Like