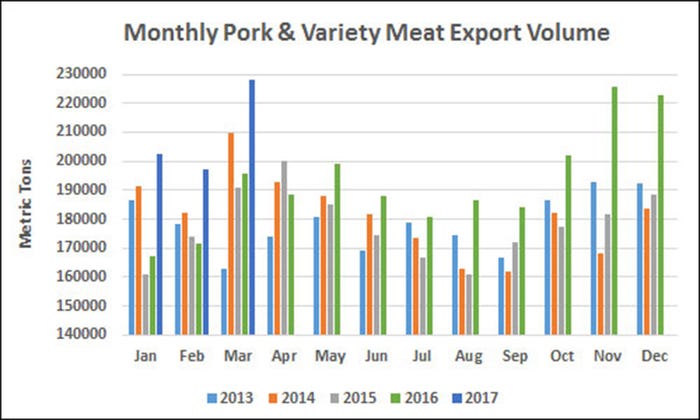

Record volume for U.S. pork exports in March

Pork exports reached 227,955 metric tons in March, up 16% year-over-year and topping the previous monthly high set in November 2016. Export value was $586.6 million, up 22%.

May 9, 2017

Source: U.S. Meat Export Federation

U.S. pork and beef exports capped a strong first quarter with excellent March results that included a record volume for pork, according to statistics released by USDA and compiled by the U.S. Meat Export Federation.

Pork exports reached 227,955 metric tons in March, up 16% year-over-year and topping the previous monthly high set in November 2016. Export value was $586.6 million, up 22%. For the first quarter, pork exports were up 17% in volume (627,647 mt) and 22% in value ($1.58 billion).

March exports accounted for 28% of total pork production and 23.3% for muscle cuts only, up from 25.4% and 22%, respectively, last year. First-quarter ratios were also significantly higher at 27.2% and 22.6%, compared to 23.9% and 20% in 2016. Export value per hog slaughtered averaged $54.93 in March, up 15% year-over-year, while the first-quarter average increased 18% to $52.42.

Beef exports totaled 105,310 mt in March, up 18% year-over-year, with value increasing 22% to $588.2 million. First-quarter beef exports were up 15% in volume (292,215 mt) and 19% in value ($1.61 billion).

March exports accounted for 12.5% of total beef production and just under 10% for muscle cuts only, each up slightly from last year. For the first quarter, the percentage of total beef production exported was down slightly from a year ago (12.4% versus 12.5%) despite an increase for muscle cuts (9.8% versus 9.4%). Export value per head of fed slaughter averaged $270.14 in March, up 11% from a year ago, while the first-quarter average increased 10% to $267.71 per head.

“Entering 2017 with record-large pork production and an uptick in beef slaughter, we knew this ‘wall of U.S. meat’ presented a challenge for our industry,” says USMEF President and CEO Philip Seng. “So the fact that first-quarter export volumes are higher than a year ago is not surprising, but it’s important to look beyond that – to the higher percentage of production being exported and the strong return on those exports. The U.S. is not just moving more meat internationally because we have more available. Our products are commanding solid prices and winning back market share in many key destinations, even with a strong U.S. dollar and many trade barriers still in place. But our competitors are working every day to reverse this trend, so we must aggressively expand and defend our international customer base.”

Mexico, Korea and South America fuel record volume for pork exports

The red-hot pace for U.S. pork exports to Mexico continued in March, with volume up 34% year-over-year to 68,866 mt, and value increasing 47% to $127.2 million. For the first quarter, exports to Mexico totaled 206,262 mt (up 29%) valued at $371.9 million (up 42%). Strong demand from Mexico is especially important for U.S. ham prices, but pork variety meat exports to Mexico also posted a strong first quarter, increasing 14% in volume (37,596 mt) and 38% in value ($58.1 million).

In leading value market Japan, March exports increased modestly in volume (37,806 mt, up 2%) but climbed 12% in value to $155.2 million – the highest since October 2014. In the first quarter, export volume to Japan was up 7% in volume (101,581 mt) and 13% in value ($411.3 million). Chilled pork exports to Japan increased 3% to 56,307 metric tons, while value increased 10% to $260 million.

Other first-quarter highlights (compared to year-ago levels) for U.S. pork included:

• Strong variety meat demand in China/Hong Kong helped drive exports to the region 5% higher in volume (131,036 mt) and 11% higher in value ($258.8 million). While muscle cut exports slowed, variety meat volume climbed 24% (to 86,097 mt) while value was up 29% to $176.2 million – making an important contribution to per-head value.

• Since posting a slow start in 2016, pork exports to South Korea have steadily regained momentum as exports totaled 51,158 mt (up 31%) valued at $137 million (up 39%). Most U.S. pork now enters Korea duty-free under the Korea-U.S. Free Trade Agreement, which has helped boost volumes of raw material for further processing, as well as processed pork products.

• Another major market rebounding from last year’s slow start is Colombia, where U.S. pork also benefits from lower tariffs secured in a recent free trade agreement. First quarter exports to Colombia doubled from a year ago in both volume (16,532 mt) and value ($36.5 million). Also bolstered by a near-doubling of exports to Chile and Peru, first-quarter pork exports to South America were up 95% in volume (23,838 mt) and 94% in value ($57 million).

• In Australia, an important market for U.S. hams and other cuts utilized in further processing, exports increased 38% in volume to 20,607 mt, while export value climbed 43% to $57.7 million.

Beef exports move higher in Asian and North American markets

March beef exports to Japan increased 41% in volume (28,135 mt) and 39% in value ($167.7 million). This capped a strong first quarter in which exports jumped 41% (to 74,411 mt) and 42% (to $427.3 million), respectively. This included a 55% increase in chilled beef volume to 33,366 mt, as U.S. beef captured its highest-ever market share in Japan’s high-value chilled sector.

Coming off a record performance in 2016, beef exports to South Korea posted a very strong first quarter, with volume up 23% to 42,551 mt and value increasing 30% to $267.5 million. With U.S. beef continuing to gain momentum in Korea’s retail and restaurant sectors, first-quarter chilled beef exports were up 78% to 8,508 mt.

Other first-quarter highlights (compared to year-ago levels) for U.S. beef included:

• Exports to Mexico posted a solid increase in volume (57,057 mt, up 17%), while value increased 3% to $226.8 million. An important destination for shoulder clods, rounds and other beef end cuts, muscle cut exports to Mexico expanded at an even faster pace, climbing 23% in volume (30,015 mt) and 11% in value ($175.1 million).

• Despite a recent slump in the value of the Canadian dollar, beef exports to Canada have rebounded in 2017, with solid increases in both volume (29,909 mt, up 14%) and value ($190.5 million, up 19%).

• In Taiwan, where U.S. beef captures more than two-thirds percent of the chilled beef market, exports increased 28% in volume to 9,746 mt and 29% in value to $85.7 million. This included a 10% increase in chilled beef volume to 3,650 mt.

• Beef exports to South America were down 2% in volume (4,919 mt) but increased 16% in value ($23 million), bolstered by a strong performance in Colombia and a recent rebound in Peru. This week USDA also confirmed the arrival of the first U.S. beef shipments to Brazil since a bovine spongiform encephalopathy-related suspension was imposed more than 13 years ago. The first significant export volumes for Brazil will likely appear in the May USDA data, which will be available in early July.

• March exports to South Africa (1,107 mt) were the highest since the market opened last year, making it the month’s 10th largest volume destination for U.S. beef. For the first quarter, South Africa ranked 11th at 1,971 mt. Export value was $1.5 million, with most of the volume being beef livers.

You May Also Like