Pork producers urged to batten down the hatches

Pork demand is a vital component to the hog market fundamentals and it is still good worldwide.

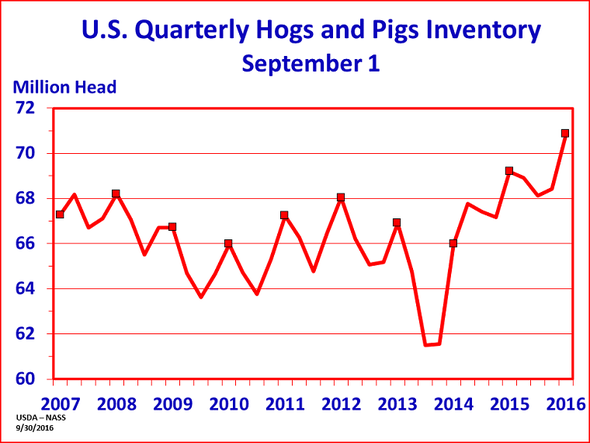

The forecast record pork production is now a reality, pressuring hog prices downward and tightening packing capacity further. U.S. hog inventory stands at 70.851 million head on Sept. 1, registering a 2% growth from last year and 4% increase since the previous quarter, according to the USDA Hogs and Pigs report. This record large hog inventory rose greater than pre-report estimate of 1.1% and most likely viewed as bearish in the marketplace.

For the U.S. hog producer, “It is just going to be a very difficult period for three to four months,” says Bob Brown, meat industry consultant from Edmond, Okla. “It is time to be batten down the hatches and do the best you can.”

Kevin Grier, president of Kevin Grier Market Analysis & Consulting in Guelph, Ontario, warns, “There is a lot of psychology entering in the hog market that is clouding pricing forecast. I keep ratcheting fourth quarter 2016 and first quarter 2017 hog prices downward.”

Demand is a vital component to the hog market fundamentals. Grier emphasizes pork demand is still positive. He says, “Demand in North America has been very good for the last few years. Domestic and export demand has been good. As long as a product, because of demand, is moving then packers will work through that like a hot knife through butter.”

Jim Robb, director of the Livestock Marketing Information Center, explains that although hog price erosion is occurring, the export profile is critical. He notes, “We are somewhat optimistic that exports will continue on tonnage basis to post a year-over-year gain.”

Still, Robb points out that total red meat and poultry supplies continue to increase. According to his firm’s calculation, total protein supplies in 2017 will be the largest since 2007. He further explains, “That is a quantity of product that has to find a home, and that is really key to the price levels in 2017.”

Diving into the numbers

Market hog inventory, at 64.8 million head, was up 3% from last year, and up 4% from last quarter. The number of pigs weighing 120-179 pounds accounts for the majority of the growth, climbing 2%. Pigs weighing 50-119 pounds remain unchanged from the previous year.

“The larger-than-anticipated market hog number is what we will try to digest and understand in the marketplace as we move ahead over the next three to five months,” clarifies Robb. “When you look overall at this report compared to expectations, the market hogs were 800,000 head more than we anticipated at LMIC. The source of that is rather continuous underassessment of farrowings and farrowing intentions in recent reports by USDA.”

For slaughter numbers moving forward, the LMIC estimates October daily barrow and gilt slaughter numbers to remain flat from September with largest weekly totals expected in November. Despite this, U.S. hog producers are keeping market weights lighter than normal overall. Brown contributes lighter market weights because extra pounds are a losing game for hog farmers.

As predicted by market analysts, the breeding inventory crossed the 6 million mark, standing at 6.02 million head. There are now approximately 167,000 more sows in the breeding herd compared to the actual inventory at the end of 2014. Breeding inventory was up 1% from last year, and up 1% from the previous quarter.

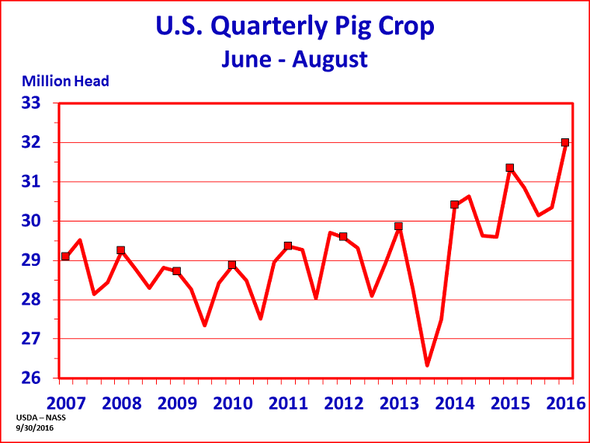

The June-August 2016 pig crop, at 32.0 million head, (up 2% from 2015) set another all-time high. According to Brown, this is a tough trend to fall into with each of the last four pig crops setting record highs for the particular quarter.

Sows farrowing during this period totaled 3.02 million head, up slightly from 2015. The sows farrowed during this quarter represented 51% of the breeding herd. The average pigs saved per litter was a record high 10.58 for the June-August period, compared to 10.39 last year. Pigs saved per litter by size of operation ranged from 8.20 for operations with 1-99 hogs and pigs to 10.60 for operations with more than 5,000 hogs and pigs.

U.S. hog producers intend to have 2.93 million sows farrow during the September-November 2016 quarter, down slightly from the actual farrowings during the same period in 2015, and down 2% from 2014. Intended farrowings for December-February 2017, at 2.93 million sows, are down slightly from 2016, but up 1% from 2015.

While market analysts agree that farrows and farrowing intentions are unaccounted in the recent reports, a readjustment in the USDA estimation will occur in the December Hogs and Pigs report. Robb explains, “We will be recalibrating for the Dec. 1 report.”

About the Author(s)

You May Also Like