Pork Output to Rise in 2015

Retailer strategies will guide price response.

June 27, 2014

For over a year, the U.S. hog market has wrestled with how many baby pigs are actually being lost due to porcine epidemic diarrhea virus (PEDV), and what that means for summer hog slaughter. The first wave of PEDV impacted the spring 2013 pig crop. The spring pig crop drives fourth-quarter hog slaughter. Fourth-quarter production is normally the largest of the year. If a few extra pigs from last year’s spring pig crop died, so what?

Reports of PEDV surged in November and December 2013, as cold, damp winter weather arrived, trimming the winter pig crop. Winter pigs come to slaughter in summer when slaughter supplies are typically tightest. The lowest hog slaughter of the year often occurs the week of July 4. It’s a short-slaughter week in the seasonally low slaughter period.

The day of reckoning is at hand. Current slaughter runs will confirm the magnitude of the winter pig-crop PEDV death losses.

Meanwhile, for much of this year, hog weights ran eight to sometimes 10 lb. heavier than a year earlier. Higher weights produce more pork per hog. That extra tonnage helps offset smaller slaughter runs. Summer heat settling in may reduce the year-over-year gain in weights.

Consumer Prices in Uncharted Territory

Tight supplies and perceived strong demand boosted spring wholesale pork cutout values to record-high levels. New record-high wholesale meat prices are fueling ample chatter about consumer resistance to paying those high prices.

Wholesale choice beef cutout values made two assaults on the $240 level from around $200 earlier this year. Pricy beef helped make pork look like a relative bargain.

Cattle slaughter typically rises seasonally into summer. Plus, year-over-year upticks in late-2013 and early-2014 placements suggest current beef supplies are relatively abundant. Beef supplies will tighten into autumn, which should provide support for both beef and pork prices through summer.

Assessing Consumer Pushback

In May, composite pork cutouts got volatile. Some primals — bellies, for example — saw double-digit daily price swings up and down.

As cutouts whipsawed, retailers stepped in to buy meat on breaks. Market bulls view buying the breaks as a sign solid pork demand rolls on. Those less optimistic, suspect end users are running on squeaky-tight inventories. They don’t want to get caught holding inventory consumers do not want to buy into a weakening market. As a result, end users are buying hand to mouth, which can create volatility when somebody gets caught out of position and needs product right away.

Meat sales volume for immediate shipment remains respectable. Sales for delivery later have waned. The fear is that consumers are pushing back harder against high prices than the industry expects.

Price Winter Hogs Now?

Going into summer, December 2014 hog futures and February 2015 futures traded $30 to sometimes more than $35 lower than summer contracts. Both seasonal and cyclical factors are driving those huge discounts.

Seasonally, hog slaughter typically rises into winter. More hogs coming mean packers need not bid as aggressively to get them. December typically has the highest monthly slaughter of the year.

Cyclically, surging profits as feed costs retreated from 2012-crop drought-reduced spikes, and pricy beef pulling hog prices higher will lure producers to boost production.

Spot-market iso-wean pigs skidded to $10 a head during the height of the 2012 drought. Spring-2014 feeder pigs sold at up to $90 a head at times. If producers are willing to pay $90 for a pig to finish, they make money. That all says profits will bring expansion.

However, feeder pigs are backing off from those lofty levels due to lower market-hog futures prices five months out.

Producers face a huge psychological stumbling block when contemplating selling hogs six to eight months out at prices $30 to $35 below current prices. But it may be the right thing to do. The market has reasons for the significant price discounts. Rising seasonal supplies is one. Cyclical expansion in response to recent profits is another. Some participants speculate that once PEDV has progressed all the way through the U.S. swine herd, its impacts will ease.

Producers should be penciling their profit margins regularly.

Watch Retailer Strategies

Cattle slaughter and beef supplies will tighten into fall. Futures point to sharply lower hog and pork prices. Logic suggests retail pork prices should drop fairly sharply.

Whether prices do drop depends on how retailers respond and how their competitors react. Retail meat prices are generally slow to rise in response to higher livestock prices. Retailers do not like to price-whipsaw their customers. Retailers will trim their margins in the short term to help maintain volume and keep customers.

Lower hog prices may stimulate higher retail pork sales volume if retailers pass those lower prices on to consumers. However, as livestock prices ease, retail meat prices are also slow to retreat, because retailers try to recover margins.

Beef supply will stay tight. Retailers may strive to capture wider margins on pork to avoid pushing retail beef prices into the stratosphere. So watch retail pricing strategies.

A Word About Broilers

Relatively cheap 2011 broiler prices, combined with the 2012 drought-induced feed-price shock, triggered a relatively rare reduction in broiler output in 2012. Broiler production has since rebounded.

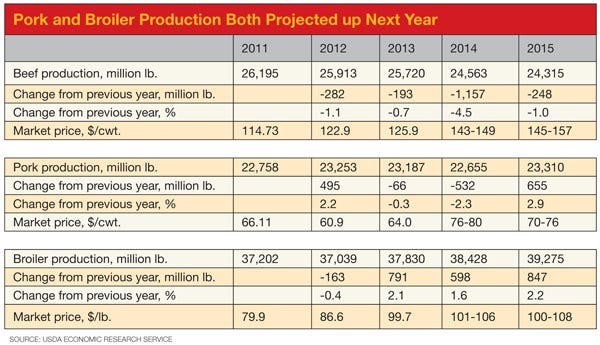

USDA projects combined beef and pork production this year will be down 1.7 billion lb. That will overwhelm the 600,000 million-lb. hike in broiler production to trim 2014 output of the three species by about 1.1 billion lb.

Beef production in 2015 is projected down 250 million lb. Pork should be up about 655 million lb. Broiler output will be up about 850,000 million lb. Total supply of the three meats will rise about 1.25 billion lb. next year.

Both beef and pork need to keep an eye out for a flock of feathers flying up behind them.

John Otte is farm management editor and follows livestock markets for Farm Futures magazine (a sister publication to National Hog Farmer).

You May Also Like