Pork Market Looks Promising in Spite of Harsh Winter, PEDV Battles

May 5, 2014

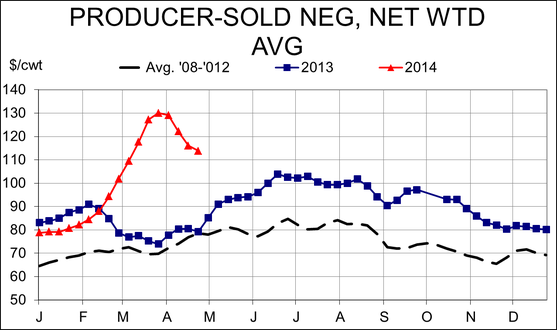

It strikes me as almost preposterous to argue that hogs at $116/cwt. carcass weight are too cheap. Some might say that after they traded at $130 in late March, but it appears to me that we are sitting about right relative to what we know about hog supplies this summer.

As can be seen in Figure 1, cash hogs have fallen steadily since that wild high back in early April. Last week’s decline of $2.22/cwt. carcass for producer-sold negotiated barrows and gilts represents a slowing of the pace of decline, though, and suggests that the “post-panic” adjustment may be running its course. The same price had fallen by roughly $7/cwt and $6/cwt in each of the previous two weeks.

Figure 1

The increase since February, though, is still roughly triple what was seen, on average, for the five years of 2008 through 2012. “But that includes the “swine flu” year of 2009!” you might object. Throw it out and the average increase actually gets smaller!

As can be seen in the chart, weekly average negotiated hog prices have risen by more than $30/cwt. this year since February 1. If we had not witnessed the run to $130, I’d bet most of us would think this magnitude of spring increase would be unsustainable but with that peak as a backdrop, my bet is that few people are so inclined.

The run-up, of course, was driven by pork prices as end-users scrambled to build inventories ahead of this summer’s porcine epidemic diarrhea virus (PEDV)-shortened slaughter runs. It appeared then – and still appears now – that those price moves were overdone as end users panicked. A more rational view of the marketplace is now prevailing and I think it is reasonably well-based on numbers and relative values. My expectation of cash highs in the mid-$120s this summer would require May prices in the mid-$110s. I still think those price levels are possible this summer. June through August Lean Hog futures all closed within a few cents of $122 on Monday.

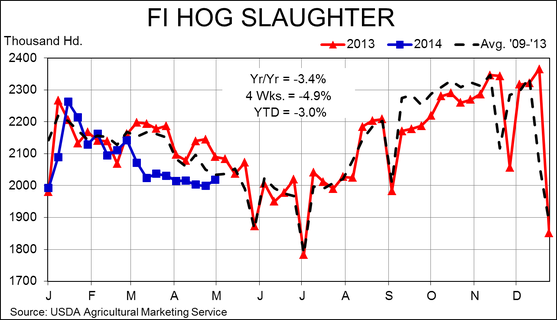

The meaning of last week’s FI slaughter total of 2.019 million head is still not clear at this point. The figure was 20,000 head larger than the previous week, a fact that might be due to catching up from Easter since it was the first full-slaughter week following the holiday. Last year’s post-Easter bump is clearly evident in Figure 2 but it is two weeks earlier. And it was MUCH larger than last week’s increase.

Figure 2

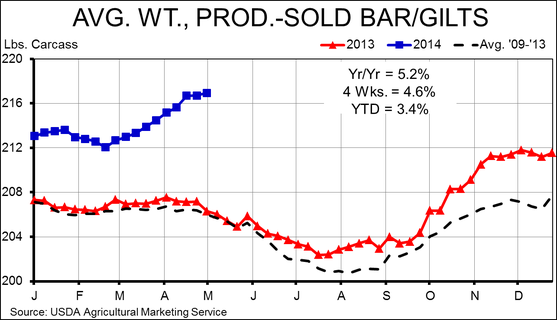

I don’t think producers changed the status of their marketings much last week. We are still far behind a normal marketing schedule as producers take advantage of prices and space to make hogs heavier and increase revenue. But the increases of market weights has virtually stopped in the past two weeks as feed prices have risen and some sanity has returned to both pork and hog markets, removing a good part of the “wait and get more money” thinking that quite correctly prevailed in March and April. Lower profit incentives and warmer weather will begin to push weights lower quite quickly now.

And so will the number of hogs available to packers. My contacts indicate that packers were comfortable with the number of pigs available through about mid-May, but are very concerned about supplies after that point. Those concerns agree with my earlier computations which say that May slaughter will be almost 5% smaller than one year ago, and June could be down more than 7%.

My calculations based on PEDV case accession data have, so far, been conservative, with actual slaughter coming in LOWER than what I believed were brutally large predictions of slaughter reductions. In fact, actual March FI hog slaughter was 6.9% lower than one year ago where my PEDV-based calculations suggested a reduction of only 1.1%. My April number is -3.7% and April slaughter will likely prove to be down 5.0 to 5.3% from one year ago.

Figure 3

You May Also Like