Pork exports show month decline; strong over year ago

July 13, 2015

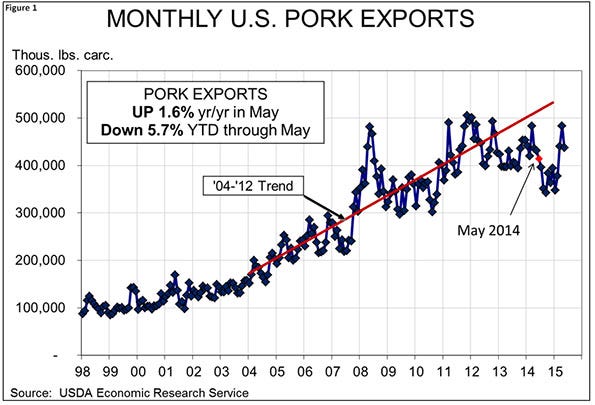

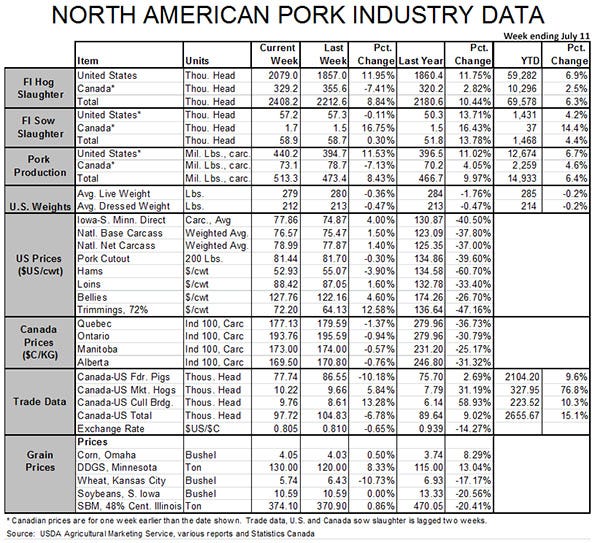

U.S. pork exports declined from both their March and April levels, but remained strong relative to other recent months and one year ago in May. (See Figure 1) Total exports of 437.5 million pounds, carcass weight equivalent, were 1.6% higher than one year ago. That follows a year-on-year gain of nearly 11% in April when shipments were swollen by the clearing of loads that were delayed during the West Coast port slowdown. May’s exports benefited from the last of that cleanup effort but most observers believe the impact was small.

May’s shipments pushed the year-to-date total to 2.086 billion pounds, carcass weight That figure is 5.7% lower than one year ago but is the closest that the year-to-date figure has been to one year ago so far this year.

May’s pork shipments were valued at $425.5 million, 17.6% lower than one year ago. Year-to-date pork export value through May is $2.049 billion, 26.9% lower than one year ago. All of those 2014 values benefited, of course, from record-high U.S. pork prices.

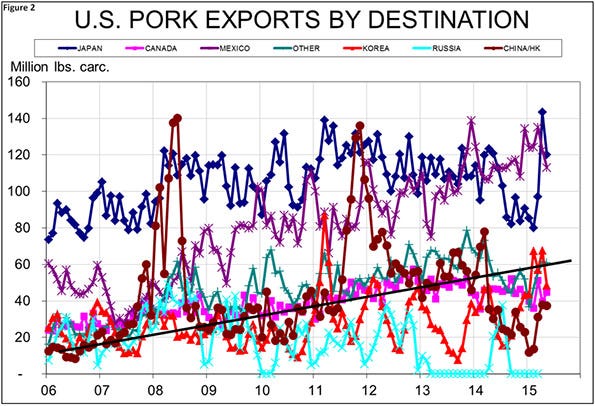

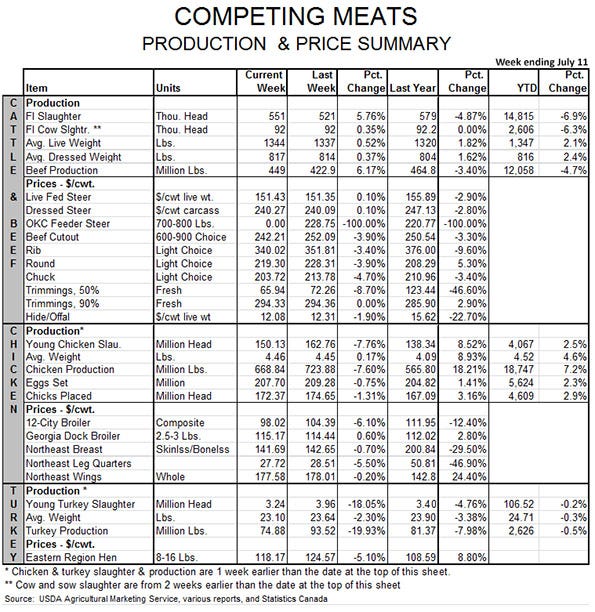

Shipments to all major markets, except Canada, declined slightly from April to May. (See Figure 2) China-Hong Kong moved back to strong year-on-year growth in May, gaining 24% on last year’s level. Korea and the Caribbean remained solid markets, gaining 40 and 22%, respectively, on last May’s volume. Japan and Mexico remained at the top of the U.S. market rankings but both fell short of year-ago export levels – Mexico by 1.1% and Japan by 4%.

Mexico, Korea and the Caribbean all have taken more pork this year to-date than they did one year ago. Their gains are 10%, 42% and 23%, respectively. Shipments to Japan remain 8% lower than one year ago and, in spite of May’s relatively good performance, exports to China-Hong Kong are still over 50% lower so far in 2015.

What lies ahead for exports?

We think good things in terms of both tonnage and year-on-year growth for exports. First, we are entering months in which 2014 exports were very bad. Significant amounts of European Union pork began to pour into world markets after being shut out of Russia. The dollar began to gain value and U.S. prices had sky-rocketed. Some EU pork is flowing back into Russia. The dollar is high but relatively stable, returning purchase timing decisions to a more normal footing. U.S. prices have fallen significantly, offsetting nearly all of the price increase seen by importers due to the stronger dollar.

The factors have changed and we will be comparing this year to those very bad months in 2014 – things nearly have to get better on a year-on-year basis. Should the May export level prevail for the rest of the year, 2015 exports would be 6% higher than last year. The USDA’s forecast for ’15 exports is 5.065 billion pounds, carcass weight, 4.3% higher than last year. That figure looks reasonable given May exports.

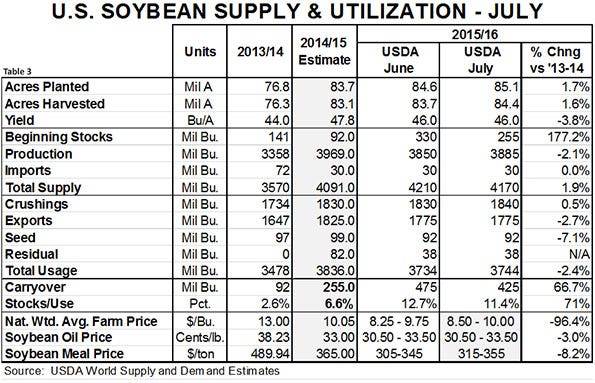

Corn, beans remain at trend values

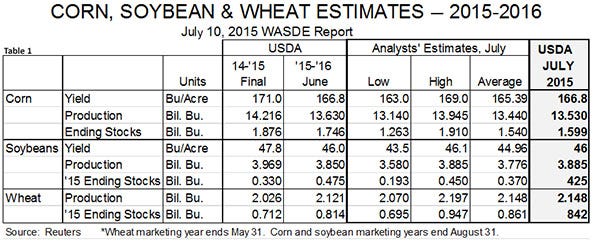

The USDA also released its July World Agricultural Supply and Demand Estimates report on Friday. (See Table 1.) The report revealed little of the USDA’s ideas for 2015 corn and soybean yields, leaving both of them at the trend values used in June. This is no surprise since a) crop conditions are so mixed and b) there has hardly ever been a case (1993 is the one) where too much moisture caused much of a decline in corn and soybean yields.

It’s not that weather conditions have been good everywhere, of course. Indiana, Ohio, Missouri and some parts of Illinois have suffered from too much rain all spring and summer. Corn conditions in those states are not good and soybean conditions, for what got planted, are not much better.

These problematic areas will have to be balanced against exceptionally good conditions in much of Iowa, Minnesota, South Dakota, Wisconsin and Nebraska. I was just told this week that Kansas and Tennessee looked great. Western Illinois looked terrific the last week of June. Barring some excessive heat, there will be large yields in the west to offset shortfalls in the east.

Most important, the USDA does not yet have any objective data with which to adjust these yields. They have done so in Julys of years past when exceptional conditions – either good or bad – warranted it, but they did not do so this year. They’ll wait for real data in August.

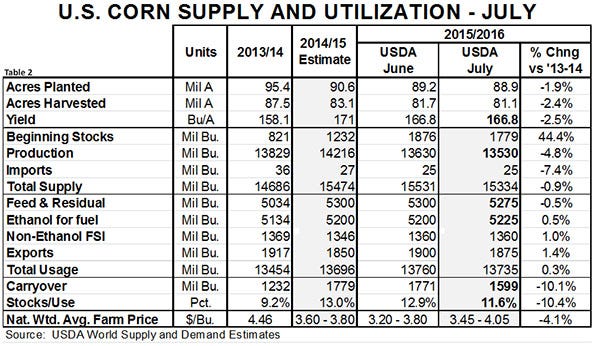

The only changes of any size were made in 2015 crop carryouts and corn and bean acreages in accordance with the June 30 acreage report. Balance sheets for both crops appear as Tables 2 and 3. Note that the USDA raised both ends of its corn price forecast range by $0.25/bushel and did the same to the soybean meal range by $10 on both ends. The entire corn range is below current futures prices while current soybean meal futures prices are near the top end of the USDA’s July predicted range.

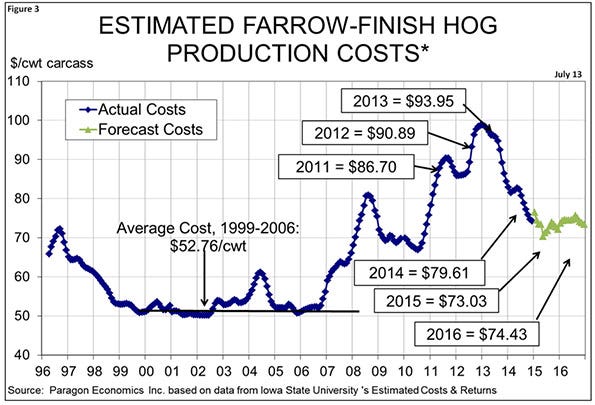

Higher corn and soybean meal futures prices have pushed our estimates of 2015 and 2016 breakeven costs to above $73 and above $74 per hundredweight, carcass weight, respectively. (See Figure 3)

About the Author(s)

You May Also Like