Pork demand remains strong

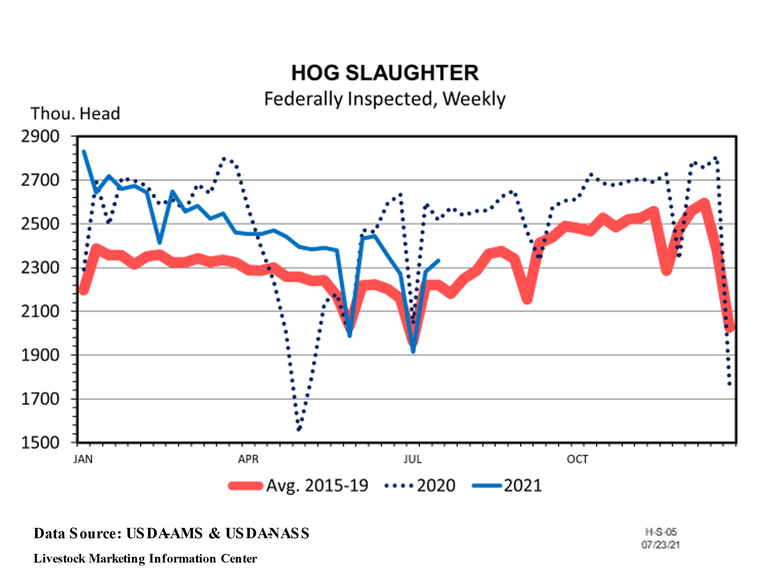

Year-to-date hog slaughter is up, so it is primarily strong demand that is supporting prices.

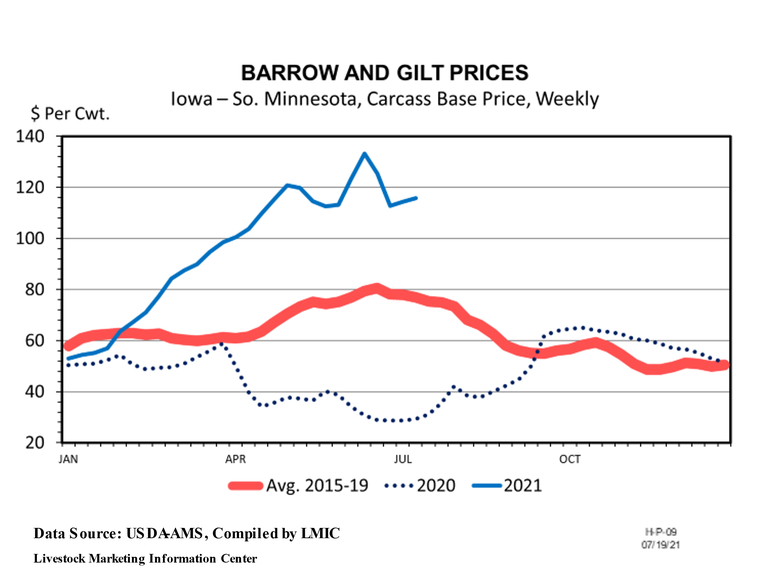

The average live price for 51-52% lean hogs during June was $86.15/cwt. That was $5.14 higher than the month before, up $51.90/cwt. from a year ago and the highest price for any month since July 2014.

Iowa-Minnesota negotiated hog prices started July at nearly four times the level of last year. Prices have been above the year-ago level every day thus far in 2021 and are expected to remain that way for the rest of 2021. Year-to-date hog slaughter is up, so it is primarily strong demand that is supporting prices.

USDA’s July WASDE estimated the average live hog price at $69.40/cwt. this year and $56.00/cwt. next year. Lean hog futures are predicting the typical seasonal price pattern for the coming 12 months. The futures market indicates hog prices will decline from now until the end of 2021 but then increase until June.

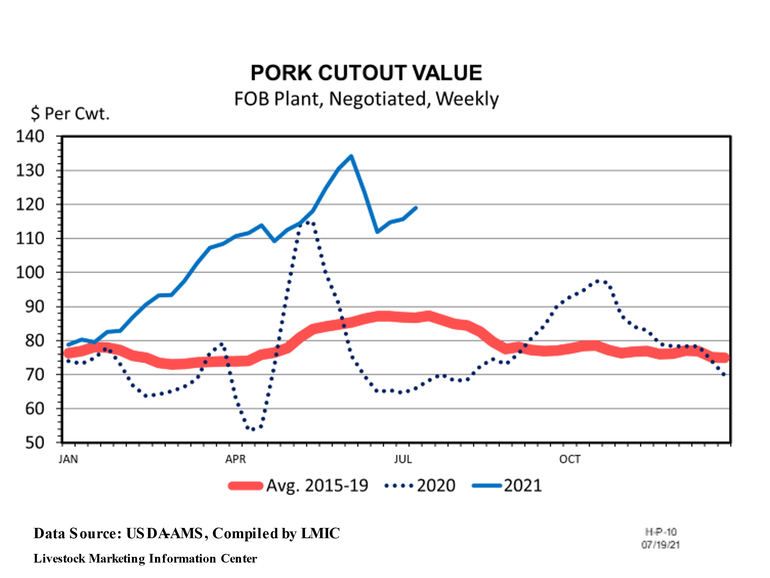

At $4.546 per pound, the average price of pork at retail during the month of June was a record high for the third consecutive month. It was up 16.2 cents from May and 30.1 cents from June 2020. These price records are surprising given that January-June pork production was a record 13.959 billion pounds.

Since the start of June, hog slaughter has been 9.3% lower than the same period last year. This is far below the 1.5% decline implied by the heavy weight hog inventory in the June “Hogs & Pigs” report. The big decline versus last year is not surprising since at this time last year packers at this time last year were playing catch up on slaughter.

Compared to two years ago, hog slaughter during the last eight weeks has been up 5.5%. This is not much different than implied by 2021 compared to the 2019 June hog inventory, which indicated a slaughter increase of 4.3%.

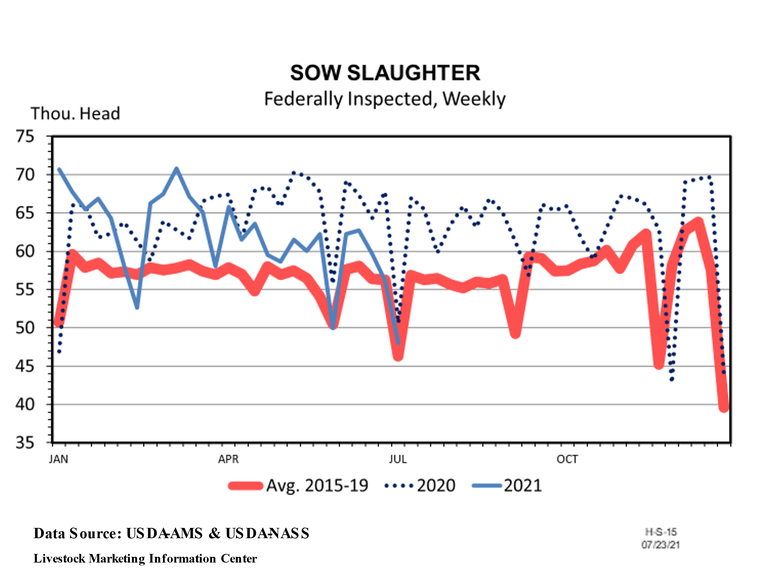

Sow slaughter was high in 2020 and early 2021 but has been down nearly 10% year-over-year for the last six weeks. This fits with hog prices which were dismal last year and have been quite high in the last few months. Look for sow slaughter to remain low at least through the third quarter.

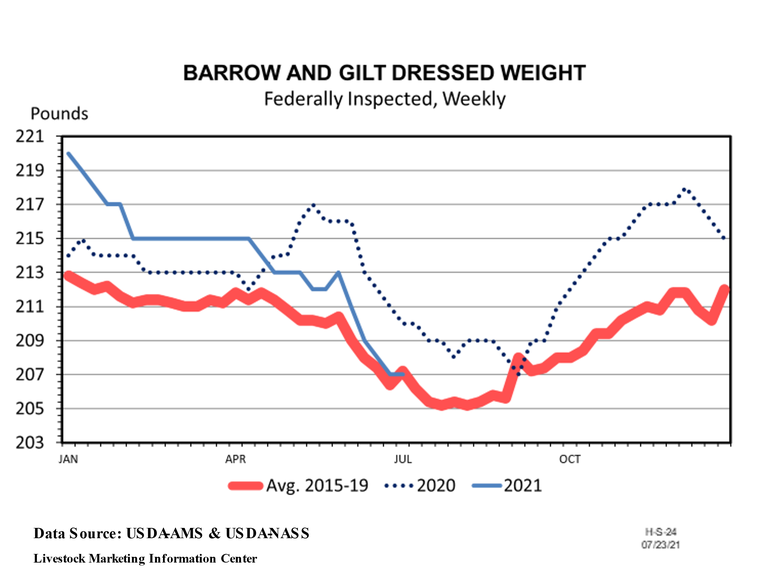

Slaughter weights took a big jump in the second quarter of 2020 when COVID-19 forced packers to curtail operations, thus backing up hogs on farms. During late spring and summer this year, weights have been well below the year-ago level as producers have been able to keep current on marketings.

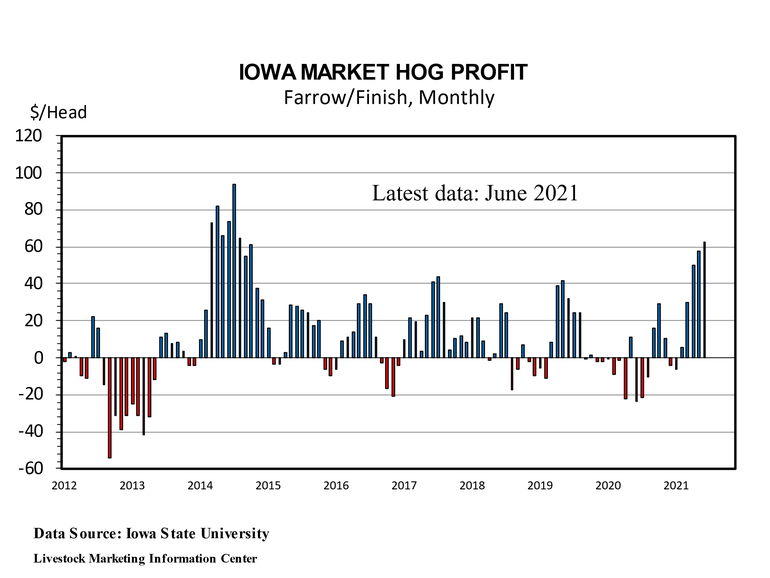

Calculations by Lee Schulz at Iowa State University put the profit for hogs sold during June at $62.58/head. June was the fifth profitable month in a row, $85.88/cwt higher than the year before and the most profitable month since October 2014.

ISU calculated the cost of production for market hogs sold in June at $86.08/cwt carcass. That was the highest production cost since November 2013. If the futures market is close to accurate, it looks like 2021 will have an average profit of roughly $35.00/head, making it the most profitable year since 2014. Lean hog futures imply 2022 profits will average close to $25.00/head.

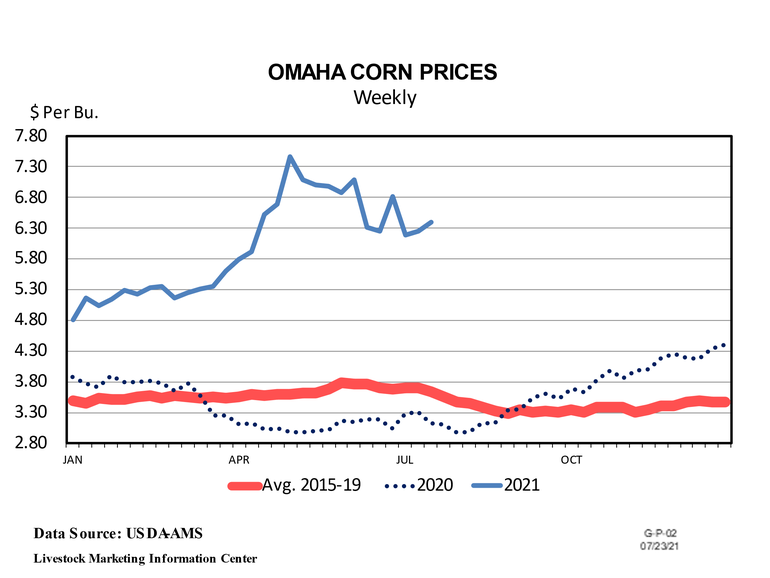

Spring corn prices went above $7.00 per bushel for the first time since 2013. The futures market expects corn prices to drop rapidly with the start of the corn harvest but still stay well above the year-ago level. The futures indicate corn prices will average between $5.20 and $5.60 during the coming 12 months.

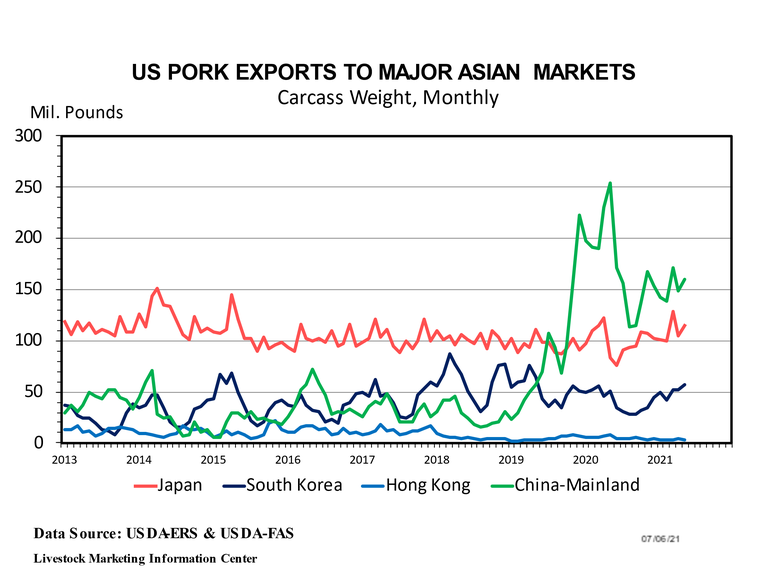

According to USDA’s Foreign Ag Service, world pork production this year will be up 8.6%, with the biggest increase being 20.4% in China. In April, USDA predicted Chinese pork production would be up 11.4% this year. Chinese production is recovering from African swine fever but is still well below their 2014 record.

Among the major pork producing countries, the U.S, South Korea, and Philippines are down this year. U.S. pork production is down due low prices in 2020 caused by COVID’s impact on workers. Pork production in the Philippines is down due to ASF.

China’s pork imports this year are predicted to be down 5.3%, but most other major importing nations are expected to import more pork than last year.

The European Union’s pork exports are forecast to be down 1.8% this year with other major exporters shipping more than last year.

The Foreign Ag Sevice is predicting 2021 U.S. pork imports will be up 8.5% (35,000 metric tons) and U.S. pork exports up 3.8% (124,000 metric tons). The U.S. exports 7.7 times as much pork as we import.

USDA’s July survey of the nation’s cattle herd found 100.9 million head of cattle. That is 1.3% fewer than a year ago and the smallest cattle herd since before 2017. The 2021 calf crop is expected to be slightly smaller than last year and the smallest since 2016. These smaller inventory numbers should result in lower beef production and thus boost beef prices which is good news for pork prices.

Friday’s pork cutout value was $122.37/cwt. That is the highest since $124.83/cwt. on June 17, 2021. The record pork cutout is $137.56/cwt. set on July 18, 2014, during the PEDV outbreak.

This afternoon USDA/NASS will release the weekly crop progress report.

About the Author(s)

You May Also Like