No supply fears, pork needs to be pushed

April 20, 2015

This is getting a little old and a lot annoying. But is it bad and can anything be done about it? No, I’m not talking about that teenage boy hanging around your porch wanting to see your daughter. I’m talking about persistent high retail prices for pork when wholesale and farm-level prices are struggling. But just as might be the case with that boy and your daughter, the answer is complicated and the results of a “solution” are fraught with danger.

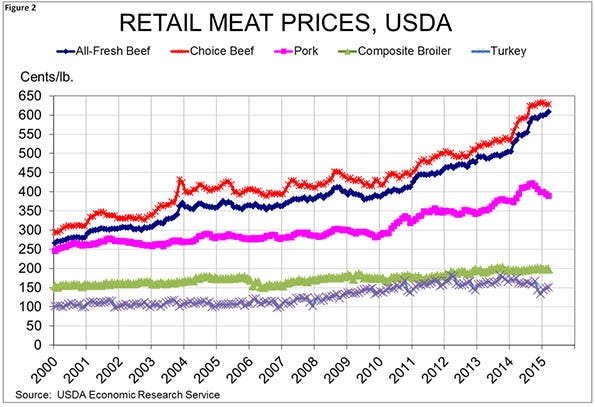

The USDA’s estimates of retail pork prices were released last Thursday and showed the price 6.3 cents per retail pound (1.6%) higher than one year ago in March, and it’s not like last year’s price was low. In fact, the average retail pork price in March 2014 was a then-record $3.83 per pound. That was the first of a string of record retail values that culminated in September’s still-record high of $4.215 per pound. The price this March is $3.893 per retail pound.

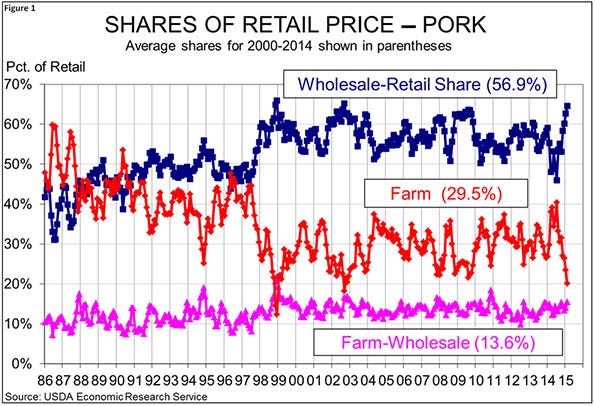

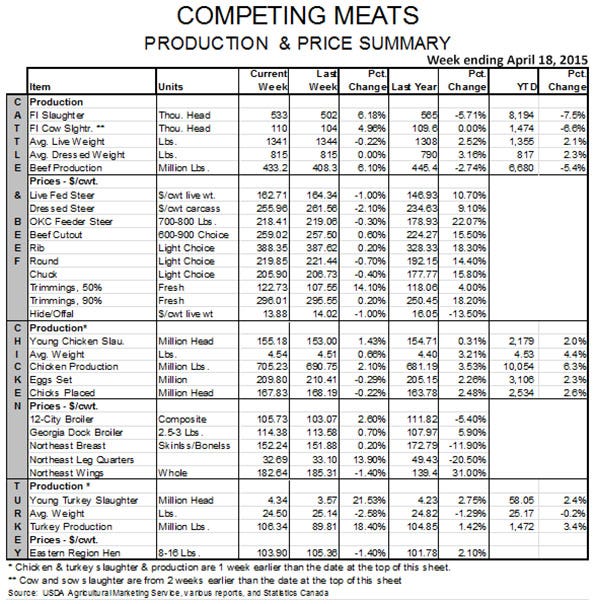

According to the computations by the USDA’s Economic Research Service, the wholesale-to-retail share of the March pork price was 64.5%, the third highest on record. At the same time, the farm share was 20.1%, the fourth lowest on record. The farm-wholesale share was, at 15.4% a bit above the 2009-14 average of 13.6% but was well within the range for that share measurement over that time period. See Figure 1.

So what’s going on?

First, the USDA’s price data very likely overstate the current price. An example: We have heard of buy-one-get-one promotions at, say, $4.99 per pound on bacon recently. We aren’t sure how that would get picked up by Bureau of Labor Statistics surveyors (who gather the data that ERS uses) but it is possible that it gets recorded as $4.99 instead of $2.495. Further, even if they get the correct $2.495, none of the price gatherers has any idea of how much is sold on that feature and the $2.495 will be averaged with the next store’s non-promotion price of $4.99 to get an arithmetic average that may be far too high, especially in times of widespread featuring. I don’t think we are in such times yet but they may be here soon.

Second, let’s remember that high retail prices are in many senses and most circumstances a good thing. Do you want to be selling a product that is worth a lot or worth a little? Which one is likely valued more highly by your customer? What does that mean for that customer’s purchase decisions when things get tough? How can a dollar ever find its way into a packer’s check for your hogs if it doesn’t first pass through a retailer or restaurant? When can wholesale and hog prices rally the fastest: When retail prices are low or high? I think the answers to all of those are obvious and are supportive of high retail prices.

Third, the USDA’s retail pork price has already fallen by an astonishing 32.2 cents per retail pound or 7.6% in just six months. “Well that doesn’t sound too astonishing to me,” you might respond. But look at Figure 2. When in history have pork prices moved this much lower this quickly? In fact, the only time that any retail meat or poultry price fell that much or more in a six-month period was late-2005 into early 2006 when the composite broiler price declined by 26.5 cents per pound or 15%. Retail meat and poultry prices are very sticky downward and the recent decline for pork, while small relative to hogs and the cutout value, has been the fastest on record.

So what should be done? Producers, packers, National Pork Board – everyone – need to push retailers and restaurants to feature pork. There should be no fears about supply this year. Pigs are plentiful and are going to stay that way as long as porcine epidemic diarrhea virus is quiet in sow farms. Margins are there to make money even if retail and menu prices are lower. While fresh pork may not be the store traffic driver of beef or chicken, bacon and brats could have some significant impacts at this time of year.

Are they all (meaning retailers) in cahoots here? I don’t think so and we shouldn’t suggest they are or that any kind of regulatory action is needed. Pork sellers, however, need to know a) there is plenty of pork and b) we are watching and waiting – but perhaps not so patiently as a few months ago.

About the Author(s)

You May Also Like