New Crop Corn Improves Prospects for Pork Profits

May 20, 2013

A dry week in the Midwest will likely be reflected in substantial, probably record-high, weekly planting progress report when those data are released this afternoon. That prospect has new crop corn futures trading near $5.15/bu. today and only four cents higher than the December contract’s lifetime low of $5.11/bu. set on June 15, 2012. That, of course, was about the time that last summer’s heat and lack of rainfall began to be a clear problem and prompted December ’13 futures to go above $6.60/bu. by early September. Should good growing conditions prevail, $5/bu. corn will be high at harvest time.

Trimming Feed Costs

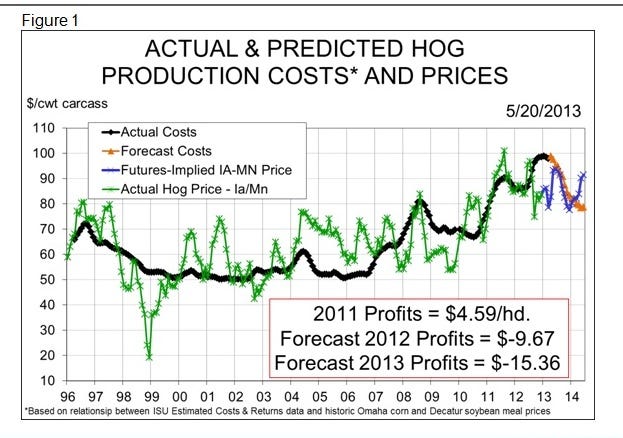

In spite of the corn and soybean meal price declines, my model still shows no profitable months for Iowa farrow-to-finish operations this year (Figure 1). The model is, of course, built on Iowa State University’s (ISU) Estimated Costs and Returns series and, thus, assumes the production parameters of that series are accurate. Feedback from a number of sources indicates that the ISU costs may be about $5/cwt. higher than the costs of the most efficient producers at this time, so there may be some farms that will turn small profits this summer.

The good news is that the model shows sharply lower costs for 2014 – at least through July. The data allow us to go that far into the future where futures prices for corn, soybean meal and hogs show black ink from February onward. And the profits next summer are substantial with current margins of around $24/head for May and June, and nearly $40/head in July, when costs are forecast to be just short of $72/cwt., carcass. If that cost level comes to fruition, it will be the lowest monthly figure since November 2010.

Like what you’re reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every Monday!

Keep an Eye on Beef, Chicken, Hog Expansion

So can we get some help on pork and hog values? In true economist fashion, I’d have to say: “That depends.” It depends on several factors, including:

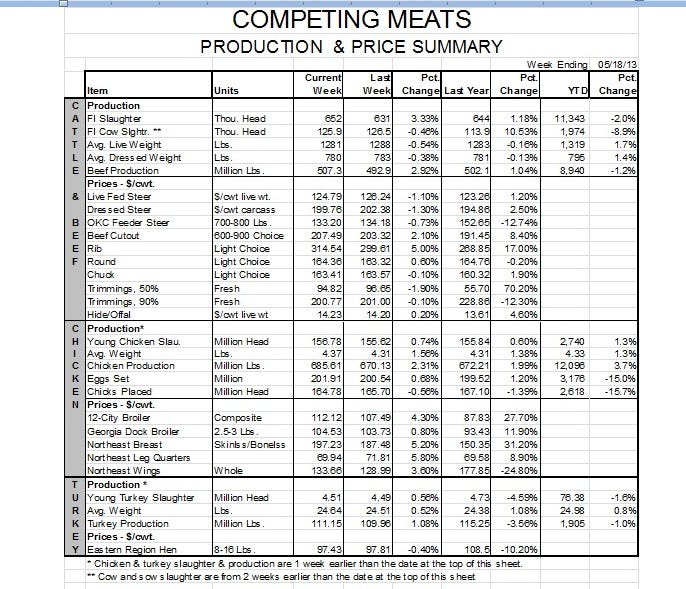

· What happens to beef prices? Choice beef has been record-high of late, finally fulfilling my forecast of a year ago. It turns out that I was just a tad early on that one, even though logic has suggested that beef prices should have been higher. But April placements were over 15% larger than last year in absolute numbers and nearly 10% larger when one extra business day is accounted for. April 2012 placements were low, but that is a pretty hefty year-on-year increase. There are still 3.4% fewer cattle on feed than last year, but weights continue to contribute more to total beef supply. I still expect strong beef prices, but we may be close to the seasonal peak with some retreat back into the mid-$190s in the offing.

· Can chicken prices stay high if the larger breeder flock finally pushes sets and placements higher? Yes, prices could stay high, but whether they can stay as high as they are now is questionable. The reason is that breast meat at nearly $2/lb. makes the business profitable and, like many others, it can’t stand prosperity. I still look for chicken to be positive for pork demand but I don’t expect the price differential to remain as large as it’s been. Even the positive impact of KFC’s boneless original recipe won’t stand long in the face of broiler companies' desires to grow.

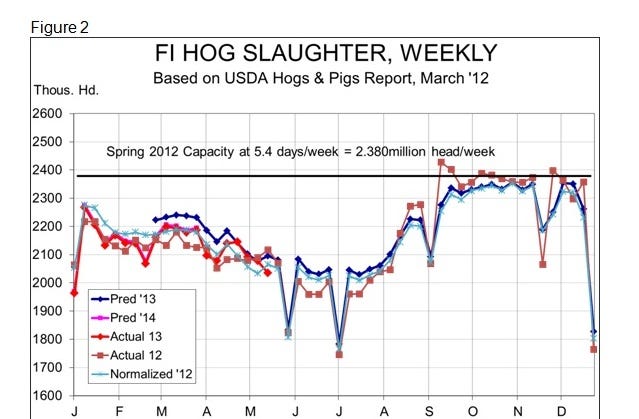

· What happens to hog supplies from here on out? Last week’s 2.035 million head was over 2% lower than the week before and nearly 4% lower than one year ago. It was also about 3% smaller than the level I had predicted based on the March Hogs and Pigs report, but this was the first significant deviation from that predicted level since early April. I don’t think this is a harbinger, though, as I expect numbers to settle in at around 2.05 million/week through July. The forecast levels in Figure 2 are 3% higher than last summer, owing mainly to low levels last year that I think were driven by excessive heat in many key growing areas. We could still see a summer hog rally but I do not expect it to be large.

The message, unfortunately, still is not good for this year even though Q4 could get better due to lower costs. Next year is looking much better provided corn and soybean yields are near normal. That is provided, of course, expansion doesn’t get too robust. But that could never happen, right?

You might also like:

Ractopamine Restrictions Cause Pork Export Slump

New Mandatory Reporting is Good, but not without Pain

What’s Caused Prices to Falter, Demand or Supply?

You May Also Like