NAFTA talks continue as pork production grows

Pork production in three NAFTA countries projected to continue to grow.

September 21, 2017

The North American Free Trade Agreement, when enacted in 1994, created the world’s largest free trade area, encompassing 450 million people and a gross domestic product of more than $20 trillion. That progress in trade is in jeopardy as trade officials from the member-countries of the United States, Canada and Mexico are at the negotiating table.

During his campaign, President Donald Trump had threatened that the United States would pull out of NAFTA altogether. Negotiators have had two rounds of discussions, with a third round beginning in Ottawa on Sept. 23.

According to a Reuters article, NAFTA trade accounts for 39% of Canada’s GDP and 49% of Mexico‘s, but just 5% in the case of the United States, the world’s largest economy. Both Canada and Mexico sell more than three-quarters of their exported goods to the United States. The 23-year-old trade deal encompasses agricultural and industrial goods to intellectual property and environmental regulation.

The National Pork Producers Council says since NAFTA implementation, U.S. trade with Canada and Mexico has more than tripled, growing more rapidly than U.S. trade with the rest of the world. These countries are the two largest destinations for U.S. goods and services, accounting for more than one-third of total U.S. exports.

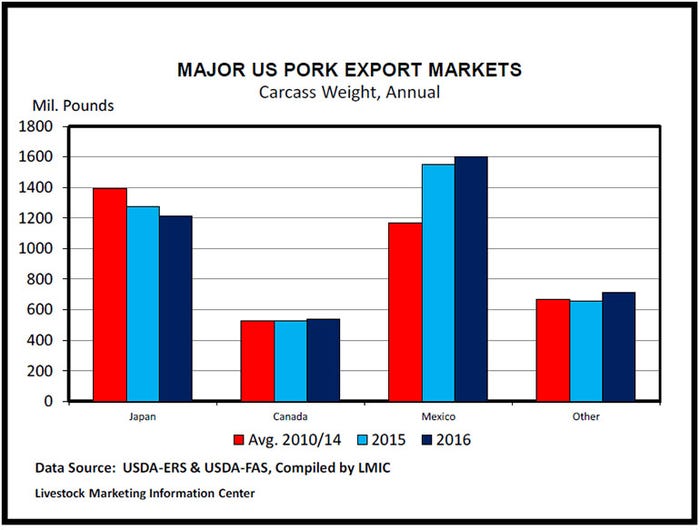

Pork producers rely on export markets for adding value to their product as about 26% of U.S. pork produced ends up in foreign markets. Exports added $50 — representing 36% of the $140 average value of a hog — to every U.S. hog marketed in 2016, when $5.9 billion of U.S. pork was exported. Mexico and Canada are particularly important export markets.

As U.S. pork production is on the rise, the Canadian and Mexican pork sectors are also forecast to show continued growth through next year. The Daily Livestock Report, citing USDA’s Foreign Agricultural Service Global Agricultural Information Network Report, says “for (Canadian) pork, both increases in slaughter levels and carcass weights are forecast, resulting in tonnage produced in 2017 up 2.5% year-over-year. In 2018, pork output is expected to continue to uptick (rising 2.0% from 2017).”

According to the GAIN Report on Mexico, “For the first time, Mexico is exporting live swine, and the pork sector continues to vertically integrate. However, Mexico depends on imports of pork to meet domestic demand.”

The Mexican pig crop production for 2018 is forecasted at 19.9 million head, up from the revised 2017 figure, as genetics introduced in the domestic herd are reportedly propelling growth. Production continues to be bolstered by domestic demand. The vertical integration, as noted in previous reports, is happening at a higher rate than in the beef sector. Recent growth by the larger players in the swine industry is supporting further production, according to the GAIN Report.

According to the Daily Livestock Report, “Exports of hogs and pigs to the United States should post year-over-year gains driven by new U.S. slaughter plants. Canadian pork exports worldwide are forecast to continue growing. To meet Mexican domestic pork needs, imported tonnage from the United States is forecast to continue higher.”

Reuters recently polled economists who say Mexico and Canada will come out of the NAFTA talks relatively unscathed. “Any changes will likely be incremental,” Brett Ryan, economist at Deutsche Bank in New York, says in the Reuters article. “U.S. corporations, particularly automakers, would be at substantial risk of supply chain disruptions. The U.S. farm lobby would also be opposed.”

Changes are likely to encompass dispute settlement mechanisms, labor and environmental standards, supply-management protections and rules of origin, among other areas, and may have the biggest impact on the auto and agriculture industries, Reuters poll respondents say.

You May Also Like