More opportunity ahead for pork industry

Despite some challenges, 2021 will be profitable for most producers.

It is hard to believe that Labor Day has passed and that we will soon put a close to 2021. It was just a year ago that the industry faced some difficult decisions regarding inventories as numerous plants closed or scaled back on harvest numbers. What a difference a year makes!

As I continue to review earnings statements with clients, it is refreshing to see that, while we did see some pockets of PRRS 1-4-4 in the upper Midwest, this year will be profitable for most if not all producers. The hard decision for many now becomes: what type of strategy do you use for 2022? I have always been a strong advocate of implementing a risk management plan that meets the goals for returns on your business. That being said, I understand that when looking back this year, you may feel like you left a fair amount of opportunity on the table. We saw this firsthand with the money that needed to be sent in for margin calls starting in March and peaking during June.

What caused the incredible swing in prices over the previous year? While I have my theories, that question remains. Looking at production a year ago, everyone was implementing strategies to reduce inventories due to plant production backlogs. Farms were breeding less sows, unthrifty pigs were culled and most farms effectively managed growth within their existing inventories. As an industry, producers responded and did what was necessary to survive last year. However, once we moved into spring of 2021 and prices started moving higher, producers would typically start pushing their production facilities to maximize output. What changed this year? PRRS 1-4-4. It might be the first time in my career that PRRS has actually impacted production numbers enough to push prices close to the 2014 levels we saw with PEDV.

The number of sows liquidated due to COVID exceeded my expectations as well as those of the industry as farms have not been rebuilding or replacing those shuttered sow farms. Over the past few weeks, I have been made aware of more sow farms for sale that I can remember since 1999. For the benefit of the industry, it is probably time that some of the idle assets remain empty. Most have outlasted their useful life, and it could be time to replace those farms with new buildings. In most years, this would be the case, however, with inflated cost of construction, it appears most producers have been sitting on the sidelines when looking at building new or even renovating older farms.

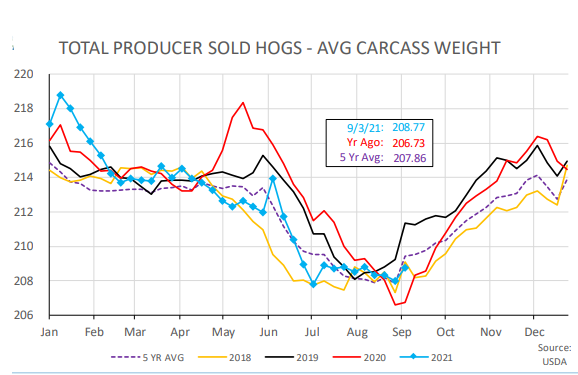

There are a few reasons why producers will continue to have opportunities in 2022, especially since demand and exports remain strong. Producers have pulled deliveries of hogs forward, not because of the economics of doing so, but because packers have requested it. They want all the hog deliveries they can get due to PRRS. This should help keep weights in check during the fourth quarter this year, and trending very close to the five-year average.

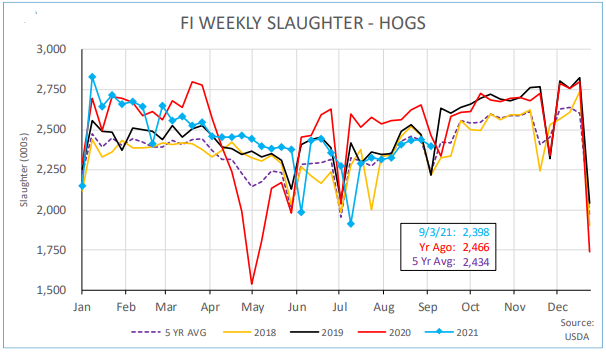

As we continue to pull production ahead, we see a tight correlation with the number of hogs available for deliveries, as illustrated below:

Even with all the support for Q4 2021, you may have to revisit your strategy. Futures have taken over half of the profit over the next 12 months in just four trading days in a typical seasonal trend. As of last Wednesday, there was about a $20 per head return over the next 12 months, and as of today, this sits at $9 per head. This could provide an opportunity to move to an option strategy for those hedges you had.

To me, the indicators to watch going forward will be the daily slaughter numbers as some packing plants slow line speeds, reducing total slaughter numbers. This could push weights higher than expected into the fourth quarter. There have been far too many years I have seen producers implement a marketing strategy one year and completely ignore it the following year, only to give back the previous year’s profits. Hopefully, as a producer, you had a sound strategy in place before the seasonal drop and will finish 2021 with a very profitable year. More importantly, continue to take advantage of profitable opportunities going forward and stick with your marking plan.

Sources: Steve Malakowsky, who is solely responsible for the information provided, and wholly own the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like