Lots of hogs here, less pork there

USDA’s Foreign Ag Service is predicting 2020 world pork production will be down 15.7% from 2018, much at the hands of African swine fever.

USDA’s September Hogs and Pigs inventory survey found a record 77.678 million hogs in the United States. That was up 3.4% from 12 months earlier and larger than the year before for the fifth consecutive year. The world’s hog population, however, is declining because of the rapid spread of African swine fever in Asia.

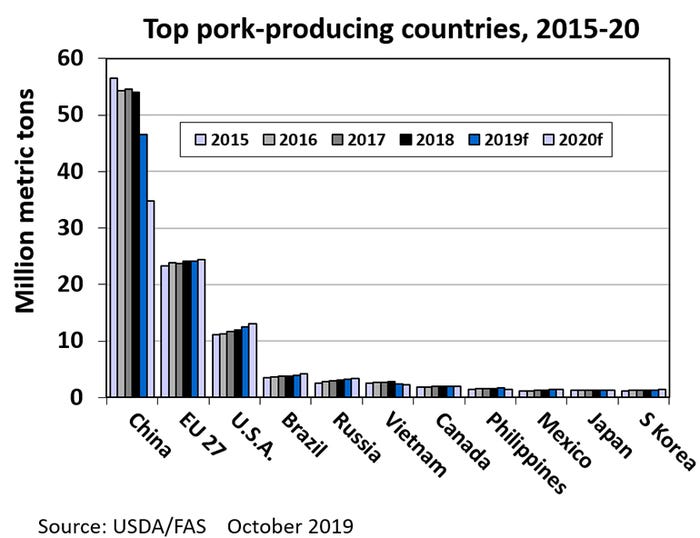

There has been lots of speculation on just how severely ASF is impacting pork production. Earlier this month, the USDA’s Foreign Ag Service weighed in with their forecasts of production, consumption and trade. The FAS is predicting 2020 world pork production will be down 15.7% from 2018. The decline of 17.715 million metric tons is due to a drop of 19.29 mmt of pork production in China. Because of ASF, Vietnam and the Philippines are also expected to produce less pork next year than they produced last year with Vietnam down 20% and Philippines down 12.6%. Other major pork-producing nations are showing increases in pork production. For comparison, the United States is expected to produce 12.516 mmt of pork this year which equals only 65% of the expected decline in China.

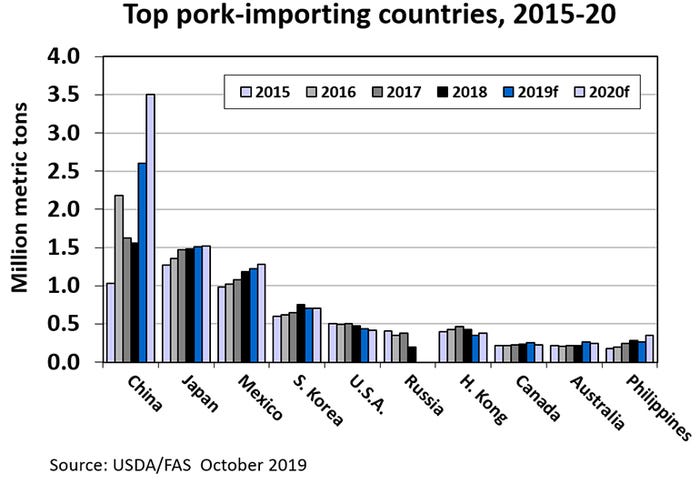

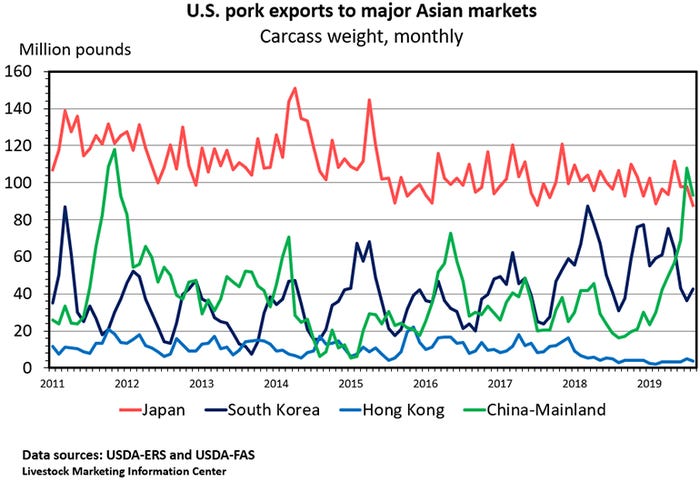

With their pork production plummeting because of ASF, China is predicted to import 2.6 mmt of pork this year and 3.5 mmt in 2020. That is up from 1.561 mmt imported in 2018. China has been the top pork importer each year since 2016.

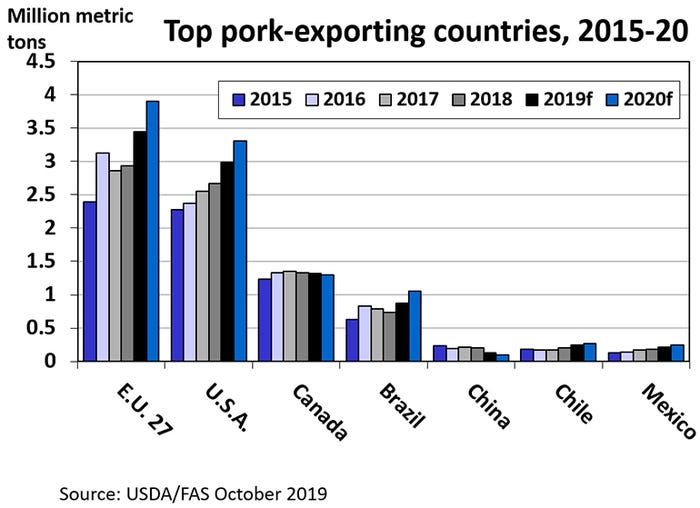

The 27 member countries in the European Union have been the top pork exporters each year since 2015. USDA’s FAS is forecasting 2020 EU pork exports will be 966,000 metric tons larger than in 2018. Over this two-year period, U.S. pork exports are expected to be up 646,000 mt, Brazil up 320,000 mt, Chile up 70,000 mt, and Mexico up 62,00 mt.

There are more than 1 billion pigs born each year. Because of ASF, the 2020 world pig crop is expected to be 252.638 million head smaller (19.9%) than in 2018 with 275 million of that decline in China. China is predicted to produce 40.1% fewer pigs in 2020 than 2018.

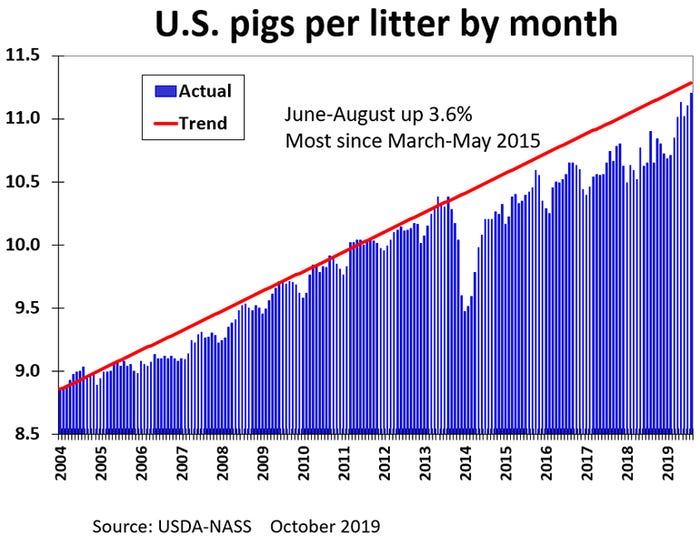

The biggest surprise in the September Hogs and Pigs report was the summer average of 11.11 pigs per litter. That was 103.6% of June-August 2018 and the biggest year-over-year increase since March-May 2015. For 13 consecutive quarters starting in December 2015 and ending in February 2019, pigs per litter has averaged 100.95% with a range of 100.19% to 101.83%. Pigs per litter was 103.48% in March-May and 103.64% in June-August.

USDA has June-August farrowings at 99.3%, September-November farrowing intentions at 99.4% and December-February intentions at 99.9% of a year earlier. With pigs per litter up more than 3%, small reductions in farrowings will not pulldown production.

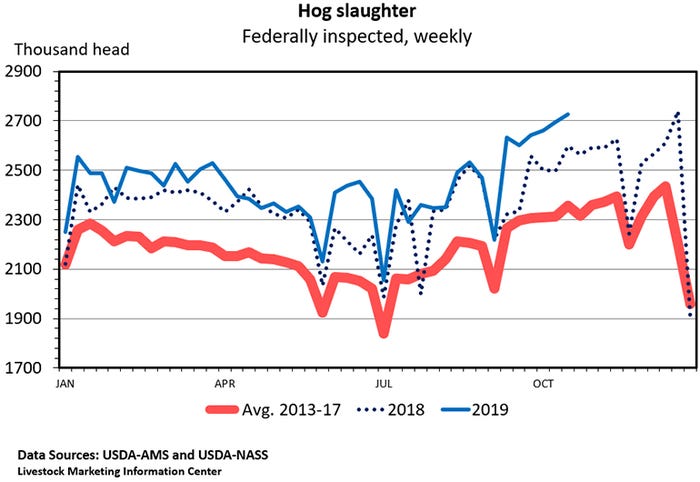

Recent hog slaughter has been huge. Since Sept. 1, hog slaughter has been up roughly 6.7%. The heavy weight inventory implied it would be up 6.1%. The two biggest slaughter days ever were in September: 492,033 head on Sept. 17 and 491,874 hogs on Sept. 10. The biggest weekly slaughter (2.738 million head) was for the week ending on Dec. 22, 2018. The second, third, fourth, fifth and sixth largest weeks were either this month or last. Look for several more daily and weekly slaughter records before the end of the year.

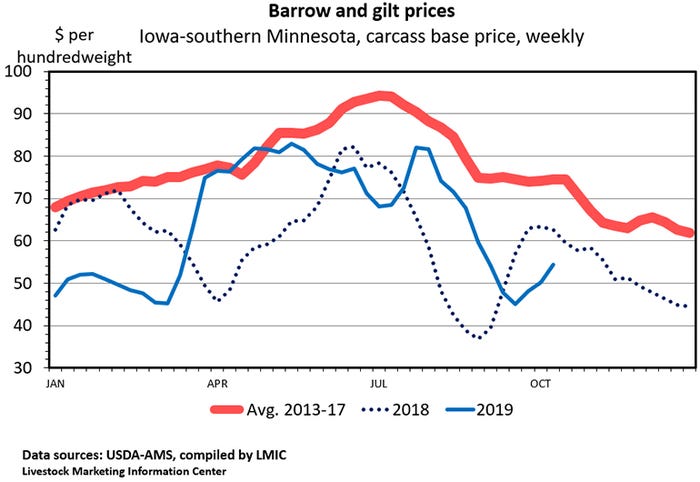

The average price of pork at retail during September was $3.879 per pound. That was down 1.7 cents from the month before, up 9.4 cents from a year earlier, and the highest month since July.

The average live price for 51-52% lean hogs in September was $41.74 per hundredweight. That was down $13.71 from the month before, up $3.30 from a year ago, and the lowest monthly average price since February.

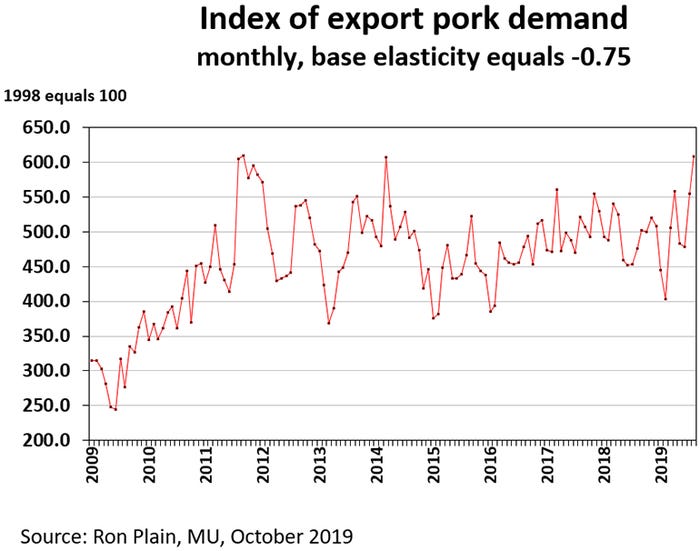

Increasing pork exports to China has caused a jump in export demand. Export demand for U.S. pork was up 22% in July and up 28% during August. Domestic pork demand was down 1.6% in August. This was the first down month of 2019.

In July and August, China was the second biggest buyer of U.S. pork after Mexico. U.S. pork shipments to China during August totaled nearly 93 million pounds, the fourth largest month for Chinese purchases after October and November of 2011 and July 2019. Last year, 1.3% of U.S. pork production was shipped to China. Through August of this year, China has purchased 2.6% of U.S. production.

Despite increasing exports and declining imports, the domestic pork supply is increasing faster than the population. The FAS is predicting that domestic pork consumption will be up 4.8% this year and up 4.0% in 2020. That will leave per capita consumption at 50.9 pounds in 2018, 51.7 pounds in 2019 and 52.1 pounds in 2020. That will be the highest since 1999.

The futures market is bullish on hog prices. As of last Friday, the December hog futures contract, at $67.95 per hundredweight, is the lowest one on the board. All of the 2020 lean hog futures contracts are trading above $71 per hundredweight with the June, July and August contracts above $90 per hundredweight. If cost of production stays in the mid-$60s per hundredweight, next year should be a profitable one for hog producers.

Calculations by Iowa State University economist Lee Schulz put farrow-to-finish losses at $0.61 per hog marketed during September. This was the first unprofitable month since February. Schulz estimated the breakeven carcass price at $62.75 per hundredweight, the lowest since June.

USDA will release their weekly crop progress report this afternoon. The monthly Cold Storage report comes out on Tuesday. USDA will release the monthly Livestock Slaughter report on Thursday and the October Cattle on Feed report comes out Friday.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like