Even with Slippage, Pork Export Record Not Out of Sight

With last week’s release of August data by the Commerce Department and USDA’s Foreign Agricultural Service (FAS) and Economic Research Service (ERS), the year-on-year declines in monthly export figures are now officially upon us.

October 15, 2012

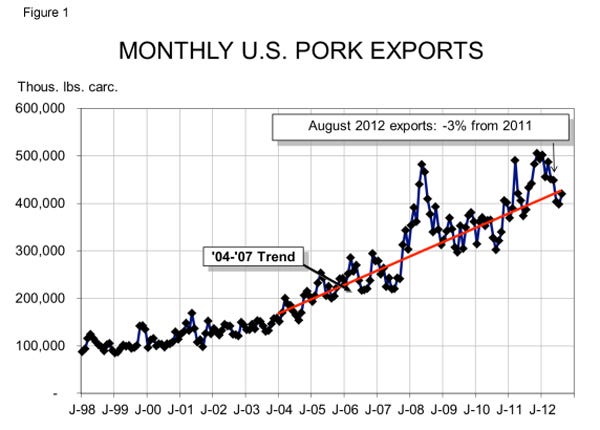

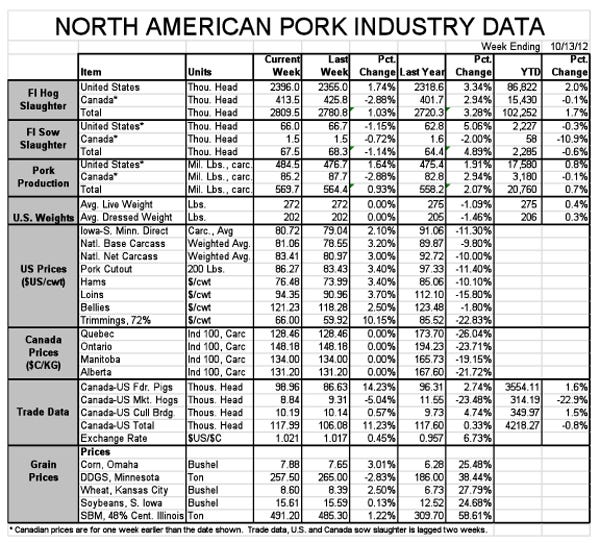

With last week’s release of August data by the Commerce Department and USDA’s Foreign Agricultural Service (FAS) and Economic Research Service (ERS), the year-on-year declines in monthly export figures are now officially upon us. The ERS data for carcass equivalent exports appear in Figure 1. August shipments totaled 419.6 million pounds, 5.5% higher than in July, but 3.1% lower than one year ago.

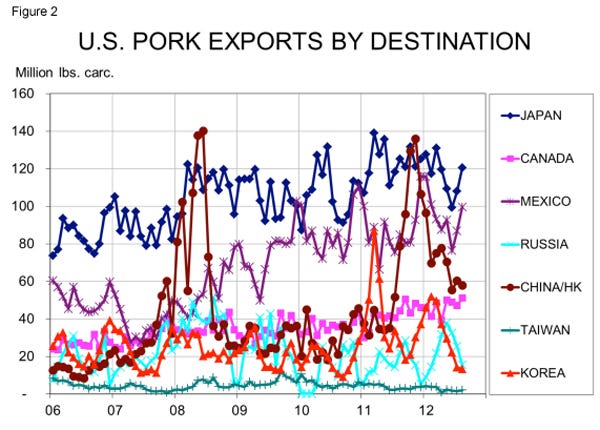

The biggest reason for the year-on-year decline is of course a shortfall vs. 2011 for exports to China-Hong Kong (Figure 2). This year’s shipments were a respectable 57.875 million pounds carcass weight equivalent. But that figure falls 26.5% short of last year’s 78.7 billion pounds during August when shipments to China-Hong Kong headed for near-record levels in October and November.

No one expects this year’s shipments to get anywhere close to last year’s for the remainder of 2012, so these year-on-year pork export shortfalls to China will get larger. Even with a record-strong Chinese currency, we expect the declines to exceed 200 million pounds or so for September through December and perhaps 170 million pounds for the fourth quarter. With Q4 U.S. production expected to be very close to last year’s level, this represents about 2.1% of U.S. production that will have to find a home elsewhere this year.

The good news is that shipments to the rest of our export customers remain strong, growing by 2.1% year-on-year in August. Mexico, Canada and the Caribbean were the leading growth destinations gaining 15%, 17.5% and 52.4%, respectively, vs. last year. Shipments to Japan were down 3.9%, while shipments to South Korea were down just over 50% compared to last year.

Year-to-date, U.S. exports are still 9% larger than 2011. Among our major customers, only Japan shows a decline (-5%) through August. China-Hong Kong is still up more than 61% for the year. Exports to Mexico and Canada are up 13% and 18%, respectively.

We need another 1.626 billion pounds of carcass weight exports for September through December to break last year’s annual record. September-December of 2011 saw 1.922 billion pounds in pork exports, so we must stay within about 15% of last year’s pace the rest of this year to accomplish a new record. Allowing for 200 million less pounds to China-Hong Kong, our other markets only need to keep pace with last year over the final four months for us to reach that goal.

Crop Market Moves Puzzling

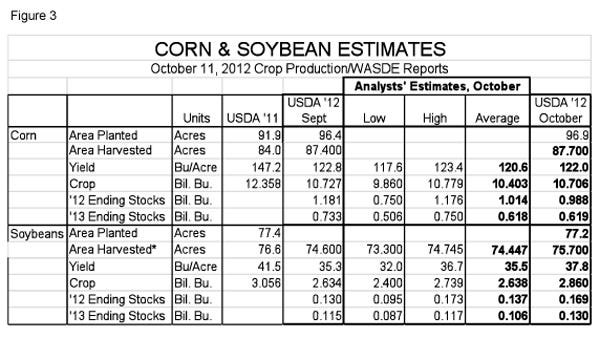

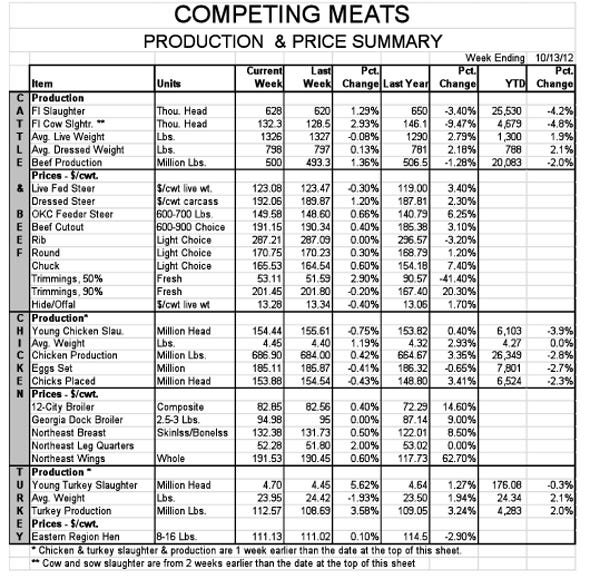

On its face, last week’s Crop Production and World Agricultural Supply and Demand Estimates (WASDE) reports from USDA looked like good news for pork producers. More total acres, no reduction in harvested acres (which was widely expected), and a reduction of only 0.8 bu./acre for the estimated national yield is all good news, right? Wrong! The market responded with near-limit gains on supply numbers that were well above the average estimate of analysts going into the report. What went haywire?

We’re not completely comfortable with any explanation since sometimes markets just do stuff. But this situation was set up by the Grain Stocks report of Sept. 29, which took year-end 2011-12 stocks/year-beginning 2012-13 stocks down by nearly 200 million bushels. In addition, USDA’s numbers for world supplies were bullish and their figures for the world wheat situation were very bullish, which means that feed wheat competition, especially from Russia and the Baltic Sea region, would be diminished. And the soybean complex put up no fight at all in spite of significantly better 2012 ending stocks and 226 million bushels of additional production.

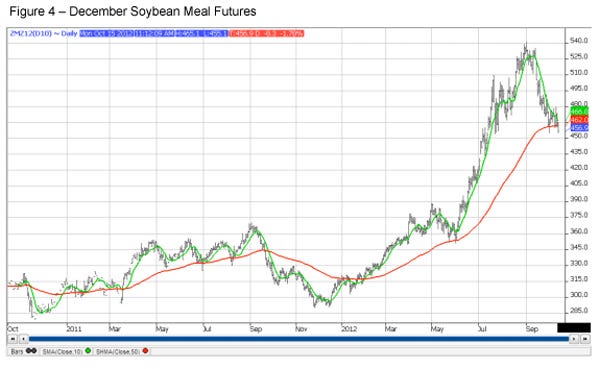

Both markets have softened considerably since Thursday’s rally with November soybeans taking out their Oct. 3 low this morning, December corn futures dropping 21 cents on Friday, and then dropping another 12 cents so far today. December soybean meal appears poised to take out its Oct. 3 low as well. If it does, the next chart objective (Figures 3 & 4) is the July 5 gap at $435/ton.

Dare we even think of meal that “cheap”? I still don’t think it is likely, but it is not impossible given a Reuter’s report that analysts are expecting 2013 Brazilian production to be 20-23% larger than 2012 output and, for the first time ever, larger than 2012 U.S. production. Continuing reports that soybean yields are running better than expected could put some more pressure on this market, but the key at this point is South American weather.

About the Author(s)

You May Also Like