Common Denominators of Successful Pork Producers

Managing risk, becoming a low-cost producer and being able to measure success will lead to pork industry profitability.

April 22, 2013

The last eight months have been challenging for anyone involved in the swine industry. It’s been especially challenging for those who don’t have some sort of risk management plan in place or have not executed their plan to head off the drought’s impact on margins. Besides the need to manage risk, the need to be a competitive, low-cost producer is vital to establishing a platform that will allow you to be profitable.

It’s amazing to see the productivity levels that production systems are achieving today. These productivity levels are a huge plus for our industry and they show how far the industry has come in regards to improving animal husbandry and animal care practices. Some common denominators that we see in successful producers include:

· Owning the sow.There are a few exceptions, but those who own the sows have had more profitability in the long term.

· Averaging 25 to 30 pigs weaned/sow/year. Some systems are hitting 30. When you look at high-health production systems, they are not only likely to be the low-cost producers on the weaned pig end, but their finishing productivity is equally impressive.

· On the finishing side, a good benchmark is a wean-to-finish mortality rate of 5% or better and selling 92% of placed hogs as Grade A sales. While some profitable systems do not hit these marks, more often than not, the profitable units are at or below these production measures.

Measuring Success

As we’ve noted many times, the ability to combine quality production and an understanding of your costs to a risk management plan will greatly improve your long-term ability to lock in positive margins.

Like what you're reading? Subscribe to the National Hog Farmer Weekly Preview newsletter and get the latest news delivered right to your inbox every Monday!

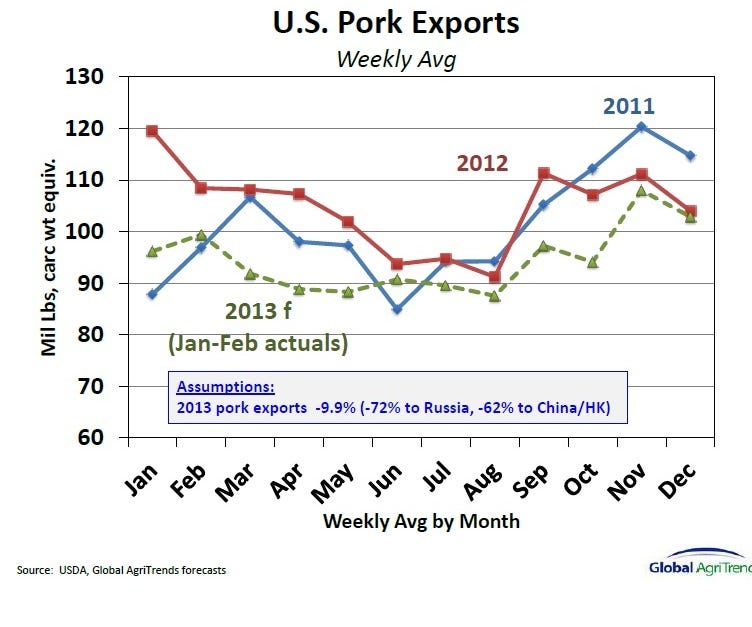

One of the keys to understanding risk management and volatility is that pork exports at 25% of total production are huge. In the graph below, Brett Stuart with Global AgriTrends illustrates how reductions in pork exports early in 2013 have affected the industry and how those reductions might play out the rest of the year. Thus, it’s no surprise that we have weakness in the cash and futures markets for lean hogs. Were you prepared for last year’s downturn ? Have you calculated acceptable margins for your operation going forward?

Pork Advocates

Another long-term key to producer profitability is their willingness to become more involved in advocating for the industry. With such a small portion of the population involved in agriculture – even fewer in animal agriculture – advocacy will be vital in the long term. Some countries have not had advocacy programs in place to address animal rights group agendas and this has led to much smaller industries and higher food costs. It is critical that everyone involved in agriculture helps educate the general public, who may not understand modern agriculture or modern agricultural practices. Providing this education is a vital risk management tool going forward.

Today’s pork producers are very good at what they do and they are constantly looking for ways to improve. This focus makes U.S. producers the most competitive in the world. The new technologies and innovations being brought to the industry make it an exciting industry to be involved in. I look forward to seeing this progress continue.

Contact Roelofs at: [email protected].

You might also like:

You May Also Like