Beef remains a solace for pork market

Eyes now turn to Friday’s Hogs and Pigs Report

March 23, 2015

I’m going to date myself again here: In the famous words of Saturday Night Live character Roseanne Rosannadanna – “It just goes to show you Jane, if it’s not one thing it’s another!”

It’s not nearly as funny written out as it was when the late-Gilda Radner delivered in that New York nasal accent but ...

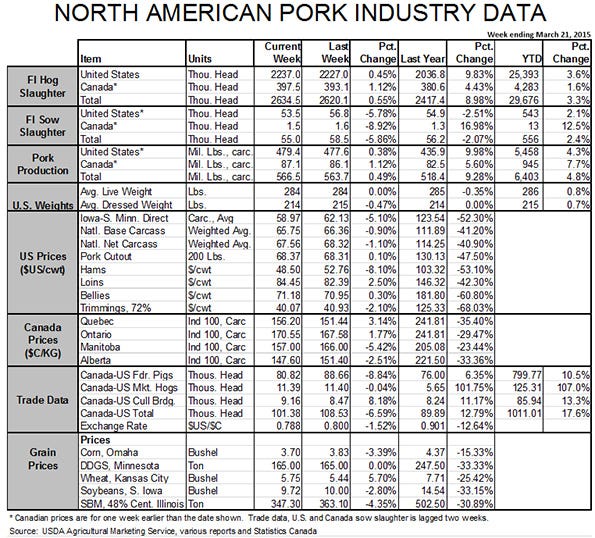

That’s how I fell about the hog market this morning with news that workers at the Olymel packing plant in Valle-Jonction, Quebec, went on strike last week. The labor stoppage would not have had much impact here in the past but the closure of Quality Meats in Toronto last year has forced a significant number of Ontario hogs into Quebec and the strike will likely block that flow. Canadian analyst Kevin Grier reports that the Olymel plant normally processes about 20,000 head per week and he estimates that 10,000 of those will be looking for a home beginning this week.

The worse news, of course, is that the “home” will likely be the United States. With slaughter coming in over 10% higher than one year ago the past two weeks, we really don’t need them but let’s not attribute too much negative to this situation. U.S. slaughter has run in the mid-430,000 range on most mid-week days for the past few weeks. The sector has a capacity of 451,520 per day so there is space for the Canadian pigs, especially in the East.

Further, those pigs were weighing on the “North American” market already. Remember that Canada is our No. 1 pork import supplier (accounting for over 75% of our pork imports last year) and our No. 3 pork export customer. Canadian pork supply and demand are already factors in the U.S. market.

This latest development is just another negative item for a market that has had plenty of them this year.

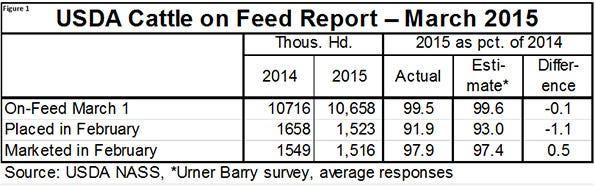

One solace remains for pork: Beef is high and it’s going to stay that way! That fact is not news either, but it did get reinforced on Friday with a Cattle on Feed report that confirms tight supplies through the summer. The key data from the report appear in Figure 1.

As can be seen, placements of cattle into feedlots with capacities of 1,000 head and more (the only ones surveyed for the monthly report) were 7% lower than last year and 1.1% lower than the average of analysts’ pre-report estimates. We thought that result, when combined with marketings and total cattle on feed numbers very close to analysts’ averages, would be neutral to Live Cattle futures today but they gapped higher at the open and are trading $1.45 or so higher on the nearby contracts as of this writing. Deferred contracts are higher but to a lesser degree.

We still have some concerns over beef markets in the short run. Not big ones, mind you, as these cattle supplies are still tight. But the very slow pace of marketings has left lots with large numbers of big, long-fed cattle. The number of cattle that have been on feed for 120 days or more is now 13.5% higher than last year. Slaughter weights are running over 20 pounds ahead of last year and are not dropping in a normal seasonal manner. Feedlots have won the stand-off so far, forcing feedlots to pay up but we think a reckoning is coming and look for a break in cattle prices in April and May. Again, not a big one but a decline to the low-$150s would not surprise us at all.

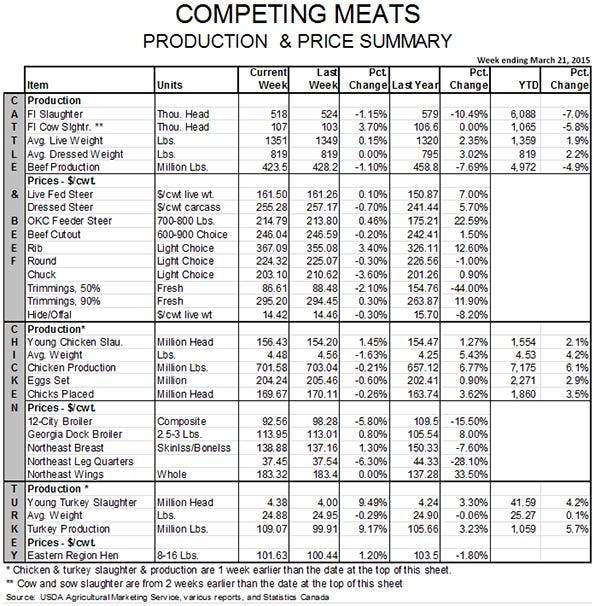

What does that do to pork? It will make beef more competitive for a bit but probably not for long enough to hurt pork’s huge pricing advantage at the moment. Pork buyers have hopefully figured out that a repeat of last year in not in the cards. Friday’s report should prevent those same buyers from thinking that any downturn in beef prices will a) get very large at all or b) last for any amount of time.

We think the situation is still ripe for retailers to feature pork big time, and it needs to happen soon. Consumers will buy more pork but they probably won’t do it at prices to which retailers have grown accustomed recently. There’s little threat of a margin squeeze so let’s get the features rolling. There are plenty of pigs coming.

We will find out all about that situation, of course, on Friday afternoon when the USDA releases its quarterly Hogs and Pigs report. The question is “How many more?” We have seen two sets of pre-report estimates for this Friday’s key numbers. One of them had a lot of +4, +5 and +6 numbers. The other had a lot of +8 and +9 numbers and a couple of +10s! My initial reaction is that those two might be the extremes but the mere fact that a knowledgeable observer could come up with some numbers that large is a bit sobering. We expect a breeding herd 3 to 3.5% larger than one year ago and a market herd up about 6%. The trouble is that the bulk of that market herd increase will be in the third and fourth quarters. Our estimates from the December report were +7.5 and +6.5 for those quarters and those were predicated by an assumption that porcine epidemic diarrhea virus losses would be about one-third as large this year. They haven’t been that large, so we could see +8.5 to 9 and +7.5 to 8 for those quarters.

We will have a complete discussion of Friday’s report in next Monday’s Weekly Preview.

About the Author(s)

You May Also Like