What does 2018 say about the year ahead for hogs?

Hog weights are expected to increase in 2019, but with hog producer margins tight to negative, the increase in slaughter weight is likely to be small.

Each weekday afternoon, the USDA-Agricultural Marketing Service issues an estimate of federally inspected livestock slaughter for that day. These preliminary estimates are updated with actual slaughter values issued by USDA-National Agricultural Statistics Service 13 to 17 days later.

The partial shutdown of some federal agencies has caused an absence of some normally available livestock data. During the shutdown, the preliminary AMS estimates of livestock slaughter are coming out daily, but the revised actual slaughter values are not. The last NASS report of actual slaughter was for Dec. 8.

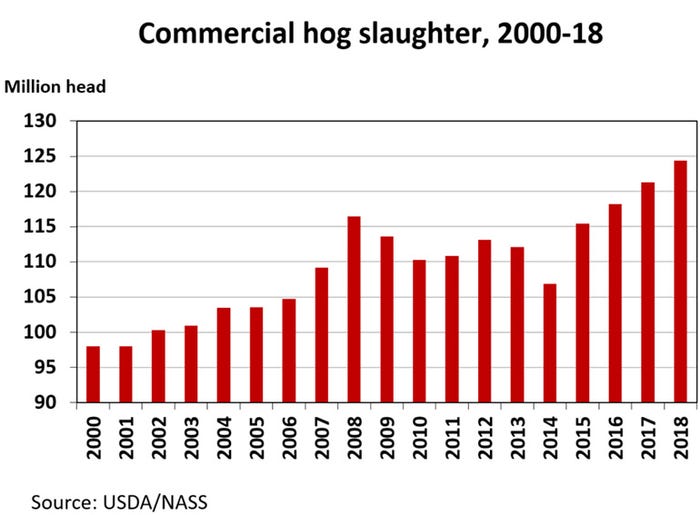

Using the NASS values for Jan. 1 through Dec. 8, plus the AMS preliminary slaughter estimates for Dec. 9-31, it appears that 2018 federally inspected hog slaughter totaled 123.6 million head. That is up 2.6% from the year before and record high for the third consecutive year. All indications are that 2019 hog slaughter will be a new record.

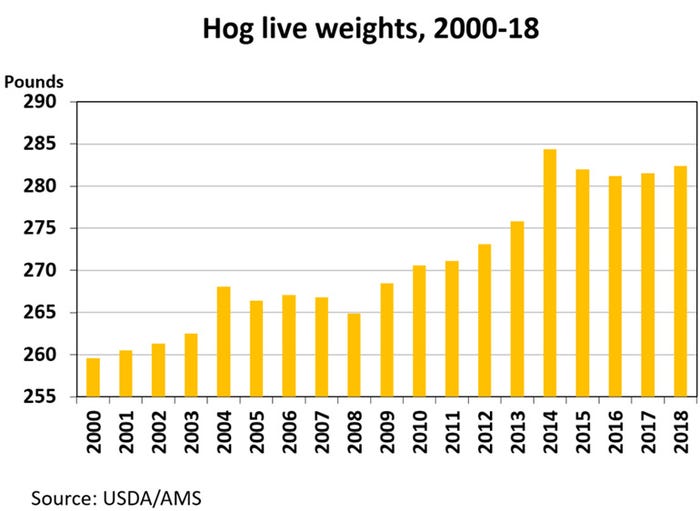

Hog weights vary year to year, but the trend in slaughter weight is definitely higher. Over the last six decades slaughter weights have increased by an average of one pound per year. The increase in weights means that annual pork production usually increases more than hog slaughter.

Hog slaughter was down sharply in 2014 because of increased death loss caused by the porcine epidemic diarrhea virus. Producers responded by pushing slaughter weights to record levels, which moderated the decline in pork on the market.

The slaughter weight of barrows and gilts in the Iowa-Minnesota series averaged 282.4 pounds last year, up 0.9 pounds from the year before, but down 1.8 pounds from the 2014 record.

Hog weights are expected to increase in 2019, but with hog producer margins tight to negative, the increase in slaughter weight is likely to be small.

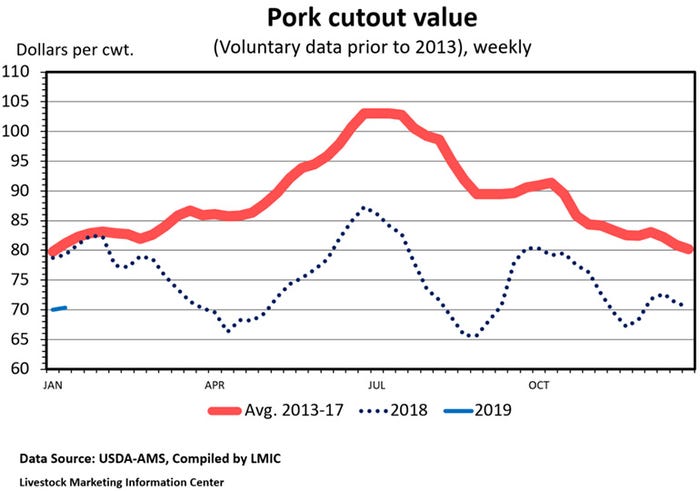

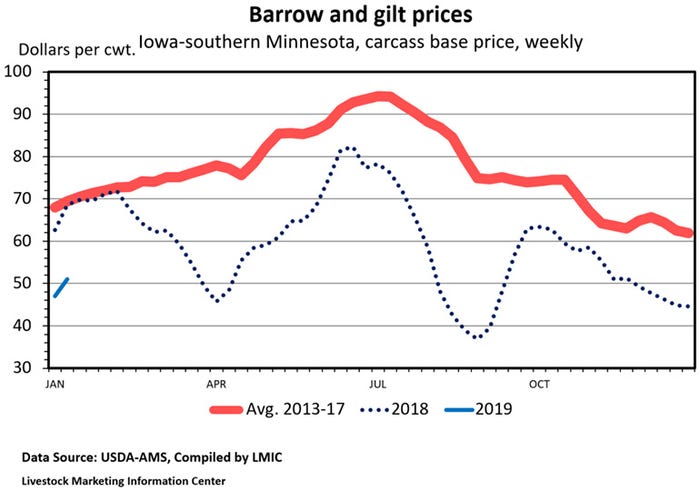

Federally inspected hog slaughter in the PED year of 2014 was 106.875 million, the lowest since 2006. Not surprisingly, hog prices were record high. Hog slaughter has increased each year since 2014, but hog prices have not decreased each year. The producer average base price in the prior day slaughter data was $100.87 per hundredweight in 2014. It was $69.70 per hundredweight in 2015, $64.38 per hundredweight in 2016, $69.56 per hundredweight in 2017 and $64.84 per hundredweight in 2018.

Hog slaughter increased 2.6% in 2017 and hog prices rose 8%. More hogs at a higher price, a good combination for producers. In 2017 U.S. pork production was up 2.6%, but that year pork exports were up 7.5%. So, domestic pork disappearance was up only 0.7%. The population grew, leaving per capita pork disappearance unchanged from the year before.

In 2018, U.S. pork production was up 2.9% the most since 2014. That year imports were down and pork exports up, so domestic pork disappearance was up only 2.0%. The population grew, thus per capita pork disappearance was up 1.3%. The per capita supply of pork is expected to increase in the year ahead, so 2019 hog prices are likely to average below those of 2018.

Weakness in the pork cutout value is holding down hog prices. Last Wednesday’s pork cutout, FOB the slaughter plants, was $69.64 per hundredweight, the lowest since Nov. 30. Low prices for pork butts are contributing to the low cutout value. Last Friday, the average negotiated wholesale price of butt primals, FOB the slaughter plants, was $72.01 per hundredweight. That was the lowest value for any day since Nov. 23, 2015.

The futures market has turned gloomy in recent days. Last Friday, the February lean hog futures contract settled at $61.85 per hundredweight, the lowest close since Jan. 2. The same day the May, June and July hog futures contracts each had their lowest close since Oct. 22. The August contract had its lowest close since Oct. 23. Why? I attribute it to concerns about the economy and larger-than-expected hog slaughter.

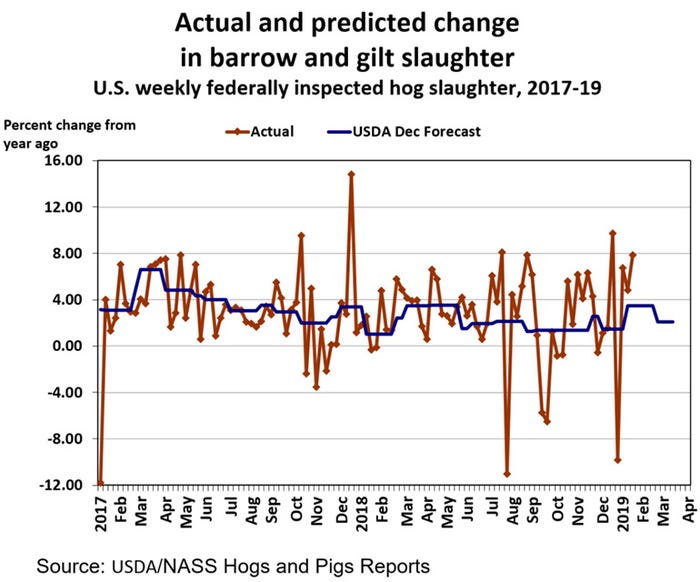

The most recent quarterly Hogs and Pigs report says the Dec. 1 inventory of market hogs weighing 180 pounds or more was up 1.47% year-over-year. USDA says the inventory of market hogs weighing 120-179 pounds was up 3.5%. These numbers indicate that barrow and gilt slaughter during the seven weeks since the start of December should have been 2.05% higher than last year. The AMS preliminary data indicates barrow and gilt slaughter was up 3.3% year-over-year. December slaughter came in light, but January is coming in above expectations.

The monthly Cold Storage, Livestock Slaughter and Cattle on Feed reports were scheduled to be released in the week ahead. These USDA reports will be delayed because of the government shutdown. Preliminary data indicate December hog slaughter was down 0.27%, year-over-year. December 2018 had the same number of slaughter days as in 2017, so daily slaughter would also have been down 0.27%.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like