Supply and demand?

Pork prices at retail in the latest reports indicate that pork prices were higher year-over-year led by bacon prices at the highest price at retail since October of 2017.

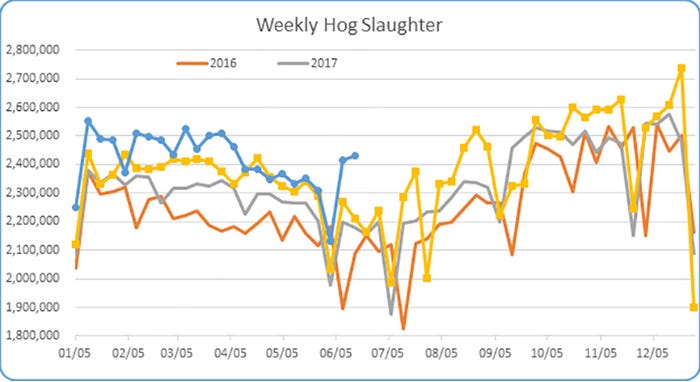

Over the past three weeks, U.S. hog slaughter was dramatically higher than one year ago. In the first 14 weeks of 2019, harvest numbers averaged 104.0% of the prior year. This was followed by a sharp decline between April 8 and May 25, with harvest numbers just 100.4% of the prior year.

With all the China talk and tariff discussion, it was hard to determine what impact, if any, the lower supply was having on the markets. Cutout rose by little more than $1.00 per hundredweight and the Western Corn Belt rose by less than $1.00. This small move in the market went against seasonal upward trends in the face of lower than expected slaughter. During the first three weeks of June harvest numbers were up to 107.2% of the prior year and hog markets remained unchanged.

What does this all mean? Our market is being driven largely by one thing, and it is NOT supply.

Based on the latest USDA Hogs & Pigs Summary, we would expect slaughter numbers from March through August to be 2.2% higher than last year. That makes the recent harvest weeks even more of a surprise given the USDA weekly hog slaughter numbers (see chart below).

It’s all about demand

Given the fact that pork production through April was record high and exports were down from the prior year, pork disappearance in the United States was higher this year relative to the past. Pork prices at retail in the latest reports indicate that pork prices were higher year-over-year led by bacon prices at the highest price at retail since October of 2017. Simply put: U.S. pork demand has been stronger.

The biggest market dynamic is clearly the outlook of pork exports to China and the rest of Asia. Compeer still believes this will drive our markets in the future and will probably increase cold storage as sellers prepare for increased exports. The timing of those exports remain a bit uncertain as China has increased their cold storage to handle pigs being marketed prior to normal harvest weights. Those African swine fever outbreaks in farms will continue to keep pig slaughter at a high level in China. This will delay the need to import large volumes of pork, but make the need greater later on.

I think the need for large volumes will be likely in August-September, but could be moved a month or more either way depending on their ability to keep the disease from spreading faster.

Source: Kent Bang, Compeer Financial, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like