Hogs & Pigs Report: As expected, but futures higher

This is the second straight quarter in which a mildly bearish report has seen almost immediate price gains for Lean Hogs futures.

December 29, 2017

USDA’s quarterly Hogs and Pigs report released Dec. 22 once again pointed to larger hog supplies in the coming year. Current hogs and pigs inventories were very close to analysts’ expectations, but front-end CME Lean Hogs futures prices reacted very favorably to the report.

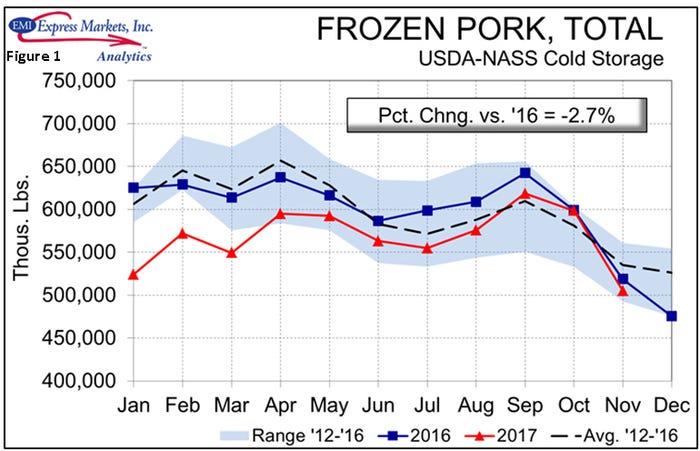

The positive price action was more likely due to a favorable Cold Storage report, also released on Dec. 22, that indicated pork stock drawdown over twice as large as the November average of the past five years. Total pork stocks amounted to 504.975 million pounds on Nov. 30, 2.7% lower than one year ago. Cuts with lower stocks than one year ago were hams (-7.5%), picnics (-23.7%), ribs (-9%), loins (-10%) and variety meats (-39%). That big reduction in variety meats stocks (to a level just marginally different from the lowest Nov. 30 of the past five years) is, I think, important. The total drawdown says that demand was definitely good in November.

Remember that production was record large so a big reduction in frozen stocks means that a lot of product moved. The variety meat reduction tells me that the big hero might well be exports. We won’t know about November domestic demand until the actual November export data are available Jan. 8.

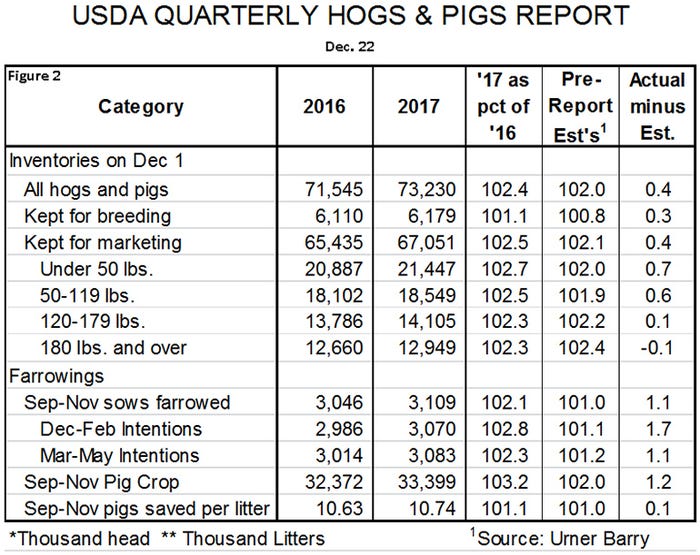

Key national data from the Hogs and Pigs report appear in Figure 2.

Some highlights are:

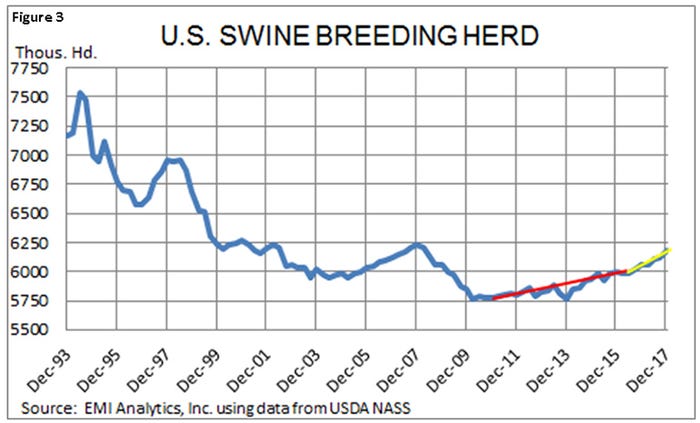

• The breeding herd on Dec. 1 was pegged at 6.179 million head, 69,000 (1.1%) larger than one year ago and the largest since March 2008. The increase represents a continuation of the growth trend that dates back to June 2010.

• USDA also made some very unusual revisions of the breeding herd. They increased the breeding herd estimate for each of the past four quarters by from 20,000 to 40,000 head or 0.33% to 0.66%. Note that these revisions increase the average rate of growth from 0.7% per year from 2010 through March 2016 to 1.2% from June 2016 to date. See Figure 3. USDA has historically only revised market hog inventories, the pig crop and farrowings to account for differences between inventories and slaughter. A number of industry observers have questioned these practices. Only time will tell whether this is a new USDA paradigm but we think it is a positive step. It’s hard to believe that USDA gets the breeding herd right every quarter when other numbers do not jive with subsequent slaughter.

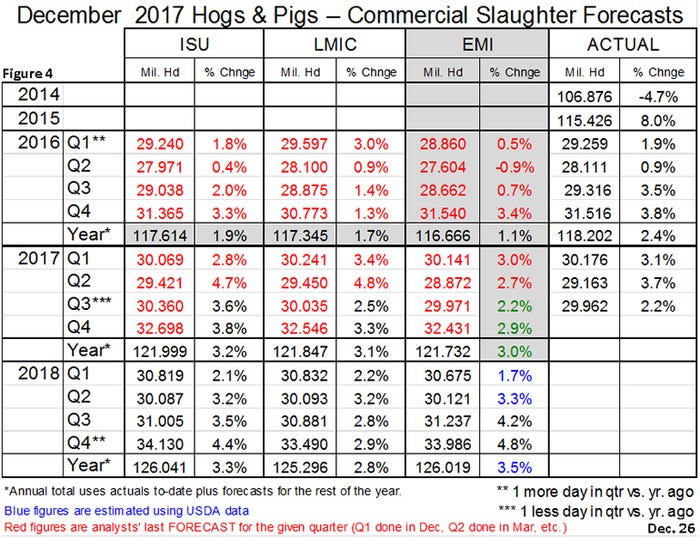

• Every other inventory number in the report — market herd and all weight categories — were record large for December, but were hardly different from the average of pre-report estimates. We would not categorize 2% year-on-year growth as modest but it certainly wasn’t a shock given the numbers we have seen this year. The figures imply slaughter growth of roughly 2% through the next two quarters.

• Farrowings and farrowing intentions came in sharply higher than analysts had, on average, expected. But we think this is a good thing as USDA has consistently under-shot farrowing intentions over the past three years. This 2.1 to 2.8% increase fits the growth of the breeding herd pretty well and, we think, will prove to be more accurate than USDA’s intentions estimates of the recent past. This could very well be another “recalibration” of the USDA estimates such as we saw one year ago when USDA’s pig crop and inventory estimates were significantly higher than those of the analysts after significant underestimates over the previous three years.

• Farrowings, the pig crop and pigs saved per litter were all record high in the September-November quarter. U.S. producers continue their remarkable productivity progress and we see no end in sight. While farrowings per breeding animal cannot increase much more, litter size and thus the pig crop certainly can and we think that growth will push hog supplies in the second half of 2018 4 to 5% higher than in 2017.

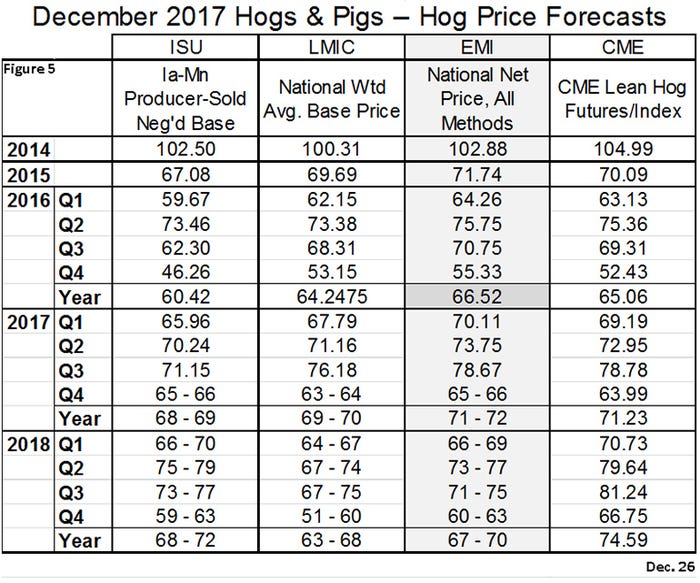

Figure 4 shows our quarterly forecasts as well as those of Iowa State University and the Livestock Marketing Information Center. It does not appear that LMIC is adjusting for the one additional slaughter day in the fourth quarter of 2018. Figure 5 shows price forecasts for 2018.

One curious item of this report was the reaction of CME Lean Hogs futures. The Hogs and Pigs report is usually released after trading hours and most often on a Friday. That practice allows market participants to digest the report at least until the next day and usually until the next Monday before taking any action in the futures market. This release was the same as last year — on the last Friday before Christmas while the market was still open. Like last year, nothing happened for several minutes. That is not a surprise for this report as it was pretty much as expected. If anything, we thought higher-than-expected farrowing intentions would put some pressure on deferred contracts. But nothing happened for about 15 minutes.

Then the nearby contracts gained about 40 cents before pausing for roughly 12 minutes and then gaining another 50 to 55 cents. They drifted about 40 cents lower over the next 15-18 minutes before rallying once more by 50 cents 10 minutes or so before the noon Central close. Contracts from February through June gained $1.35 to $1.70 for the day. July through December gained $0.30 to $0.93.

This is the second straight quarter in which a mildly bearish report has seen almost immediate price gains for Lean Hogs futures. Comparing actual numbers to pre-report estimates has suggested little change in prices and says that if prices would change, they would move lower. Clearly the Cold Storage report was a positive driver for this report but was it enough to justify $1.70 or more on the nearby? Is demand so strong that a neutral report is actually viewed by the trade as bullish? Or are the pre-report estimates somehow out of touch with the sentiment of the people actually trading futures? We believe the first two factors were certainly at play. A sample size of two is insufficient to conclusively judge the third.

About the Author(s)

You May Also Like