Hog futures offer reasonable pricing opportunities

October 5, 2015

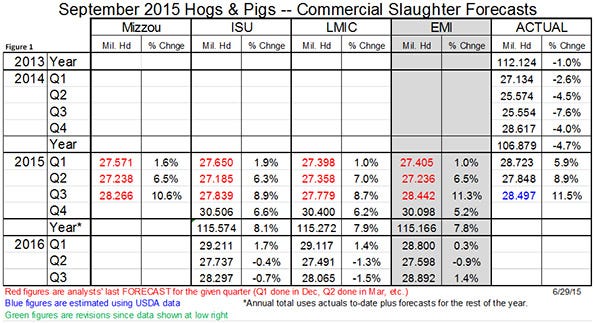

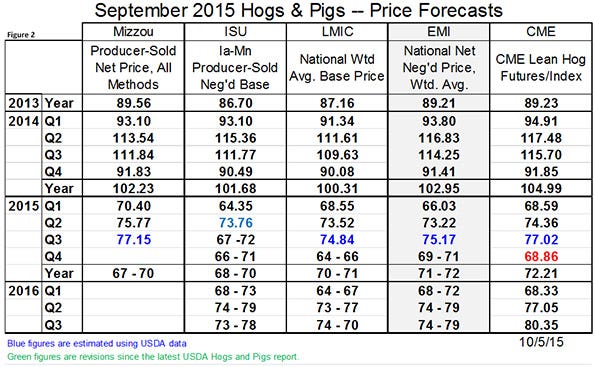

My quarterly slaughter and price forecasts tables, based on the September Hogs and Pigs Report, appear in Figures 1 and 2. I have not been able to get forecasts from Missouri to date. I will include them when available.

Note that the Livestock Marketing Information Center made virtually no changes to their forecasts based on the latest report. I made some changes but they were relatively small based on a report that was pretty much as expected. I still think futures markets are offering reasonable pricing opportunities at present.

Where will current conditions take production next year? The answer depends on a lot of things but most observers are saying higher. Or HIGHER! For some who think a huge pile of product is headed our way.

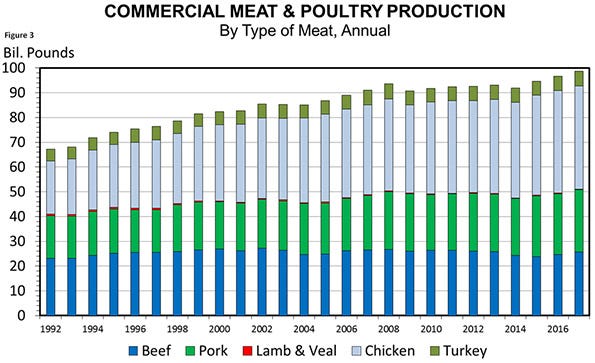

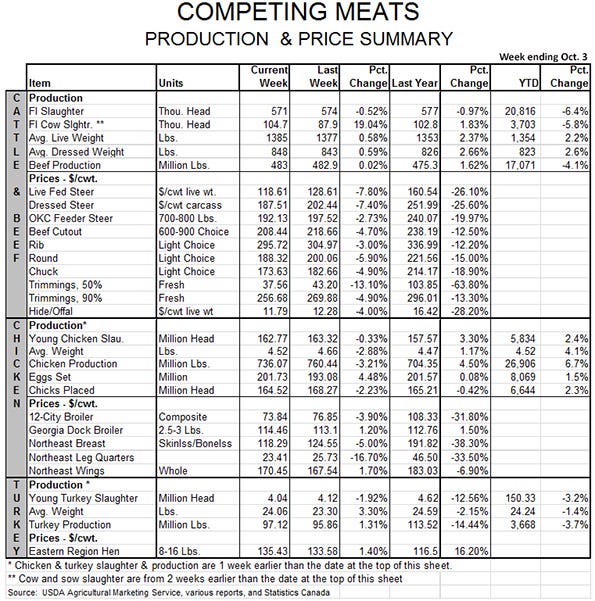

Figure 3 shows total U.S. meat and poultry output by species since 1992. A major trend change occurred in 2009 when producers began to deal with significantly higher prices and an economic downturn that impacted consumer demand. I think the recovery would have been pretty quick from both of those had it not been for 2012’s short crops and record-high grain and feed prices. The one-two punch of the policy-driven rapid growth of ethanol output and the short crops were big burdens for the meat and poultry sectors.

But two good crops and some time to adjust to those higher prices work wonders! Production this year is forecast to reach 94.553 billion pounds of carcass/ready-to-cook weight, breaking the record of 93.598 billion pounds set in 2008. Recall that that year’s total was significantly increased by hog numbers and pork production that resulted from circovirus vaccines. That will be a growth of 2.9%, the largest such rate since 1999.

The next two years hold more increases and more records. The LMIC in Denver projects 2016 total meat and poultry output to be 96.664 billion pounds, up 2.2% from this year. They peg 2017 output at 98.657 billion, up another 2.1% as beef production finally begins to grow following the large cattle reductions since 2010.

What will be the key factors?

First – disease. Will highly pathogenic avian influenza and porcine epidemic diarrhea virus be factors this winter and, if so, just how large? Many expect PEDV to be a bit worse than last year but nothing as bad as the devastating epidemic of 2013-14. HPAI is more of a wild card since we don’t know just how much it really impacts broilers even if it gets in them. The southward migration and fall weather are near, though, so we should know more soon.

Second – exports. Those 2017 numbers will not happen without some rebound for exports and the dollar shows little sign of weakening. Note that the chart is total production so profits are needed to get there and we think exports have to grow some.

Third – costs. This next year looks great right now with our cost estimates the lowest since 2007 for every species. But 2017 is a long ways out there and another crop must be made to keep costs down. How will El Nino impact weather as it wanes? Will a La Nina follow quickly?

Fourth – policy. I don’t know that any policy changes will impact production this quickly but what if we use a larger chunk of the antibiotics we now use to keep animals healthy and growing? How might that impact productivity? Will enough time be allowed to make adjustments?

More protein is very likely. How much more remains to be seen. Have a great week.

About the Author(s)

You May Also Like