Ho-hum pig report, but not a ho-hum reaction

The Oct. 1 rally is likely driven more by the news of a U.S.-Mexico-Canada trade pact. But Friday was positive across the board when the report was ho-hum.

October 1, 2018

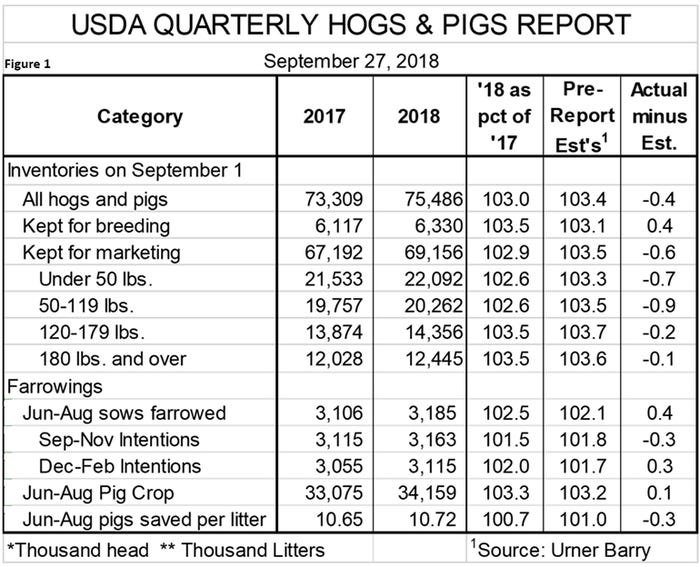

Thursday’s quarterly Hogs and Pigs report should have been the definition of boring. As can be seen in Figure 1, every year-over-year number in the report was within 1% of the average of analysts’ pre-report estimates as compiled by Urner Barry. That should mean the USDA numbers were “in the market” causing futures prices to reflect this knowledge. But the actual futures market has told us to not be so quick in reading its mind.

But first, the report and the numbers:

• Virtually every national number in the report is either a record for the quarter or an outright record. Nothing new there as this has been the case for some time during this expansion.

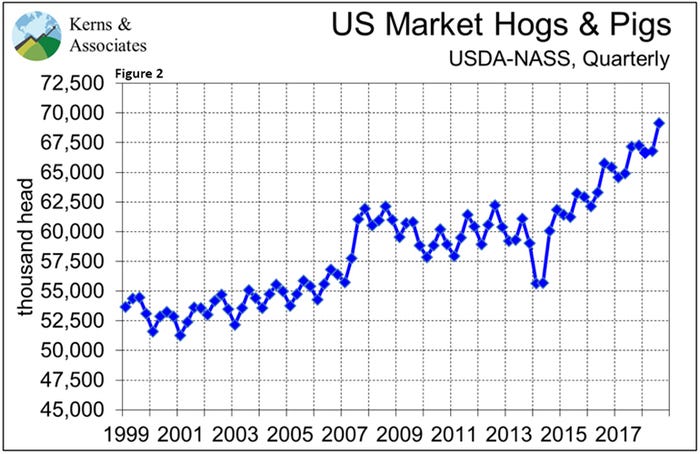

• The total market herd of 69.156 million was record large at 2.8% larger than the previous record set last Dec. 1. As can be seen in Figure 2, not only is this a record and a continuation of the steep uptrend in market hog inventories since the U.S. industry recovered from porcine epidemic diarrhea virus, it may actually be higher than this recent trend. The next few USDA reports will refute or confirm that observation. One point does not a trend make.

• The breeding herd of 6.33 million head is the largest since June 1999 when U.S. farms held 6.515 million breeding animals. The 3.5% increase was slightly larger than analysts expected. I hadn’t expected that large of an increase on the heels of June’s 3.1% year-on-year growth, but I’m not surprised. While rumors have flown about cancelled or delayed expansion plans since the July-August swoon, we have been able to confirm hardly any slowdown in the expansion pace.

• The only “actual vs. expectations” pattern that I can discern is the fact that all of the actual percentage changes for market weight categories are less than analysts’ average expectations. I’m not at all sure that means anything given that none of them are even 1% different but I’m looking for something!

• The under-50-pound inventory agrees reasonably well with the June-to-August pig crop and the pig crop agrees with farrowings and the recent trend in litter size growth. We do think June-to-August farrowings appear light relative to a 3.5% larger breeding herd, but we need to remember that this 3%-plus breeding herd growth just started six months ago. Some of those added females had not reached farrowing by the end of August.

The “agreement” problem for this report is the 180-pounds-and-over inventory. That number is 3.5% larger than one year ago and many of those pigs have already been slaughtered. This year’s September data covers 19 weekdays, five Saturdays and one holiday. Using the same number of various days from last year give us September 2017 slaughter of 9.79 million head. This year’s figure is 9.6 million head but there were about 240,000 head of hogs in the Carolinas that were not slaughtered during the Hurricane Florence shutdowns. Add those in and you get barely 0.5% more slaughter this year versus one year ago. From an inventory that was 3.5% larger on Sept. 1?

That discrepancy for same-month slaughter versus 180-plus head count is one of the largest I have seen. And it calls the market inventories at least into question. As does the market price action of the past few weeks. Packers have been aggressive buyers of hogs. While a big cutout value rally is part of that, we know that packers would not have been bidding hogs higher out of the goodness of their hearts. They were bidding higher because market-ready hogs were harder to find. Flat producer-sold hog weights confirm this tighter-supply-chasing-hogs scenario.

Does this mean we think the report is completely wrong? Absolutely not. We think it just says that there aren’t as many heavy hogs out there right now. Nothing more or less. But that is plenty and fits well with prices, slaughter and weights in recent weeks. I don’t think those fitting together is an accident.

But those factors do focus my attention on slaughter runs from mid-October forward when the market-ready supply will come from the Sept. 1 120- to 179-pound stock. USDA says it was 3.5% larger than one year ago. That’s the mark I and every other analyst will be using as a yardstick.

At first look, I was also concerned about an undercount on farrowing intentions. Growth of 1.5% and 2% relative to a 3.5% larger breeding herd seems low. But using the past four years’ average for farrowings per breeding animal in inventory and assuming 2.5% growth in the breeding inventory (it won’t keep growing by 3%-plus will it?) puts farrowings at 3.164 million and 3.112 million litters in September-to-November and December-to-February, respectively. Those numbers are very close to USDA’s figures.

And now about that futures market reaction? This report was called neutral by most analysts, but LH futures were up $1-$2 per hundredweight in Friday’s trading. The rally on Oct. 1 is likely driven more by the news of a U.S.-Mexico-Canada trade pact. But Friday was positive across the board when the report was ho-hum.

The June report was neutral to nearby contracts and bearish to the deferred months due to breeding herd growth and larger-than-expected March-to-May farrowings. Nearby contracts were sharply higher and deferred months lost about $1 the day after that report.

In March, the report was as close to pre-report estimates as it has ever been, and futures got hammered the next Monday (there was no trading on Good Friday).

Last December saw a slightly bearish inventory report and a very bearish farrowings and litter size report. Nearby contracts were higher and deferred contracts were mixed in trading the next Tuesday, the day after Christmas.

So, what does this mean? It appears that the pre-report survey responses may not be gauging what is “in the market” as well as they once did. I don’t believe that is a reflection on the estimates or, for sure, the estimators. It is likely due to hog supply not being the primary driver that it once was. Domestic demand, trade and, perhaps most important, outside money and automated trading likely have a collective impact that just swamps that of supplies and supply expectations.

I know that’s not a very helpful judgement for those of us watching markets and reports and trying to use them to enhance the prices we receive for pigs. But the data say that is the case and it is we, not the market, that will have to adjust. At least in the short run.

Have a great week!

About the Author(s)

You May Also Like