You want what?

So what is a pork producer to do? Accept the punishment and factor the current values into your forward projection?

November 21, 2022

As we approach the end of the current year and take a peek ahead to 2023, budgets are being generated, operating lines are being calculated and the prospects for a profitable year look promising. In the glow of this optimism lies a persistent and antagonistic condition that plagued us for the better part of last year and does not look to go away anytime soon. Namely corn basis.

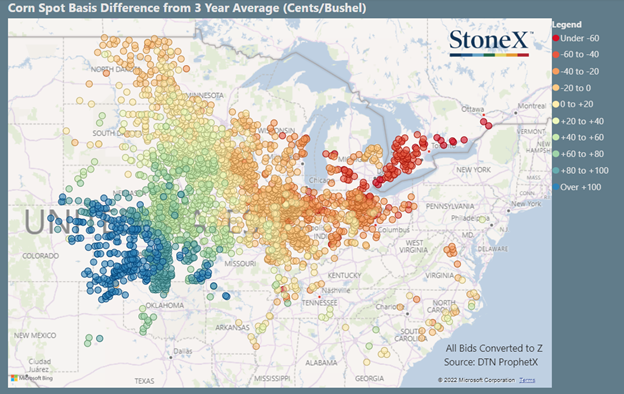

The attached picture provides a graphical look at this situation and its broad geographical impact – it is most pronounced in the west as you migrate away from the Chicago-and-south delivery channel. Why are we experiencing such big basis numbers and what can you do about it? Let's tease that out just a bit.

The values posted on your quote screen of values in Chicago are intended as a proxy to the value of corn to an end-user with consideration of transportation (basis) and time (spreads) as regulating factors to this calculation. The ultimate "end-user" in the CME calculation is the export market – derived by export values at the Gulf of Mexico – with recognition of barge freight up the Mississippi and Illinois rivers to generate a value along the registered deliverable locations.

This is an important consideration. We do not print values in Chicago and then add freight to the Gulf, we allow the world market to determine values in New Orleans and then subtract freight. This may seem like reciprocal math, but the nuance is important, especially now.

Our strong U.S. dollar makes our corn less attractive on the world market and generally profitable conditions across the world for feed grains encourage more nations to enter the production and export market. This whole configuration with the CME and "normal" basis in times when export markets are robust and grain carryout numbers are comfortable works in a reasonable fashion. We are not – and I do not think we are going back anytime soon – in an arena where the traditional methods are effective and reflective of your risk profile. Your risk is much greater now relative to previous years.

So what is a pork producer to do? Accept the punishment and factor the current values into your forward projection? Is there an alternative or a solution to this situation? The answer is a somewhat unsatisfying "kinda" and "maybe" mixed in with a proper economic explanation of "it depends." You probably already know there is not a silver bullet – if there were, we would have already deployed it by now. I do think the tighter basis values do need to be taken into consideration with our forward budgets, but there is something that a given subset of our production system can lean against to keep things from getting completely crazy and it may sound like a goofy idea, but there is a potential solution. Take delivery.

That term may strike fear in anyone that has a futures account and has received the dreaded phone call from your broker with the words of, "you have been delivered on." In general, it is not a crisis but it does represent a pain in the side. You have to make arrangements to pay for the gross price of corn – each contract of 5,000 bushels multiplied by the gross amount needs to be wired immediately.

If you are a bit skinny on your operating note or do not have broker that is willing to float you money for a day, there is a reason that your heart skips a beat. You can normally pay the penalty, redeliver the grain and put this one down as a lesson learned. But what if you want the corn? This is where the fear factor gets turned on its head. If you willing to ride a long position into delivery and accept the delivery ramifications, you are in a position of power, not a victim, and this game gets a lot more fun.

From this point on I am going to address the opportunity for those that are tertiary to the Illinois River, defined by anything east of Interstate 35 that runs through the middle of Iowa and west of the Ohio River. If you are in this relatively broad geographic territory, I am talking to you. If you are outside of that region this message will not be quite as applicable, but you may want to continue reading to understand the opportunities referenced and their ramifications on something that does impact you – commodity spreads.

As I referenced before, the CME is intended to be a proxy for the cash market. The way this is executed is by assigning delivery houses generally up and down the Illinois River as the execution methodology for convergence of futures and cash values. Most of these facilities are owned by names you know, ADM, Bunge, Cargill, etc. These are established entities that are keenly aware of the rules of the game and have little interest in allowing you to disrupt their gig ... and that is exactly what I am encouraging you to consider.

I have to nerd out here just a little to provide economic structure of what normally happens versus the motivation of the current situation (recall, we are not in "normal" times and need to change the way we operate). It is not an accident that these delivery houses are along the Illinois River and owned by the majors. They are intended to take grain in from the country and load barges that float to the Gulf. The majors have very efficient and long-standing logistical infrastructure (ADM owns the largest barge company in the United States, ARTCO) to load barges along the interior and transfer it to facilities in New Orleans that load ocean-going vessels.

That is what usually happens and there are a myriad of rules and regulations that define how much they have to load and when they have to do it, the rules are generally written to favor the interests of those with the investment in facilities, not the annoying hog farmer that wants to take product via truck, and this is where the proverbial rubber meets the road. You see, in the pages and chapters of rules and provisions is a seldom-used clause that allows grain in the delivery house to be loaded into a truck. It is a hassle for all parties. The big grain elevator would much rather put corn on the belt and load a barge, the entire system is built for doing that. They do not like the inconvenience.

For the entity that requests truck delivery, this is not the same as going to your local coop to buy some grain – you will not receive the same friendly greeting, enjoy a cup of coffee and leave with a calendar or hat. This is not about love, it is all about money and the motivation may be worth the effort. You can expect to pay a 16.5 cent premium over barge loadout for the switch to truck, you will also be charged 8 cents per bushel per month storage – this is not a cheap option.

If the economics of what I describe come into play, the other item impacted will be spreads – which is why it is important for those outside the corridor that I referenced. The loadout of grain from delivery houses generally results in the tightening of spreads, an item where all players can participate.

Here is the bottom line: Convergence in the delivery market is an opportunity for the end user. It is clunky and not fun and may still make sense. My best guess is that in the corridor I identified a producer should rarely pay more than $.75 over the nearby option. If the ask is more than that, you should consider standing on the futures and taking delivery. I am happy to share more information about the details of this approach, it is one that is uncommon, we are in uncommon times and need to think creatively.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like