What do you fear more: recession or inflation?

As competitive as we may be, the pork sector is not immune from the macro-economic forces at play.

June 20, 2022

The clicking of the roller coaster as it approaches its apex always produces anxiety of "what comes next" that is predictably followed by the rush of adrenaline as you accelerate down the other side. This analogy seems appropriate right now as the uncertainty of the hog market has two things in common with the roller coaster – first, we got on this thing voluntarily and by our own accord and, second, there are certainly going to be some twists, turns and undulations in the future.

To wit, what do you fear more: recession or inflation? The proverbial cat is seemingly out of the bag in regard to inflation with fuel prices at their highest level ever and Jerome Powell scrambling to slam on the brakes with a .75% raise in interest rates – a magnitude of increase that just last month was specifically deemed to be off the table.

Food inflation for in-home purchases was up a whopping 1.4% last month, we are well into double-digit increases in food price versus year-ago levels. I don't need any further reference to fuel prices, you feel that one on a routine basis.

The unemployment rate is hovering near 3.6%, historically a low number (the participation rate is hovering near 62%, well off its recent high of 67%, our labor pool is seemingly choosing not to represent itself for a myriad of reasons). Click, click, click. Something is going to happen on the other side of this hill and I suspect/fear that it could turn your stomach.

Let's talk about the good news first. Just on the heels of a well-attended and upbeat World Pork Expo, pork producers ushered the June contract off the board just shy of $110. This was well off the highs that we printed earlier in the year and some may be a bit disappointed in the finishing value, but I remind you that we have only closed June hogs north of $100 three times in the history of the contract, this year being the third time.

While it is true that the cost of production means that $100 is not what it used to be (more on that later), it still represents respectable profits for the majority of pork producers. I suspect – if we have any faith in the March Hogs and Pigs numbers and the June numbers do not shock us – that we will continue to see a thinning of weekly harvest numbers into the heat of the summer before we seasonally expand into the fall pig crop.

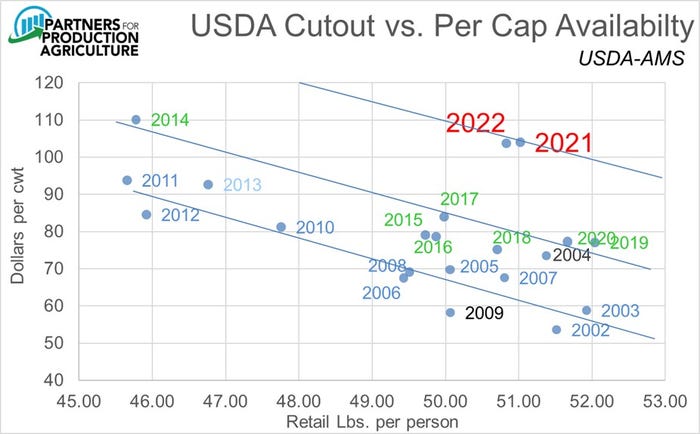

This may represent our last hurrah for hog futures and pork producers may wish to take a good look at forward profits in the weeks ahead. On the demand front, pork is priced very competitively against other proteins and, even with soft export demand (primarily due to China), domestic demand remains strong enough to keep wholesale pork demand very near its record-high 2021 level (see chart below prepared by Dr. Steve Meyer).

My concern is that as competitive as we may be, the pork sector is not immune from the macro-economic forces at play. The equity markets are signaling trouble ahead associated with the difficulty in taming inflation without tossing the entire economy into a tailspin. Slowing economic growth with inflation eating away from discretionary spending will take a bite out of nearly every sector, I believe we will be better off than most (Anybody watching bitcoin? Ouch) but will not be unscathed in the process.

While the United States faces its own unique challenges, the rest of the world is not faring much better. The value of the dollar continues to exhibit strength which – all else equal – will continue to weigh on our export prospects.

One arena that does seem immune from the price compression is the value of our inputs. The price of December corn has bounced off a technical retracement and is encroaching on the values we traded in early May when we were in serious doubt of anything resembling a normal planting progress. Since then, we have hovered near normal for planting pace and crop rating.

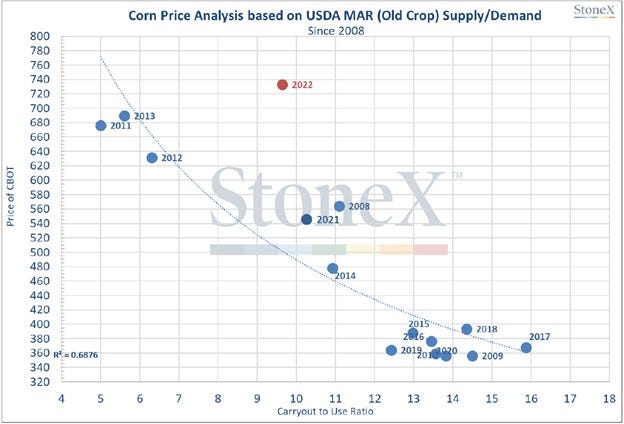

Corn prices are not reading the book of "normal" either. Take a peek at the chart below which depicts the price relationship associated with various carryout ratios in past years. We are trading at values that are far in excess of what we would consider to be fair-market-value in past environments.

That red dot near $7.50/bu "should be" closer to $5.00/bu if historical relationships were to hold true.

Which brings us to the actionable items for a pork producer – what are you to do in the throes of all of this confusion? I shared in last month's column that margin management is my advocated position in reviewing all of the components that impact profitability, my concern has only been heightened since then. The equity markets are deep in correction territory, inflation is on fire and policy makers have been slow to respond to the stimuli, balancing the quell of inflation without choking the economy into a recession in the presence of a strong U.S. dollar does not bode well for anything resembling a soft landing.

When our 2.3 million head per week harvests transition into something closer to 2.6, I suspect we will start feeling the pain of reality and enter the fray of the fight for margin. I remain a huge fan of the livestock insurance market which is about to undergo some changes at the first of July that make them even better than what we have today. Until we have more confidence in the direction of all of the factors that impact our profitability, caution is warranted and a more measured approach is advocated.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like