Weather or whether

Prop 12 is troublesome well beyond the scope of pork chops as individual states could use this ruling for social jerrymandering.

June 19, 2023

The hog market is caught in an updraft because of "whether" – as in whether or not California Prop 12 is causing a surge in shipments – as well as we have a grain market caught up in weather situation of a typical summer fashion. Regardless of how you spell it, we have ample volatility to address on both the revenue and the cost side of our business.

Let's start with Prop 12. This past weekend, we received some additional clarification from California that reads as follows, "whole pork meat already in the supply chain as of the July 1 implementation date will continue to be allowed to be sold in the state until Dec 31, 2023." All pigs slaughtered prior to July 1 will qualify for movement into the state. Non Prop-12 compliant animals harvested after July 1 will be forced to find a home elsewhere.

This likely makes the situation cleaner from the packer perspective of knowing the firm cutoff on what pork can/cannot enter the state and may extend our mad scramble to get product into California for another couple of weeks. Then what? I suspect we will come down from our sugar buzz with a bit of a thump if the California rush is what has led to the recent rally as the inverse would prove to be true, also. Our fundamental analysis would indicate that the recent rally is a selling opportunity for pork producers, even acknowledging that we are not near the price levels of the past two years even though production numbers are similar.

If Prop 12 is our main discussion item in the pork complex, we should probably pay heed to legislative activity that may alter the current course. The Senate is dusting off proposed legislation that was considered in 2021 (it did not gain significant traction at that time) in the wake of the Supreme Court Prop 12 ruling. Colloquially called the EATS act (Ending Agricultural Trade Suppression), a group of farm state senators are pushing for the federal usurping of Prop 12 to disallow individual states to deviate from the Interstate Commerce Clause for agricultural products. Link to the legislation here.

Justices Kavanaugh and Gorsuch both articulated in their writings that Prop 12 is troublesome well beyond the scope of pork chops as individual states could use this ruling for social jerrymandering if one state was not enthralled with another state's views on a given topic. This legislation would address that component for agricultural products, it does not read as if it is trying to save all of humanity from the fallout of this decision. As expected, the groups supportive of Prop 12 are less-than-enamored with this piece of proposed legislation and are doing what any good activist would do – claim the world would end if they do not get their way. This will, of course, be a developing story where we need to remain aware. Our voices need to be heard – please contact your representatives and senators if you have an opinion.

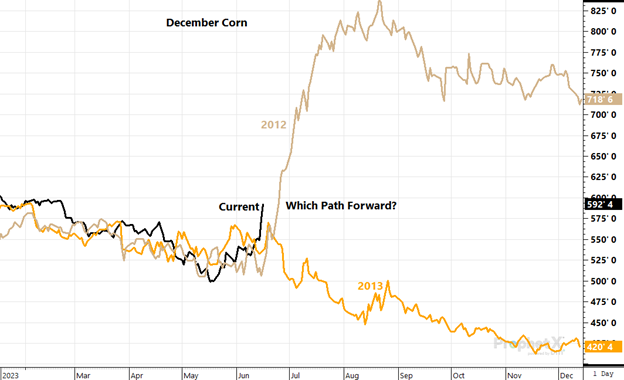

The weather market of 2023 is underway in a predictable – if erratic – fashion. The crop went into the ground in a timely manner which pushed December futures below $5.00 for a period of time, only to see the market come roaring back in a not-so-fast-my-friend manner by rebounding more than $1/bu and now on back on the cusp of $6.00. As of last week, we have officially transitioned from a neutral ENSO environment to an El Nino – the warming of the Pacific ocean temperatures. This would normally bring rain to the western growing belt, but nothing is that easy when it comes to weather. We are still in the throes of a Negative PDO event that has been with us the past few years, this battle of meteorological supremacy is difficult (if not impossible) to predict and we are, unfortunately, in a wait and see position. Many want to point to our current pattern resembling 2012 where the rains were non-existent and corn rallied to over $8.00/bu. Notice on the attached chart that we are eerily similar to the pattern of 2012, but equally so of the 2013 pattern and those two years diverged significantly from here until harvest.

So what is different this time? I think a couple of things are noteworthy. Recall in 2012 that we were in the middle of the ethanol boom and we needed every acre and every bushel to satisfy that increasing demand. Exports went into the tank and we taught the world that the United States was not the sole supplier to the world as Brazil took over that mantle for a brief period before the 2013 crop put everything back to "normal."

Fast forward to today and in the absence of a significant weather problem last year for the U.S. crop, Brazil still overtook us for the No. 1 corn exporter of choice. Hint: they are not giving that title up anytime soon. You may recall that the United States was the #1 producer of corn and soybeans for decades. That yearall came to an end in 2018 when Brazil took over at the king of soybean production. Today, a mere five years later, Brazil will produce roughly 50% more soybeans that the United States.

You do not have to squint to figure out who is winning. Will Brazil pull the same trick on passing the United States as the No. 1 corn exporter? Probably. Between increasing acres and production in Brazil and a U.S. domestic policy that favors commodities staying at home (Renewable Diesel and Sustainable Aviation Fuel), the stage is set for the United States to become more insular and Brazil to become the exporter of choice for the world.

In such, let's take a little reality check of the price of corn in relationship to the balance sheet to discern the next move in the market. I would contend that the current USDA balance sheet has a massive opportunity for a downward revision to exports should prices remain at or above today's levels. Consider that the USDA is indicating a bounce of about 500 million bushels more to the export numbers next year compared to this year. Our sources in the export sector indicate that their expectation is that next year may do well just to hold serve year over year, much less increase volumes. Five hundred million bushels is roughly six bushels/acre on 90 million acres, this allows us to have something other than perfect growing conditions and still maintain a balance sheet that is not stressful for corn. Similar scenario when comparing carryout levels year over year – we were starting with a running head start of several bushels to the acre buffer so losing a few from the 180+ yield projection is not a disaster. My somewhat indifferent attitude to the current weather concerns are not blind, we can't have a 2012 weather disaster and simply shrug with no worries. My only point is that our balance sheet – as it stands today – has some room for less-than-perfect weather without causing a price panic.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

About the Author(s)

You May Also Like