Views from both sides of the fence

Does the recent rally signal a fundamental shift in the hog market?

February 19, 2024

.jpg?width=850&auto=webp&quality=95&format=jpg&disable=upscale)

Please note this story from last week, we may have gotten a bit too exuberant from that posted export number: CHICAGO, Feb 16 (Reuters)-U.S. data published on Thursday that showed large increases in weekly pork export sales and shipments was incorrect and will be updated next week, the USDA said Friday.

Lots of moving parts in the market, lets tackle a few of them.

Does the recent rally signal a fundamental shift in the hog market?

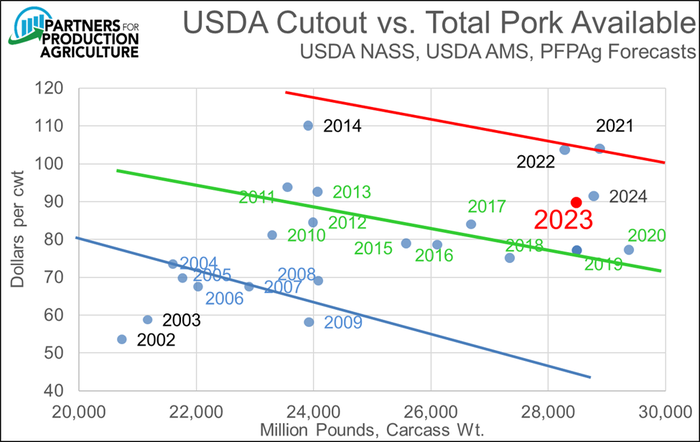

The increase in prices is a most welcome relief to what has been a terrible stretch for the pork production community. However, I tend to think that this is more of a correction to get markets aligned rather than an outright rally indication. I will cite two items from our esteemed economist, Dr. Steve Meyer. The first depicts the implied demand curves for wholesale pork and where we sit right now, this is a Dr. Meyer staple. There is good news in this data. First, we have moved the 2024 projection higher over the past six months as real demand has improved. Not to the nirvana of our 2021-2022 experience, but nicely off the well-trodden green line observations from 2010-2020. This shift allows profits to flow through the packer and into the producer – yes, we projecting a small profit in 2024, a welcome relief from the dismal 2023 showing.

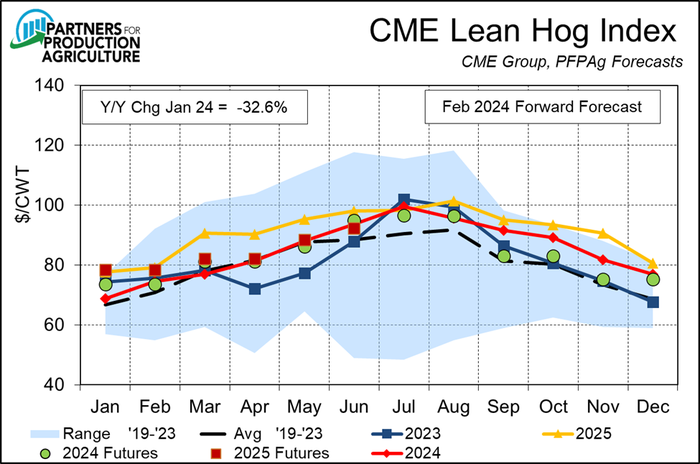

The second chart is part and parcel to the first, as the futures market (represented by the green dots) has moved higher to meet the economic predictions for 2024. These two things are consistent with one another. As we have witnessed an outward shift of the demand curve, the futures market has recognized the change and has increased in value to reflect the more positive scenario. This is great news ... but let's not get too far in front of our skis and think we are on the cusp of significant run. Not yet. We will need to see a larger disparity to compel us to forecast an outright, unbridled rally in the market. This subtle shift we have experienced is welcome. Please note that the summer months have largely come inline with the flow, the fourth quarter has yet to respond with any significance and may be the place where opportunities still exist to be patient.

Was there anything notable at the Ag Outlook Forum?

Oh yes. The grain market had a bit of a rude awakening from the meeting last week. Now, this one is akin to attempting to rouse a slumbering teenager – the grain market has had several wakeup calls, the producer community would rather ignore the alarm and go back to their most pleasant dream as represented by the last four years of good (outstanding?) profits. It is time for the agronomic community to quit hitting the snooze button and face the new reality. Input prices for animal agriculture are moving lower and there is little on the horizon to stem the tide.

The numbers from the USDA were not all that shocking. Lower corn acres (91 million) and increased yield (181 bpa). Neither of these numbers are a surprise, just another dose of reality to the grain producer – your glory days are done. The grain markets had been trading at lower levels coming into the report, we touched on life-of-contract-lows this week as the hope of a reversal is tough to fathom. Funds are short a near record amount, the production community is long corn at a factor of about 10x the fund short.

Who wins this battle? I expect any upward movement in futures to be met with catch-up sales from the farm community that is woefully undersold and needs to reluctantly participate with more sales – sales that will cap any rally. The verbiage from the USDA indicates higher carryouts and lower prices for corn and soy, they anticipate a slight rebound in exports. But the U.S. is so uncompetitive right now (Ukrainian corn and Brazilian beans are dominating the offers) that prices will have to move significantly lower to witness and uptick in export shipments.

Is there hope for the grain producer? I see two events that could signal a bottom and make us pay attention. The first is the conflict with Iran and what that may mean to oil prices if things escalate in that region. The second is palm oil production. Palm oil is negatively correlated with El Nino, we are currently in an El Nino pattern that is expected to last until the summer months. Note that palm oil production is roughly 10 times that of U.S. soybean oil production. IF (that is capitalized intentionally) we would get a significant reduction in palm oil production that correlates with Middle Eastern tension you could see a situation that supports ethanol and soybean oil. I offer this as a potential out to the undersold grain sector, I do not see this as likely. The grain farmer is backed into a corner and they are beginning to feel the discomfort.

Is there anything new from the Biden administration regarding the direction of renewable fuels?

This one is very interesting and I strongly suspect we have not heard the last on this debate. Recall that the current administration is focused on combating global warming via the generation of sustainable aviation fuel. The logical building block for this process is ethanol, but there is a problem. The model to evaluate the effectiveness of a process and its impact to greenhouse gasses is called GREET (greenhouse gases, regulated emission and energy use in technologies) does not reflect favorably on the ethanol industry as a substrate for the generation of SAF.

The congressional response from farm-state Senators? Change the model, of course. And that is the direction we have been heading until now. Reuters reported that the Biden administration, in a nod to the environmentalist lobby, has altered this directive and is now going to go harder on ethanol, much to the chagrin of Mr. Grassley from Iowa. Here is the verbiage and the link.

EXCLUSIVE-WHITE HOUSE SET TO BACK TOUGHER CLIMATE MODEL FOR ETHANOL, SOURCES SAY (Reuters) President Joe Biden's administration is poised to announce an adjustment to its scientific modeling for ethanol that will show the corn-based fuel to be less effective at reducing greenhouse gas emissions than previously estimated, three sources briefed on the plans told Reuters. U.S. corn-based ethanol worse for the climate than gasoline, study finds | Reuters

What does this mean to the pork producer amidst this scrum? I think it means there is no immediate threat of a replay of the disaster from the introduction of the ethanol industry as we know it that started 2005ish. There are no new plants under construction (or being considered as far as I know) and they have their proverbial foot to the floor with ethanol production. Ergo, there is no significant way in which ethanol can chew up more corn in the near future. It seems to me their goal is to hold serve and not lose the SAF avenue for disappearance against a backdrop of falling gasoline demand as a motor fuel.

The bottom line to all of this is leaning toward the category of “good” for the pork producer. Your revenue values are trending higher while your biggest cost, feed, is moving lower. 2024 is probably not going to be a banner year for pork producers, but the moderate profit opportunity is a welcome relief from 2023.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Contact Kerns via email.

About the Author(s)

You May Also Like