To restore hog producer profitability, one of three factors must happen

Pig numbers and pork supplies are important in and of themselves but there is a funnel in our system at the packing house level.

April 9, 2024

Mantra – A word or sound repeated to aid concentration or meditation.

We start with that definition because if any of you have heard me speak over the past year or so, you have heard my mantra:

(Here everyone can join in by assuming a contemplative position. The commode works fine by me. Just don’t tell us about it. If you do that lotus position thing, don’t blame me when your wife/husband/anyone handy has to come help you untangle your legs and, perhaps, stand again!)

So all together now—Hum.

Dr Meyer’s Mantra:

To restore hog producer profitability one or more of three things must happen:

Costs must fall

Demand must improve

Hog supplies must decrease.

Hum.

The reason for my constant harping, or repetition, was to keep listeners focused (i.e. concentrated) on those three factors and the fact that they controlled only one of them: pig supplies.

And now it looks like producers have been saved from making even more Draconian cuts to their herds. At least for the moment.

The reasons, of course, are that the first two factors have cooperated quite well with our need to improve profits from last year’s abysmal levels.

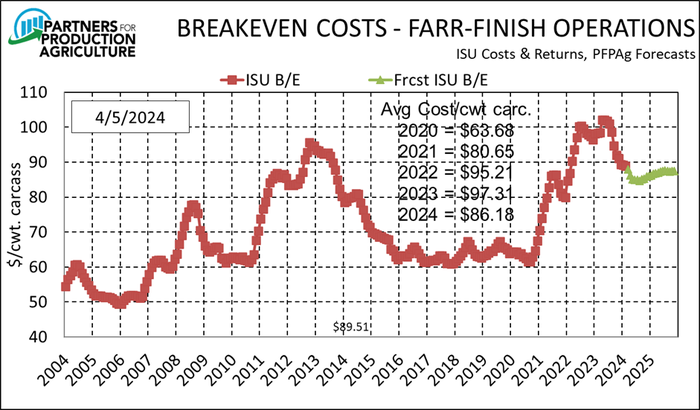

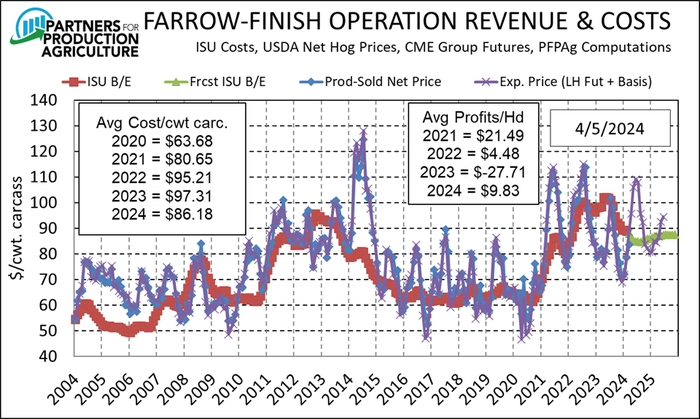

First let’s look at costs. Figure 1 shows the results of my model which is based on the historic estimates found in Iowa State’s costs and returns series. I regressed (a statistical process that, I must admit, even I don’t fully understand but that, thankfully, makes me sound very professorial) those costs on historic corn and soybean meal prices to get a prediction equation that is the driver of my estimated costs for the rest of 2024 and 2025. The resulting equation is a good one – explaining 99% of the historic variation in costs.

Figure 1.

What that means is that if producers actually see corn and soybean meal futures prices as of last Friday over the next 10 months, the cost of production for a farm with the same parameters as ISU employs will see costs in the mid- to upper-$80s per cwt. carcass weight. The ISU model fits, we believe, the low-cost 25% of so of producers, however, so the average U.S. producer will see costs in the low $90s.

Relative to a long historical view that is still very high but is clearly better than record highs of the past two years. Good South American crops are a primary reason for the break and good U.S. crops this year could push the estimates even lower. I would be very surprised to see them get below $80, though. And I would urge readers to not get greedy! We probably need to be thankful for what we have now and become positively joyous if feed prices and costs get lower.

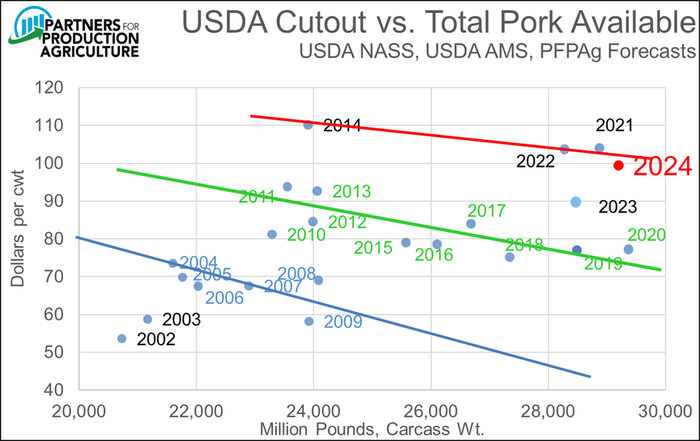

Second, demand has improved dramatically, especially at the wholesale level. Figure 2 shows a scatter diagram of annual price-quantity pairs since 2002. The price here is the cutout value and the quantity is total pork availability so this diagram represents the wholesale pork market. Those groups of negatively related observations represent the wholesale pork demand relationship in various periods. 2014, 2021 and 2022 were “off the charts” good. 2014 was driven by the porcine epidemic diarrhea virus scare over pork supplies while 2021 and 2022 were driven primarily by stimulus dollars pushing consumer spending. The observation for 2023 is a combination of a very bad first half of the year when the price-quantity pair was back near the pre-2021 group and a much better second half which pulled it back toward 2021-22. And 2024? That currently looks swimmingly good and is the primary reason we see hog prices at the levels they are now.

Figure 2.

Why is 2024 so good? Remember this is wholesale demand so both domestic and export markets drive it.

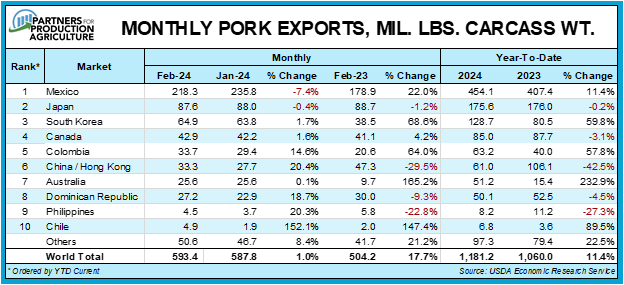

U.S. pork exports are on fire through February. See Figure 3. Mexico is, as always, leading the way but Korea is in our market big time, largely because of lower EU availability.

Figure 3.

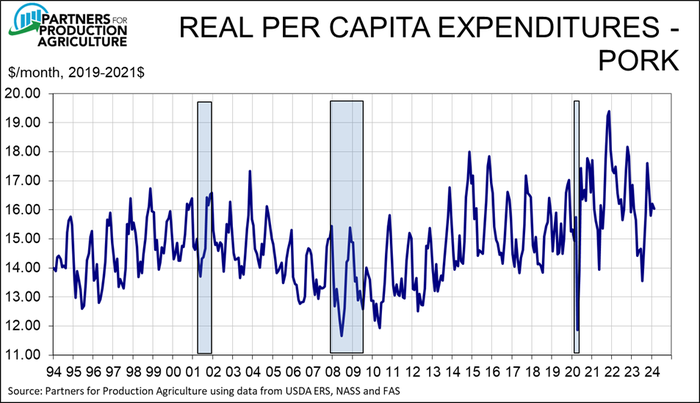

Domestic demand has been stronger as well with February real per capita expenditures down just 0.1% from last year. See Figure 4. The real test comes in the next six months. Notice the sharp dip in pork RPCE last year. I have never arrived at a good explanation for that dip but I do know that avoiding it this year is critical in keeping the wholesale pork and hog markets strong. Macroeconomic variables remain quite positive so I believe consumer demand will out-perform last year provided no big disasters befall us.

Figure 4.

Which brings us to supplies. The March Hogs and Pigs report tells us that reductions are not forthcoming. In fact, my calculations put Q3 and Q4 slaughter up 3.0 and 3.4%, year-on-year. Note that 1.5% of those are due to extra slaughter days but +1.5 and +1.9% do not suggest any backing off of pork tonnage. Demand can handle that output and provide reasonable (??) profits for 2024 but productivity growth marches on and likely means even more pigs in 2025.

And finally there is the capacity issue. Pig numbers and pork supplies are important in and of themselves but there is a funnel in our system at the packing house level. The loss of the Perry, Iowa plant puts a pinch in that funnel that suggests capacity utilization will be very high this fall. Comparable and maybe a bit higher than last fall when spot hogs fell into the $40s.

Figure 5.

Model profits of nearly $10 per head is better news than we’ve seen in a long time. Will factor number three torpedo the gains in factors one and two? I don’t think so but everyone should keep all three in mind. Hum.

About the Author(s)

You May Also Like