Time to get cracking on those hog hedges

March 28, 2016

Talk is cheap. When a broker, adviser, banker or consultant says “you should assume some hedges” it’s easy to say but much more difficult to plan, execute and maintain during the course of the production cycle. So, as the headline says it’s time to get cracking on hog hedges, let’s walk through my specific reasons why and identify a specific idea.

First, it helps when devising a hedging plan to boil down the fundamentals to as simple an equation as possible. What we have in the case of pork production are forecasts for record large production this year on top of record large production last year. In addition, the USDA is projecting record large poultry production and higher beef production compared to last year. In total, meat production will be record large this year.

Second, being specific to pork production, there exists some level of concern in regards to slaughter capacity being challenged at some point this fall. I’m certainly not predicting a situation similar to what developed in the fall of 1998, but with production projected to be record large, this possibility must not be overlooked.

Third, a look at the lean hog price charts is pleasant in that futures have been trending upward since important lows were scored last fall. Simple economic theory would indicate that demand for pork must be strong if prices are trending higher in the face of record large production. Pork is cheap. When low prices are offered long enough the demand burner kicks into high gear. We are experiencing improvement in pork demand both on the domestic and export front. All pork cuts are attractively priced compared to year-ago levels with the exception of bellies. Belly demand has been consistently strong and relatively inelastic; keeping belly prices historically strong in relation to the value of the pork carcass. Nearly all other pork cuts, including hams, picnics, loins, butts and trim have been trading well below their five-year average price levels.

Finally, in the face of up trending prices but also in the face of record large production including record large total meat production, it’s our stated opinion and objective to lock-in or hedge a portion of fall production at prices securing a profit for your business. In other words, if something goes wrong on the demand side of the equation, in the face of large production, locking-in prices for a portion of production into the seasonal high timing is strongly advised.

Option window strategy

Specifically, we prefer a method of hedging we term an option window strategy. This is different than simply selling futures. We desire to establish a price floor above the cost of production but at the same time provide you with a marketing window in which a price higher than your price floor can possibly be realized. In options trading these are called three-way risk reversals. Let me be even more specific. The low in October futures last fall was $62.50. The recent high (March 18) was $69.95 with the contract high from early last fall at $70.10. We’re much closer if not very close to the contract high and a far cry from the contract lows. The seasonal top timing is anywhere from early March to early May. In other words, in my opinion, we’re right in the middle of the seasonal top timing with prices very close to their contract highs. Time to establish some hedges.

Being even more specific, my clients have been working orders to buy the October hog $68 puts/selling the $58 puts/selling the $72 calls at a premium outlay of between 50 and 100 points. In summary, this is a marginable position providing a net price floor between $67 and $67.50, depending upon the amount of premium paid. In addition, this hedge provides protection as far down as $58. Finally, this hedge provides opportunity to market your October hogs in the window from $68 to as high as $72. If this window is acceptable and profitable, for a portion of your production, we recommend establishing and maintaining the hedge.

Similar strategies can be executed in the December options and even moving out to the February 2017 options. Using the same rule of thumb, if the option window you’re looking at is profitable, one should consider locking-in the window and maintaining the hedge. Keep in mind these are marginable positions meaning financing is critically important in the event that prices move higher after the hedge is executed. Working closely with a banker, consultant and/or broker is highly advised.

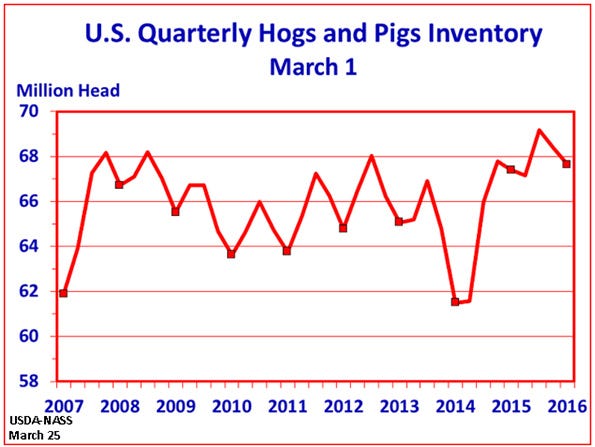

Report: Cautious expansion

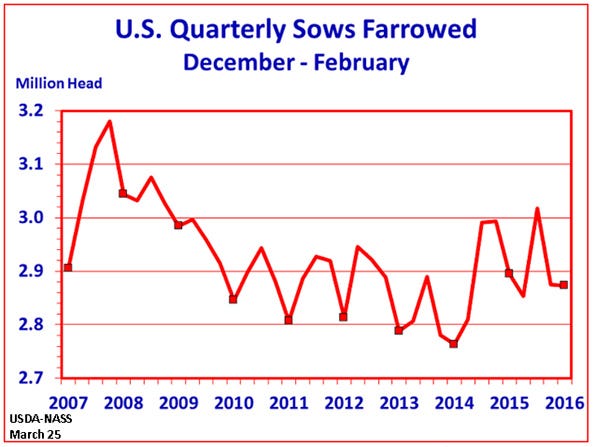

The March 1 quarterly hog and pig report showed cautious expansion plans by the industry. All hogs and pigs were pegged at 100%, kept for breeding also measured at 100% of last year and kept for market hogs were pegged at 100%. The pigs per litter during December-to-February, at 10.30, was up slightly from the September-to-November period and actually down nearly 2% from December-to-February of last year.

While production remains large, in fact record large, this report is comforting in that aggressive expansion is simply not in the works. Also, some reproductive and disease challenges were clearly evident in the size of the winter pig crop. This report should be friendly to the summer and fall contracts in the days and weeks ahead, providing hedging opportunities. I found the report interesting in that the traditional pork producing states in the hog belt are not expanding. Breeding numbers were lower in Indiana, Iowa, Minnesota, Missouri and North Carolina. Breeding numbers were up rather substantially in Oklahoma, Texas and South Dakota.

I found the report interesting in that the traditional pork producing states in the hog belt are not expanding. Breeding numbers were lower in Indiana, Iowa, Minnesota, Missouri and North Carolina. Breeding numbers were up rather substantially in Oklahoma, Texas and South Dakota.

About the Author(s)

You May Also Like