Tight Corn Supplies Could Get Even Tighter

To say the least, last week was a tough one for the pork industry and all other users of corn and soybean meal. While temperatures moderated a bit and there was some scattered moisture around the Corn Belt, conditions remained very poor as corn entered its key reproductive phase in many areas.

July 16, 2012

To say the least, last week was a tough one for the pork industry and all other users of corn and soybean meal. While temperatures moderated a bit and there was some scattered moisture around the Corn Belt, conditions remained very poor as corn entered its key reproductive phase in many areas.

USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report slashed projected national corn yields by 20 bu./acre from their June level. Generally, the mood of analysts was that the reduction may not be large enough given current conditions and forecasts for continued drought and a return to temperatures near 100 degrees or higher in many areas.

The yield reduction, plus slightly lower projected harvested acres, dropped the estimated 2012 corn crop to 12.97 billion bushels, 1.82 billion lower than the June estimate of a record 14.79 billion. I expect this figure to get smaller in August given current conditions. USDA’s first yield estimate based on actual sample data will be released on Aug. 10.

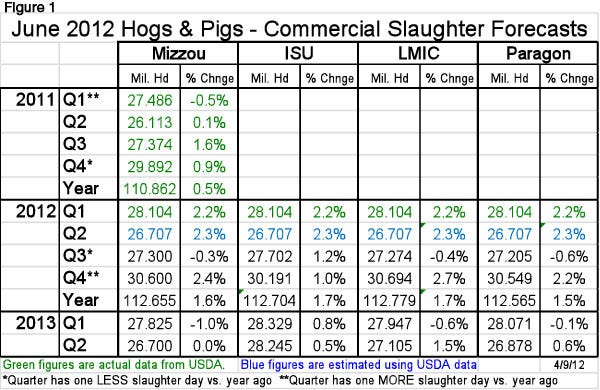

USDA slashed several key usage categories in order to accommodate the output reduction (Figure 1).

Rightfully, the largest reduction was for the feed/residual category. You’ll recall that this number was pegged at 5.45 billion in June, 20% higher than last year. The primary driver of that increase was a “fudge factor” in the residual component to account for an expected early harvest and the subsequent shift of a substantial number of bushels from the 2012-13 crop year into the current crop year. A bit of that may still happen, but USDA has obviously revised both that movement and, I think, 2012-13 feed usage downward to get to July’s 4.8 billion bushel figure.

USDA projections also very correctly reduced ethanol usage from 5 billion to 4.9 billion bushels. Several plants have already shut down as corn prices have risen and gasoline prices have fallen. But there is a limit to how far ethanol output will decline. First, ethanol is about the only octane booster available to gasoline blenders. In this role, the price of ethanol can be larger than its energy-content price of roughly two-thirds the price of gasoline.

Second, the Renewable Fuel Standard (RFS) will come into play. Allowing for one quarter of the 2012 crop year’s 13.2 billion gallons and three quarters of the 2013 crop year’s 13.8 billion gallons, the effective RFS for the 2012-13 crop year will be 13.65 billion gallons of ethanol. That amount would require 4.875 billion bushels of corn, almost precisely USDA’s current estimate. Accumulated Regulation Identifier Numbers (RIN) can be used for a portion of the RFS requirement, so USDA’s estimate could still be a bit high but not by much given the RFS mandate.

That leaves exports. USDA cut its 2011-12 export estimate by 100 million bushels to 1.6 billion. The feds also reduced the 2011-13 estimate by 300 million bushels from the 1.9 billion in June’s report. Will foreign buyers actually cut back that much? They need feedgrains just as much as do U.S. users. The stronger dollar will certainly contribute to the export reduction, as will higher world supplies of feed wheat. Let’s hope USDA is right on this one.

The net impact was to push year-end carryout to 1.183 billion bushels and year-end stocks-to-use of 9.3% – levels that, again, I think could get smaller. It appears the futures market agrees. Based on recent history, a year-end stocks-to-use ratio of 9.3% would give an average farm price of just over $5/bu. To get prices to $7/bu. would require a stocks-to-use ratio of less than 5.

Soybean Supplies Tight, Too

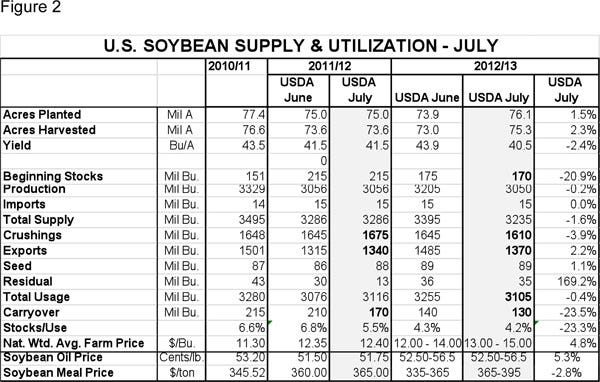

The soybean crop is in dire straits, too, but there is still time for some recovery – if it rains (Figure 2). If it doesn’t, a bad meal situation could get worse. The reason is, until next spring when the South American crop is harvested, the United States is the only supplier of soybeans for a soybean-hungry world.

Note that even with significantly higher prices, USDA has increased forecast 2012-13 soybean exports. There just are not enough to go around after Argentina and Brazil’s disappointing harvests this past spring. That soybean meal is going to be expensive is a foregone conclusion. Just how expensive is the question. About the only consolation we can draw on at this point is that it hurts poultry producers worse than it does hog producers because their standard diets contain much more meal.

Limited Options

What can you do? Not a lot at this point. It’s hard to imagine, but it is entirely possible that things could get worse! Long-term forecasts still indicate drier-than-normal conditions. Can you protect yourself against an even larger disaster? Sure. At-the-money calls for December soybean meal would limit your futures cost to about $500/ton right now. The cost could be reduced by about $30/ton by writing $450 puts. The trade-off, of course, would be a limit to the downside potential should rainfall return. Or, you could leave the downside open by not writing the puts.

The same strategy would limit December corn futures to $8.30 or so. Writing a $7 put would knock roughly 30 cents off that maximum. Like the soybean strategy, it would limit downside potential should conditions improve, but most think it may be too late for that to have much impact.

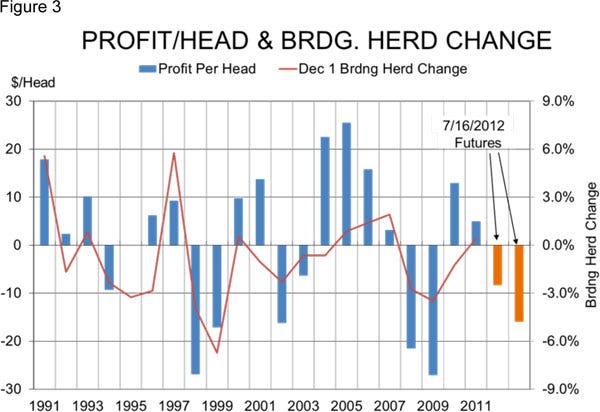

And what does it mean for long-term hog production? Figure 3 shows the relationship between the year-on-year change in the December breeding herd and profits back to 1991. At this point, I would be very surprised to see the December 2012 breeding herd larger than that of December 2011.

About the Author(s)

You May Also Like