The slap of reality?

Any economic disparity between producer groups in this downturn is likely more attributed to production output, not the pricing mechanism.

March 20, 2023

Pork producers experienced a rude awakening last week with a sharp selloff of futures, the summer contracts compressed by more than 1,000 points, and we now have no contracts trading over $100/cwt despite this value representing roughly breakeven values. Was this a fluke? Was it in conjunction to money flow and the banking crisis? Was it fears of a border-closing disease? In our opinion, it was none of the aforementioned items, it was simply a correction of a market that was trading outside of its fundamental zone and experienced a correction.

Let's frame this discussion under the auspices of the author being an advocate for the pork producer's profitability. We will cheer for our team with enthusiasm and hope for the best. It is our job to be analytical and point out when we think the futures market is incongruent with reality. This market was destined for a correction despite our hope for a different response. Let's tease this one out a bit.

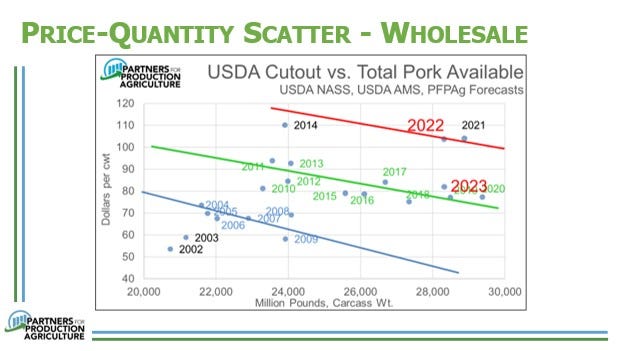

Dr. Meyer has been shouting from the rooftop for quite some time that the demand component was signaling trouble for the market long before last week. His regression work at the wholesale level indicated that we had fallen back to the pre-COVID levels of demand and – given the numbers from the most recent Hogs and Pigs Report – we were trading at levels that were too lofty if that situation did not shift. The market seemingly took heed of this fundamental truth and internalized that we were no longer trading a demand curve represented by the red line, but are back to the reality of the green line. To be sure, this is an evaluation of the wholesale trade. A study of the retail side would imply that retail margins remain healthy while the farm and processor margins are compressed.

We have more pigs than we thought. In fact, the month of March will average a weekly kill of nearly 2.5 million while the December report indicated that we would be about 115,000 per week less than that number. That is not a good setup for the pork producer and has nothing to do with the technical or money flow in the market, it is a reality that we have been harvesting more pigs and producing more pork than the market will allow at the higher prices. This is economic reality. The next Hogs and Pigs Report will be out on Thursday, March 30 and will provide a glimpse of the future with a likely revision to the previous report.

Weights have been creeping higher. We have no tangible evidence that we have been pulling pigs ahead as an explanation of the expanded harvests. The packer-owned category has indicated heavier weights and an abundance of numbers attributed to the East Coast. We may look for a silver lining, it is not to be found here.

This recent compression has nothing to do with any information regarding the anticipated Prop 12 release. The Supreme Court historically saves leaks for major cases, the Prop 12 decision does not rise to this level.

Conversations with our favorite lenders would indicate that – on average – we are financially able to stand a financial drawdown without significant changes in behavior. There is, of course, a distribution around the mean, but the bottom line is that we are not on the edge of a collapse of most enterprises. That is good news that we are generally in decent financial health, it does not indicate that we will be out of this quagmire in short order.

Unlike previous sessions of price compression, the market has not chosen winners and losers based on marketing parameters. In past times of constrained profitability, the pricing mechanism of the production community played a large role in the economics of the organization. Not so today. Whether you are on a cutout based contract, a fixed basis or a negotiated market, the price you receive for your animal is similar. The exception to this is a cost-of-production contract that will be better than any market based program right now. Any economic disparity between producer groups in this downturn is likely more attributed to production output, not the pricing mechanism.

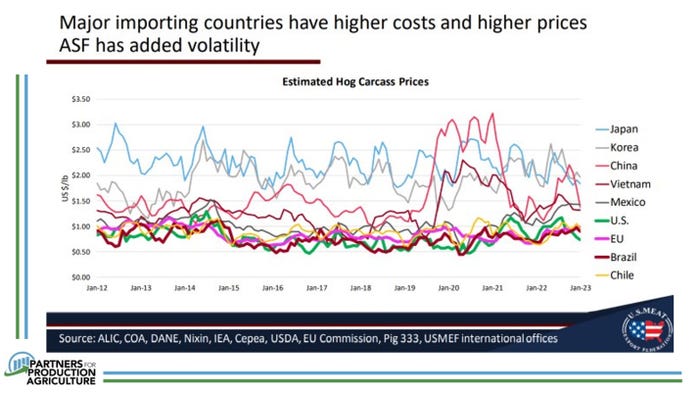

So what is a pork producer to do in the midst of the great reset? Our work would indicate that we are much closer to "fairly" priced relative to where we were trading. Therefore, any increase in exports or bump in the product could produce an uptick in futures whereas previously we would have attributed any good news to simply satisfying the elevated forward curve. Additionally, if we are trading fundamental markets (which I fully believe we are), then being the low cost producer will eventually prove to be a beneficial item. The impacts of this market compression will force liquidation within the high cost producers of our export competitors (Europe) and provide an opportunity for the U.S. to capitalize on subsequent higher prices. The attached chart from USMEF shows the U.S. (green line) is currently the low cost producer of the markets in this data – we may just need to hold on a little longer to reap the benefits.

The bottom line is that the fall from grace that we just experienced was not technical, it was not a fluke, it was not the impact of an unproven rumor. As painful as it was, it was the coalescence of the fundamental forces of reality playing out in front of us.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

About the Author(s)

You May Also Like