The hog market domino effect?

We have not only set record prices in China, we have exceeded them in excess of 50% of the previous records.

October 14, 2019

Recent happy-talk in the midst of the Chinese delegation visiting Washington has the agricultural trade drinking deeply after a long walk in the desert. If we are to believe the rhetoric and tweets, ag is the Big Winner with a $50 billion package forthcoming.

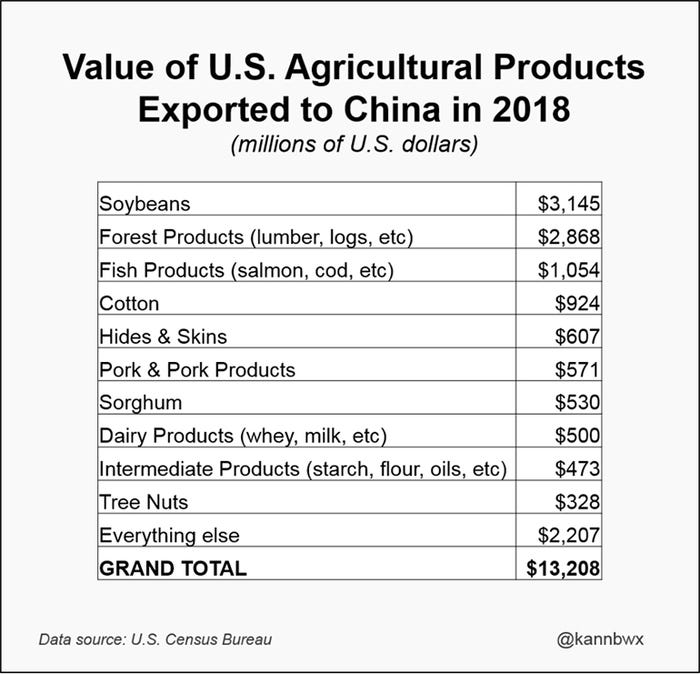

To put this in perspective, the United States sent China roughly $13 billion worth of goods in 2018 (see table below). Details are murky right now with Beijing providing a different understanding than what is coming from U.S. news sources. One Bloomberg article references the expenditures are to take place over the next two years.

I have previously shared that this — the removal of the political logjam — is the final piece of the puzzle necessary to allow financial forces to move in a natural state. Steve Meyer did a good job last week of articulating the fundamental economic parameters at play, and let’s take a step back and review the components in front of Meyer’s argument. Specifically, I think there are six things necessary for trade to take place in a manner that fits our bias and hopes.

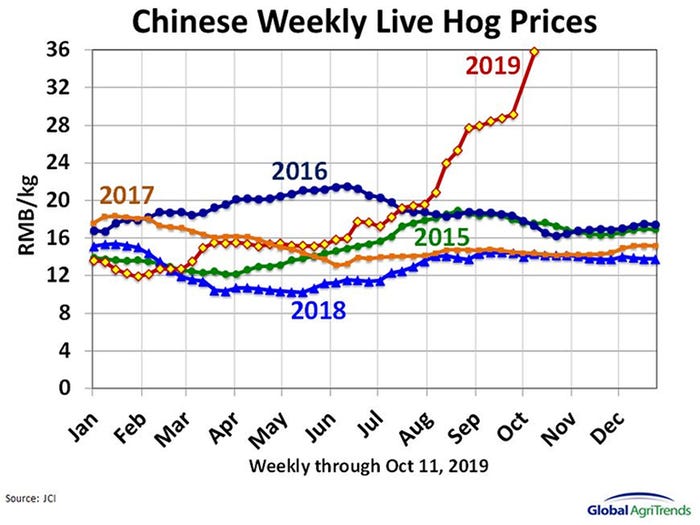

The price of hogs in China to move higher. We have this in spades. Attached is a chart of Chinese prices — notice a trend? We have not only set record prices in China, we have exceeded them in excess of 50% of the previous records. As of this morning, the average price of hogs in China is roughly $36 renminbi per kilogram, the equivalent of $231 per hundredweight. That is the live price. If we convert to carcass, it is $313 per hundredweight. Wow.

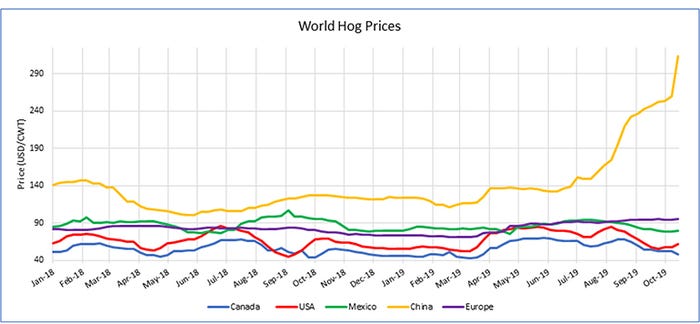

A discrepancy in market prices. High hog prices in China are only one aspect. You have to have opportunity, too, to manifest opportunity. As an analogy, if the gas station closest to your house is offering fuel at $4 per gallon and the price is the same across town, it makes no sense for you to do anything other than pay the price at the most convenient location. If, however, the price across town is $50 per gallon, you will make the effort to obtain the cheaper product. We have this in place, also. World values of pork have not followed the appreciation we have seen in China, this offers a financial opportunity for exporters, like the United States, to move product into the higher priced market.

Availability of replacement product. The economic motivations that we described in the first two points have to be in conjunction with product physically available to move. If, for instance, we had some artificial restriction of movement from the United States (embargo) then none of this makes for trade. Fortunately, we have gracious plenty product. Maybe too much.

Lack of attractive alternatives. Similar to my gas station example, if the price of a competing protein, like beef or chicken, does not experience a correlating move, it would provide an incentive to avoid pork purchases (as some level of elasticity) as a substitute. Fortunately, the price of competing protein in China has experienced a similar percentage rise, we may be accelerating the pace of pork price appreciation recently, but the trend is positive for pork movement into China.

A discrepancy between expectations and reality. We are generally jarred out of our comfort when we encounter something other than what we expected. Take a kid from rural Iowa and plunk them in the middle of New York and ask them what they think about prices for everything from rent to restaurant prices and you will get the picture. What is commonplace to someone from The Bronx is culture shock to others. This same scenario plays out with our motivation for change over things we can control (unlike rent in New York) via changing of sourcing of product in our situation. The yellow line (China price) is substantially higher than where it was (expectation) and what can be sourced from the rest of the world (opportunity).

This brings us to the last component necessary to facilitate trade. Consistency in trade. Note that this does not say the absence of tariffs. The current economic motivation overwhelms the current tariffs, it is the uncertainty of what changes may be on queue that keep things pent up, in my opinion. We have had a de facto embargo in place in China, one that our sources indicate has recently been loosened and the only item holding us back is the expectation of tomorrow is murky, at best. IF we are to see the recent trade delegation as positive, I believe the premiums we have built into the 2020 futures string is both sane and logical.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like