September Hogs and Pigs Report expectations

Negotiated base carcass price for market hogs reached $106/cwt during late July; last week negotiated prices averaged under $80/cwt.

USDA will release the results of their September hog inventory survey this coming Thursday. I expect it to show a slightly smaller swine herd than at this time last year. I expect the market hog inventory to be down 0.4% or so. I expect the report to show farrowing intentions for the fall and winter to be down roughly 4%. Large financial losses for hog producers in late 2022 and the first half of this year is the primary reason for the declining herd.

Sow slaughter has increased in recent weeks. Over the most recent nine weeks with data, sow slaughter was up 9%. During this same period barrow and gilt slaughter was up only 2%. Increased sow slaughter in May and June would imply fewer farrowings in October and November. Of course, increased sow slaughter can be offset by increased gilt retention.

The pigs per litter number is tough to forecast. It is driven by disease outbreaks, by weather, by profitability and by technology. This spring March-May pigs per litter was a record 11.36 head. That was up 3.27% year-over-year. Hot summer weather should have pulled down June-August litter size. I’m going with a forecast of 11.29 pigs per litter for June-August, an increase of 1.5% from last summer.

It is likely USDA’s September report will make some upward revisions to the June hog survey estimates. Since the first of June hog slaughter has been up 1.2%. The June hogs and Pigs report indicated slaughter would be up 0.2%. I’m expecting a 1% or so increase in the June heavyweight market hog inventory and an increase in the March lightweight inventory number so they will matchup with summer hog slaughter.

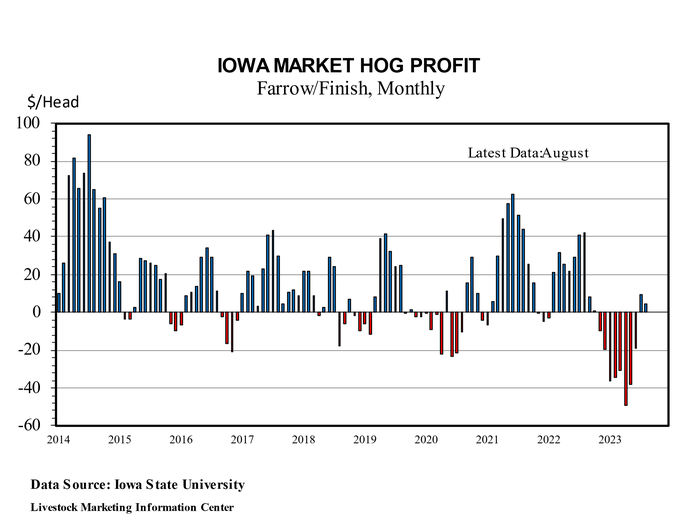

Each month economists at Iowa State University estimate costs and income for Iowa hog farms. Their calculations put the profit for hogs marketed in August at $4.60 per head. This was the second profitable month following eight months of losses. Unfortunately, it looks like the remaining months of 2023 will post large losses.

ISU’s calculated cost of production for hogs marketed in August was $74.03/cwt (live) or $98.70/cwt (carcass). This was the lowest monthly cost since March as corn prices have dropped with harvest drawing closer. Feed costs are expected to trend lower until winter.

As is usually the case, this year the peak in hog prices occurred during the summer. I expect low hog prices until the year ends. The negotiated base carcass price for market hogs reached $106/cwt during late July. Last week negotiated prices averaged under $80/cwt.

The average liveweight price for 51-52% lean hogs in August was $71.51/cwt. This was $2.41 higher than the month before, but $14.12 lower than a year earlier. USDA is forecasting the 2023 average liveweight price at $59.90/cwt and next year at $65/cwt.

Pork prices in grocery stores are down a bit this year, but they have remained well above the five-year average. During August retail pork prices averaged $4.834 per pound, up 13 cents from the month before but down 11 cents from a year earlier.

Packer margins were extremely tight in the first half of 2023 but improved in July and August.

Hog slaughter weights have been down most of the year. To date, hog slaughter is up 1.3% but due to light weights pork production is up only 0.1%.

International pork trade has been a big positive this year, in large part because low hog prices discourage pork imports and stimulate pork exports. Pork imports have been below year-ago for every month thus far in 2023. Pork exports have been higher than last year for each month of 2023. USDA expects pork imports to be down 17.8% this year but up 4.5% in 2024.

During the first seven months of this year pork imports totaled 650 million pounds,(carcass weight equivalent), down 21.7% year-over-year.

During the first seven months of this year U.S. pork exports totaled 3.955 billion pounds, up 8.9% compared to January-July last year. USDA expects pork exports to be up 7.2% this year and up an additional 1.5% next year.

Through July 2023 pork imports equaled 4.15% of U.S. pork production and pork exports equaled 25.24% of production.

USDA is predicting 2023 pork production at 27.159 billion pounds (up 0.6% year-over-year) and live hog price at $59.90/cwt. For 2024 they have pork production up 0.6% and prices averaging $65/cwt.

This year pork production is expected to be up 0.6% and hog prices down 15.9%. Next year pork production is forecast to be up another 0.6% and hog prices up 8.5%. Doesn’t make a lot of sense.

Corn prices were volatile during the spring but mostly held between $6.25 and $6.75 per bushel. Cash prices have declined by nearly $2 since mid-June. This is good news for hog farms.

Corn futures are trading well under $5 per bushel on the December contract. The summer contracts for 2024 are trading a bit over $5.

About the Author(s)

You May Also Like