Seeds are sown for another year of record production

The obvious answer to the optimism is that demand for U.S. pork has been outstanding and that futures traders, evidently, are betting this will continue not only in the weeks ahead but in the months ahead.

December 22, 2017

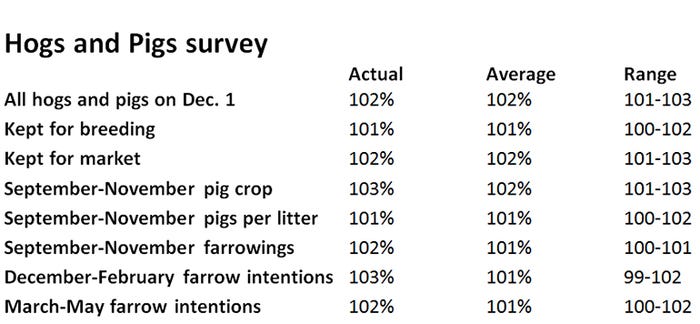

The results of the quarterly Hogs and Pigs Report are listed in the table below. The report did not contain any negative surprises. The futures market was in a bullish psychology phase going into the report. When the numbers were released, futures were up 50 points. Into the close, front month February lean hogs closed up 140 points.

Several items stand out from this report. The kept for breeding numbers suggest (to me) that the smaller producers continue to exit the industry and the large corporate producer continues to expand. Contract growers continue to dramatically expand. For example, finishing barns are being constructed at an aggressive pace in Iowa and Ohio yet breeding numbers were lower in both of these states. Specifically, breeding numbers were lower in Ohio, Indiana, Illinois and Iowa. Breeding numbers were up substantially in Michigan, Missouri, Nebraska, North Carolina, Pennsylvania, South Dakota and in Texas. This data appear to confirm that the small independent producer continues to leave the business while the corporation, the giant breeding companies continue to expand.

Another item that stands out is that continued expansion was reported (breeding herd up 1%) which confirms record large production will occur in 2018. In addition the report confirmed another record pigs per litter at 10.74. Thus, farrowing 2% more sows this fall resulted in 3% more pigs. Another item that stood out was the increased farrowing intentions slated in this report. The survey indicates that producers intend to farrow 3% more sows in the December-February timeframe and 2% more in the March-May period. Assuming continued progress in pigs per litter, one can expect resulting pig crops over the next six months to be 3% to 4% larger. Current profits reaped over the last year in tandem with cheap and hugely plentiful corn appears to be vastly outweighing any concern regarding the future of the North American Free Trade Agreement. I’m wondering if U.S. hog producers should be more concerned about the likelihood that NAFTA will melt away at some point next year. I’ve talked to producers in Canada who believe that NAFTA is on the way out. Take a look at a chart of the Mexican peso. This currency is plunging into new lows for the entire year.

As of today, February lean hog futures settled at $70 with the latest CME lean hog index at $61.76. These two will converge on Feb. 14. The board is highly optimistic that cash prices will rally impressively during January. The board goes on to predict that prices will rally into April. April lean hog futures settled today at $74.77. So at this moment futures traders are wildly optimistic in the face of record large production and despite the fact that average live hog weights are up five pounds compared to this time last year. Referring back to the farrowing intentions for the December-May timeframe, the October and December hog contracts closed Friday at their contract highs.

The obvious answer to the optimism is that demand for U.S. pork has been outstanding and that futures traders, evidently, are betting this will continue not only in the weeks ahead but in the months ahead. We now know for a fact that the seeds have been sown for another year of record large production. Will demand be strong enough to absorb this level of production, in tandem with record large poultry and record large beef production and keep hog prices trending upward and producers profitable?

About the Author(s)

You May Also Like