Record pace for U.S. pork variety meat exports lifts per-head value

Variety meat exports have surged to Mexico, with shipments increasing 31% to just under 118,000 mt, while soaring 40% in value to $220.4 million.

November 29, 2023

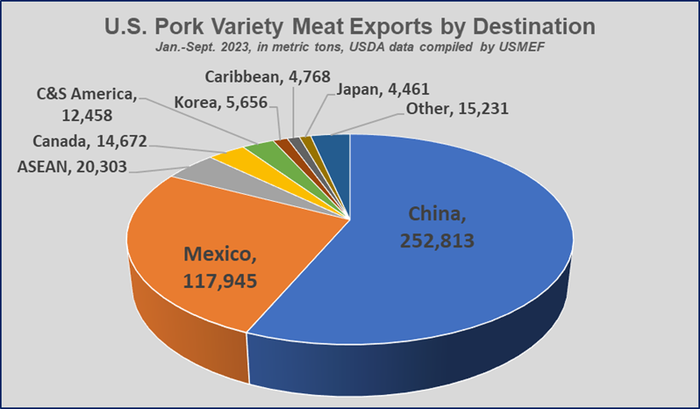

The strong momentum U.S. pork exports have established this year has been bolstered by record-large shipments of edible pork variety meat. Demand for these products depends almost entirely on the international marketplace, and while China remains the leading destination for U.S. pork variety meat, several markets have contributed to this year’s export growth.

Through September, pork variety meat exports totaled 438,190 metric tons, up 15% from the same period last year, while export value climbed 13% to $1.03 billion. This growth helped push pork export value per head slaughtered to a record level at $63.16, up 5% year-over-year, with nearly $11 attributable to variety meat exports.

2022 was a record year for pork variety meat exports to China, and despite the Chinese market currently having a robust supply of domestic pork, demand for U.S. variety meat has held up relatively well, with January-September shipments to China climbing 10% from a year ago in both volume (252,823 mt) and value ($650.6 million). This performance is especially impressive, given that U.S. pork entering China remains subject to retaliatory duties.

USMEF

Shipments to China could also gain momentum from additional plant approvals. In late October, China’s General Administration of Customs cleared 12 U.S. pork establishments for export to China. These were the first such approvals in more than 10 months. Eight more establishments were approved in late November and are expected to begin shipping soon.

Meanwhile, variety meat exports have surged to Mexico, with shipments increasing 31% to just under 118,000 mt, while soaring 40% in value to $220.4 million. The larger volumes to Mexico include a sharp increase in chilled variety meat items, for which Mexico is the dominant destination given its close proximity. Chilled shipments to Mexico topped 71,000 mt, up nearly 30% from a year ago and about 60% higher than in 2021. Frozen pork stomachs to Mexico increased 26% year-over-year to 12,241 mt, with the average price jumping 21% to $2.10 per pound. Mexico’s competing bid for stomachs has driven prices higher, even for stomachs exported to China or other destinations.

“The growth in stomach exports to Mexico is encouraging, because the U.S. industry has faced more competition in this space from the European Union,” explained Erin Borror, U.S. Meat Export Federation vice president for economic analysis. “Mexico’s imports from the EU are still significant, but down more than 20% this year.”

Led by strong growth in the Philippines, pork variety meat exports to the ASEAN region also increased this year, with shipments through September up 60% to more than 20,000 mt. In the Philippines, where USMEF promotions have recently featured more variety meat items in traditional wet markets, exports increased 52% to 18,608 mt, with value topping $25 million (up 24%). Though shipments to Vietnam are still relatively small, exports more than tripled from a year ago to nearly 1,500 mt, valued at more than $2 million. The U.S. also exported small volumes to Malaysia and Indonesia, where domestic production has been impacted by African swine fever.

USMEF

ASF has also played a role in the Dominican Republic’s increased need for pork variety meat. With domestic production struggling and pork consumption on the rise, variety meat exports to the DR have nearly doubled from a year ago. January-September shipments climbed 95% to 3,143 mt, valued at nearly $6 million (up 148%), driven by larger volumes of pork feet and head meat. In the Caribbean region, Trinidad and Tobago has also emerged as a promising destination for pork variety meat, with exports up 52% from a year ago to 524 mt.

Elsewhere in the Western Hemisphere, variety meat volumes also increased to Canada, El Salvador, Chile and Peru.

Borror notes that while the strong increase in pork variety meat exports reflects robust global demand, it is also encouraging news on the supply side of the equation. Exported pork variety meats totaled 10.19 pounds for every head harvested this year, the most since the recent peak of 10.23 pounds in 2017 and up from 9.64 pounds in 2022.

“During the pandemic, plant-level labor shortages and skyrocketing transportation costs made it much more difficult to capture and ship some variety meat items, because the return just would not cover the costs,” she said. “Labor is still tight and shipping costs still have to be managed very carefully. But the situation is much improved, and this is great news for an industry that needs to maximize the value of every animal. When the full range of variety meats can be exported, it’s a win for the entire U.S. supply chain.”

About the Author(s)

You May Also Like