PRRS Challenge Again Dominates Winter News

March 19, 2012

Perhaps the hottest debate topic in the pork industry this winter has been the extent of PRRS-driven death losses. There is really nothing new about that statement. It could have been made each of the past 10, 15, perhaps 20 years. This disease and its amazing and depressing ability to mutate and gain new levels of virulence has defied many, many good minds and undermined some very good planning and efforts. To say the least, it has been a challenge.

But will it impact the market this year? Producers always think it will. “PRRS has killed every pig in southern Minnesota so we will run out of pigs in June!” – or something along those lines – is the gist of the claims. Of course, porcine reproductive and respiratory syndrome (PRRS) has not killed every pig in any geographic area and, in fact, may not be any worse from one year to the next. There is a background level of death loss that the market has become accustomed to and, unless we experience something significantly worse than this “normal” level, we will never see a supply or price impact.

This is not a new phenomenon. There was a time not so long ago that we had this discussion around Transmissible gastroenteritis (TGE) every year. I have not raised pigs in the PRRS era, but I did in the TGE era and on occasion it was no fun. That characteristic smell of an infected farrowing house – wet, slimy pigs and dead pigs could be just about too much to take on some days. But those “killed every pig in Iowa” scenarios never showed up in supply data because they, too, were “normal.” They didn’t even show up as TGE waned (I think due to confinement barns and much better bird control), because it was a gradual process.

This may be the year I am proven wrong but my experience – and that of my mentors, Professors Glenn Grimes and Ron Plain from the University of Missouri – is that, though it seems worse than ever, we will not see these losses in the form of abnormally lower supplies this summer. Here is why:

A form of selection bias exists in that the producers not experiencing death losses do not talk about it. All we hear are the horror stories. None of the producers hitting 28 or 30 pigs/sow/year this winter say anything partly because hog producers are not prone to boasting and particularly because they would never mention such good fortune when another producer is experiencing such losses. That would be piling on in the worst way and hog producers just don’t do that.

Disease-driven death loss episodes begin small, grow gradually and then disappear gradually. There is no sudden shock to total supply on either end so the impact is hard to see. We have never seen a sudden disease introduction, but we have seen a relatively sudden disease solution when circorvirus vaccines went into full production in the summer of 2007. The increase of weekly slaughter from the summer low to the fall maximum was record large; it was even larger than in pre-1990 years when seasonal variation in pig crops was much larger.

For every hog farm getting hit hard this year, there is a farm that got hammered last year that is doing okay now. Now I know that statement is not always true as some farms are chronically infected with PRRS. And I’m certainly not a veterinarian, but my limited knowledge of immunity fits with this observation pretty well: Clean farms are susceptible, whereas recently infected farms have some immunity that protects them – for a while. The question is whether the outputs of the offsetting farms are equal and, over a large sample, they are probably pretty close.

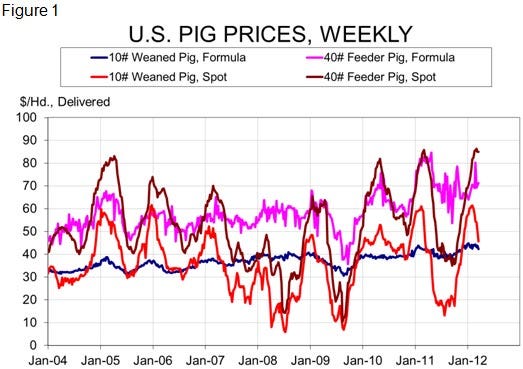

None of this is meant to minimize in any way the awful situations that some producers have found themselves in this winter. It is chilling to hear an Ohio producer say that he lost 15% of his SOWS to PRRS. And I know there are other stories like that. But even this year’s weaned and feeder pigs markets (see Figure 1) are only slightly higher than last year’s and are about the same as 2005 and, in the case of weaned pigs, 2006. There is little evidence that abnormally short supplies caused blow-out tops in the summers of those years.

But there is one issue that could cause a downward supply shock yet this spring: last summer’s heat. There was nothing gradual about it. It hit virtually everyone at the same time and, in spite of our sophisticated buildings, artificial insemination, tight management, etc. had reportedly a significant impact on conception rates. Those should have shown up in late September-November and early December-February farrowings, but USDA’s numbers do not fit with the anecdotal evidence. September-November farrowings were up 0.45% from 2011 and December-February farrowing intentions were up 0.77% from one year ago. Those are from a December 1 breeding herd that was 0.4% larger than in 2011.

If the anecdotal accounts are correct, we could see a drop in weekly slaughter from the forecast rates in late April. One analyst colleague told me he had April 20 marked on his calendar. I have it a bit later than that but not much. It appears we will put my “sudden event” vs. “gradual event” theories to a test.

About the Author(s)

You May Also Like