Pork tariff relief sorely needed in Vietnam

Vietnam market still holds significant opportunities for imported pork.

September 8, 2021

The Biden administration recently issued a fact sheet announcing advances in U.S.-Vietnam trade relations. One of the items included in the announcement was Vietnam’s "positive consideration" of a U.S. proposal to eliminate or reduce Most Favored Nation (MFN) import duties on pork, corn and wheat products.

The U.S. Meat Export Federation (USMEF) is awaiting further details on the status of this proposal, but the announcement underscores the fact that tariff relief for U.S. pork is much-needed in the price-sensitive Vietnamese market.

Even before African swine fever (ASF) was confirmed in Vietnam in early 2019, the U.S. pork industry saw strong growth potential in this emerging market. Though largely self-sufficient in pork production, Vietnam's growing middle class and rapidly growing foodservice and retail sectors presented intriguing opportunities for U.S. pork. The U.S. pork industry was poised to benefit from significant market access gains in Vietnam through the Trans-Pacific Partnership (TPP) before the United States withdrew from TPP in 2017.

"Although Japan was the TPP member that drew most of the media attention when discussing access for U.S. red meat, we also saw improved access to Vietnam as a major win," said USMEF President and CEO Dan Halstrom. "Once the U.S. withdrew from TPP, a bilateral agreement with Japan understandably became the top priority for U.S. agriculture, and thankfully the U.S.-Japan Trade Agreement largely replicated the gains in pork market access that were included in TPP. But that is not the case in Vietnam, where the successor agreement to TPP (the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, or CPTPP) and Vietnam's free trade agreement with the European Union have put U.S. pork at a severe disadvantage."

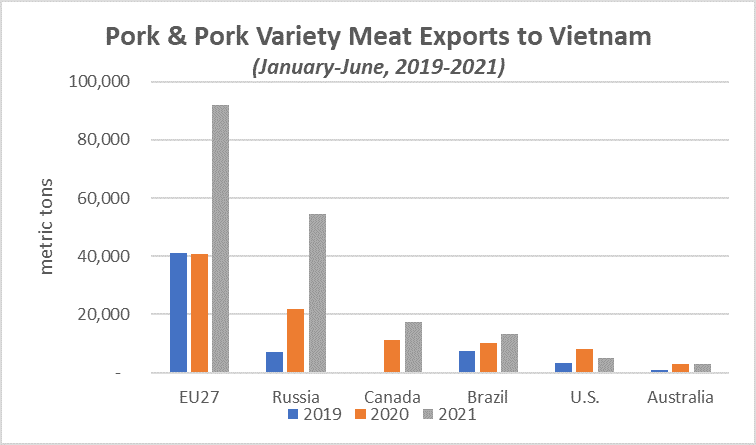

Vietnam's MFN duty rate for imported frozen pork is 15%. The 2021 rate for imports from Canada and other CPTPP members is 7.5%, while pork imported from the EU is tariffed at 11.3%. The MFN rate for pork variety meat is 8%, while the rates for Canadian and EU variety meats are 2% and 6.4%, respectively. Vietnam is also a significant destination for Russian pork, which also benefits from favorable tariff treatment.

In July 2020, with ASF having dealt a serious blow to its domestic pork production, Vietnam reduced the MFN rate on frozen imported pork from 15% to 10% in an effort to bolster pork supplies and stabilize prices. This tariff reduction provided a boost for U.S. exports to Vietnam, which totaled nearly 17,000 metric tons (mt) in the second half of 2020 – an increase of more than 60% year-over-year and more than double the volume exported in the first half of the year. But the MFN rate returned to 15% on Jan. 1, 2021, which widened U.S. pork’s tariff disadvantage in Vietnam compared to major competitors.

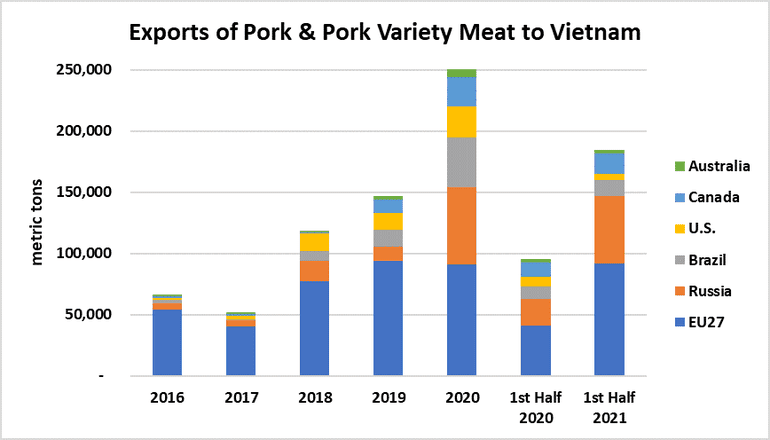

Since the temporary MFN rate reduction expired, U.S. exports to Vietnam have been in decline despite the country's continued strong demand for imported pork. In the first half of 2021, pork and pork variety meat exports to Vietnam from major suppliers essentially doubled from a year ago, reaching 185,000 mt. Conversely, first-half exports from the United States were down 41% from a year ago, dropping below 5,000 mt. In July, U.S. exports sank by 94% to just 169 mt. Among competitors, Vietnam an especially attractive target for exporters from Germany and Poland because these countries do not have access to China, Japan and many other major export markets due to ASF-related restrictions. Russian exporters are in a similar position, as Vietnam has taken more than half of Russia's total exports this year. Most of the remaining volume was shipped to Ukraine, Belarus, Kazakhstan, Mongolia and Hong Kong.

While Vietnam's pork production has recovered to some degree from ASF and COVID lockdowns and other restrictive countermeasures have recently slowed economic activity, Halstrom says the market still holds significant opportunities for imported pork.

"Unfortunately U.S. pork has been largely relegated to the sidelines, with our tariff disadvantage being a significant obstacle," Halstrom explained. "USMEF is pleased that market access for U.S. pork is a high priority in the Biden administration's trade discussions with Vietnam, and we are anxious to see these talks progress."

Sources: U.S. Meat Export Federation, who is solely responsible for the information provided, and wholly own the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like