Poker and pawns: Who’s at the trade table?

We are still concerned about where meat is going, we are concerned whether we are going to make a crop. Threats may take on a different face but the prospects for long-term profits are still promising.

May 14, 2018

There is an old joke that contends if you sit down at the poker table without knowing who is the fool in the group it is probably you. I was reminded of this while observing our president play cards in the arena of prescription drugs. We were watching him live on CNBC while the stock market was actively trading. The financial fate of that industry ebbed and swooned with his every sentence as measured by stock price fluctuations.

It was somewhat humorous as I was an innocent bystander in this case — but what happens when Mr. Trump starts talking about things that impact the ag sector? My posture shifts from mildly amused to occasionally irritated. I think it is important to recognize our human tendencies in situations where it is our ox getting gored and we have a vested interest in the outcome. Having information and knowledge of “who is at the table” can help keep things in perspective. It is against this backdrop that I would like to frame a couple of things as they relate to the pork sector.

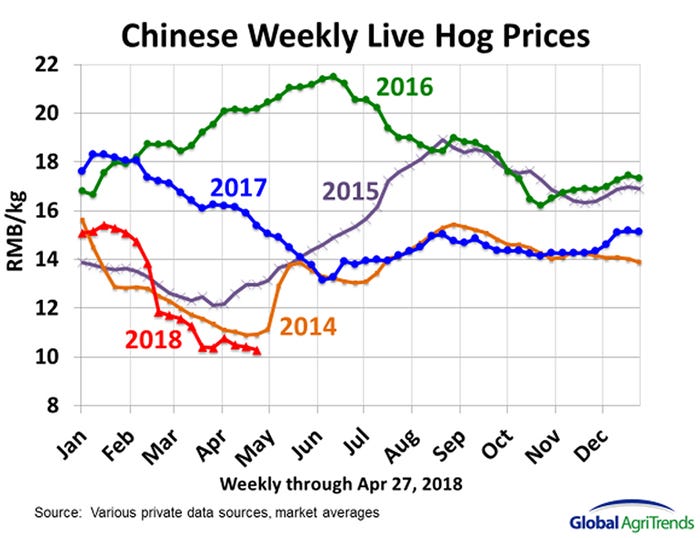

First, the direct impact of the pork tariffs have likely made their impact and there is not too much to fear from any further political tensions between China and the United States. We were not going to send much in the way of muscle meat that direction, anyway, in 2018 for a myriad of reasons, the primary one being the sharp decline in Chinese prices as depicted in the graph below, courtesy of our associate, Brett Stuart.

Variety meats will likely still flow, but the damage has been done and shipments of the major components can’t go down much from nearly zero.

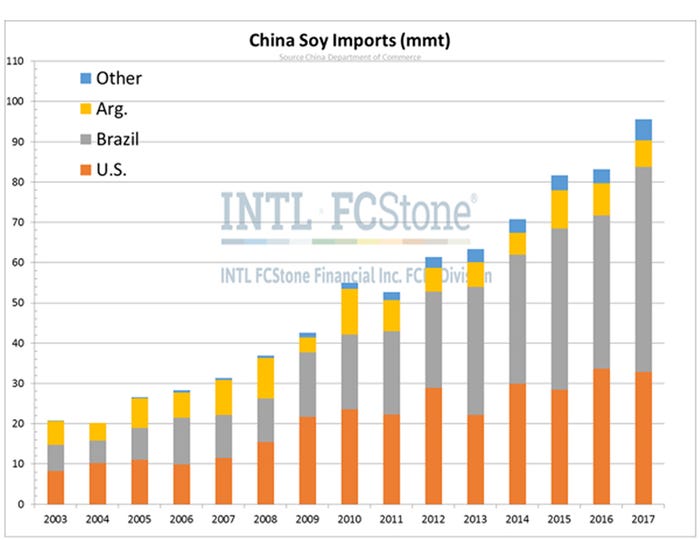

Second, the situation on soybeans is far from over. I will share my observations of the recent USDA report a bit later in this column, but right now I want to frame the big picture and it looks like this: China absolutely can’t sustain its appetite for soybeans absent the United States’ supply. We have a proposed 25% tariff on the table for beans that has not yet been instituted, and I suspect it never will be. This is an important topic, here is what the math looks like in rough numbers.

Argentina: 40 million metric tons production; most of their production goes to the crush industry, exports run about 5 mmt

Brazil: 120 mmt of production; 40 stays domestic, about 70 moves to export

United States: 120 mmt of production; use equally split between export and domestic use — 60 each side

China: 100 mmt of imports (about 75% of world trade)

Even if every bean exported from Paraguay, Uruguay, Argentina and Brazil went to China, they would still be lacking roughly 25 mmt that has to come from someone. Guess who that “someone” is? That’s right, the good ’ol USA.

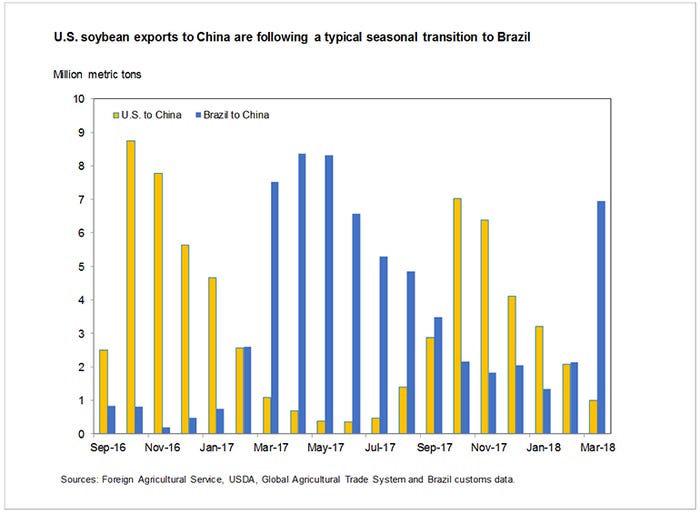

Here is what the flow has looked like over time in a graphical form. The bi-hemispherical rhythm has Brazil as the kingpin for six months of the year, roughly March through September, and the United States filling in the other half.

Remember my reference to poker and knowing who is at the table? The Chinese are well aware that the calendar is not their friend. They are without options if the trade dispute drags into the fall when they have traditionally turned to the United States for supply. Do you think that Mr. Trump, the self-proclaimed Master Negotiator, maybe knows the same thing? Yep. This, my friends, is likely the second largest driver of soy price discovery (weather and U.S. production will be the primary focus) for the balance of 2018. I do not have the room in this column to tease out the intricacies of crush margin, world soybean meal trade channels and a plethora of other fun stuff. The rest of the items that I think are interesting are probably on the right side of the decimal. If you watch weather and Chinese negotiations, you will cover the biggest part of the nut.

The USDA released their first look at corn and soy balance sheets for the current crop and they contained a few items of interest. First, the corn balance sheet was snugged up a bit, as expected, by the reduction in acres this year and a trendline yield calculation that changed (lower than the previous computation) this year. Demand was reduced in the feed sector despite more animal units, exports were projected lower and ethanol demand up a bit. All in all, the balance sheet is doable, but leaves no room for aberration.

The soy numbers were interesting as they moved exports higher in the face of the proposed tariffs which has created a tighter balance sheet than anticipated. On the heels of the report, markets faded. Not a good sign for the wannabe bean bulls.

One last item. I am just back from a fantastic conference in Tennessee. A thought-provoking lineup of speakers discussed a myriad of topics from cultured (fake) meat to lessons learned from other species to former GMO vandals that have now joined “our” side. Very interesting stuff. My take away from the two days in Nashville is this: everything is “normal.” We are still concerned about where the meat is going, we are concerned whether or not we are going to make a crop, the threats may take on a different face but the prospects for long-term profits are still promising. Be not afraid, or at least not paranoid.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Joseph Kerns

About the Author(s)

You May Also Like