Pendulum swings from discount to premium … why?

Rest assured if ASF spreads within the hog herd in China the current tariff on U.S. pork will evaporate quicker than a drop of water on a hot skillet.

August 27, 2018

The theme of my column in July was that lean hog futures, trading at sharp discounts to cash hog prices, were undervalued. The futures market had baked too much bad news into prices. I suggested that’s what markets do during the price discovery process. The pendulum swings from grossly undervalued to grossly overvalued. Identifying when the pendulum is about to change direction is the key.

When published in July October futures were trading $27 under the cash market with December priced $32 under the cash. Three weeks later, futures ripped higher by 660 points in three sessions. Indeed, when the near-term peak was reached on Aug. 20, October futures were 1,170 points off their contract lows with December futures reaching 1,220 points off the lows. In addition, as of Aug. 20 the October contract resides 530 points over the CME cash index with December 300 over the cash.

So, what the heck changed? Did cash hog prices bottom? No. Did the product bottom out? No. Did the hog runs dry up and production drop off more than expected? No.

The near-term fundamentals, the fundamentals impacting the market going into the fourth quarter have not changed. However, three fundamental items have bubbled to the surface that have potential to change the longer-term fundamentals. These include the North American Free Trade Agreement talks, upcoming trade talks with China and the United States and the discovery of African swine fever in China.

Upon reflection, in my opinion, the thrust of the buying was likely attributed to the ASF situation in China. The trade issues of NAFTA and negotiations between China and the United States will likely be very slow going and unlikely to have immediate market impact. The ASF story, however, currently just starting to unfold, could have a major impact on price discovery moving forward.

Four cases of ASF to date have been reported in China. The location of the cases forms a triangle with several hundred miles between locations. This marks the first time, ever, that ASF has been detected in China. Authorities, it appears, have no idea how the disease was introduced into the country. There is no vaccination for ASF and it spreads rapidly. It is not dangerous to humans. However, the only way to prevent the spread is massive and quick culling when a new case is discovered. The disease will kill infected pigs fairly quickly. Infected animals cannot be used for human consumption for fear of spreading the disease further.

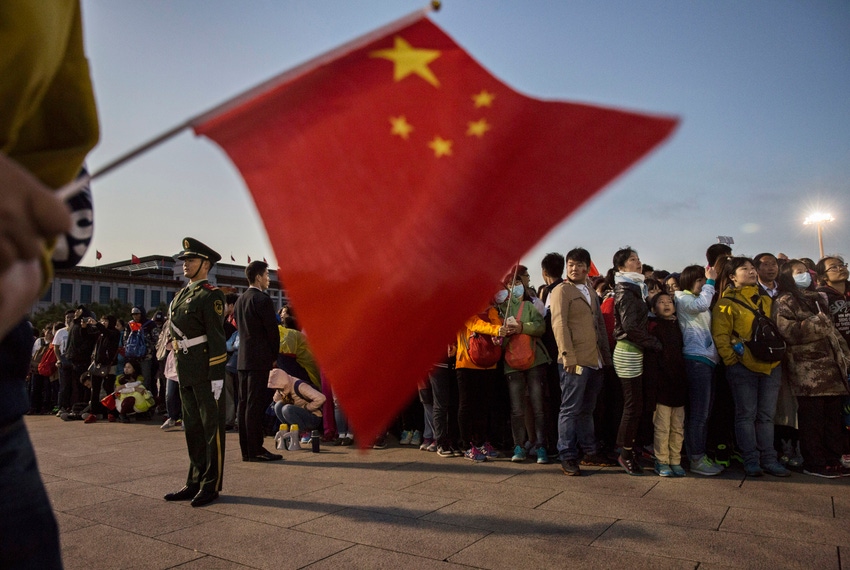

If ASF spreads in China, this will, eventually, have a major impact on hog prices in the United States. China holds half of the total pig population in the world at over 400 million head. In addition, the Chinese are huge consumers of pork, consuming over half of the pork raised in the world. The spread of ASF in China could result in the culling of millions of pigs.

The futures market is somewhat subdued in spite of this threat mostly because China does not export any pork. If ASF were to hit a major exporter, exports would be shut down immediately and trade disruption would drive prices higher in other exporting countries. However, if evidence continues to surface that the disease is spreading, with no success of containment, at some point the market will realize what’s about to happen and prices will start moving higher. This is solely based upon the situation in which the disease spreads.

My sources, sources that have been to China, have seen how they raise pigs, seen how they transport pigs and have seen firsthand how they process pigs, they are telling me that China will have a very difficult time preventing the spread of this disease. If this situation unfolds, at some point lean hog futures prices will begin moving sharply higher. With confirmation the disease is spreading with little success at containment, prices will move sharply higher, quickly, and then ask questions later.

Trying to get some perspective on this story is difficult. Estimates are that about six million to eight million pigs were lost in 2014 when the porcine epidemic diarrhea virus hit the United States. Hog prices that winter/spring went ballistic. April lean hog futures rallied from $90 in early January to $127 before they went off the board in mid-April. June hogs moved from $100 in early January to $133 by the middle of May.

The hog numbers in China are overwhelming to consider. Current estimates peg the pig population in China at 433 million. For comparison, the pig numbers in the European Union are estimated at 150 million, 73 million in the United States, 38 million in Brazil and 22 million in Russia.

If ASF spreads in China and they have to cull just 1% of their herd in an effort to contain the disease, you’re talking about over 4 million head. What happens if they have to cull 5% or more? Now you’re talking 20 million pigs. Keep in mind that China is, by far, the largest pork consuming country in the world. Despite their huge pork production, they still import vast quantities of pork every year. In other words, every hog that’s lost to disease in China will have to be imported from either Brazil, the EU or the United States.

Several years ago, the largest Chinese pork producer purchased Smithfield Foods, the largest pork producer in the United States. They made this purchase for food security reasons as well as for the technology advances. Rest assured if ASF spreads within the hog herd in China the current tariff on U.S. pork will evaporate quicker than a drop of water on a hot skillet.

About the Author(s)

You May Also Like