Packer margins deep in the red

Hog prices and cutout value have averaged a little different in March, April and May.

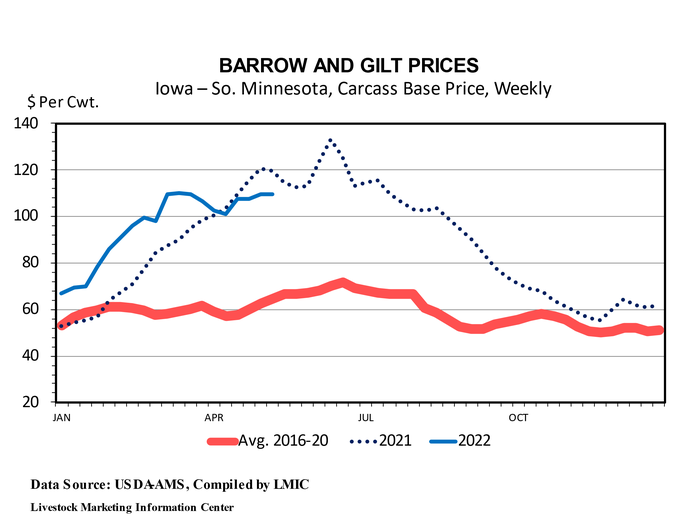

Hog prices usually rally as we move closer to midsummer. During the last 10 years, the live price for 51-52% lean hogs has averaged $54.03/cwt. in March, then $1.19 higher in April, $5.05 higher in May, $3.34 higher in June, and 32 cents higher in July. August prices have averaged $5.16/cwt. lower than July.

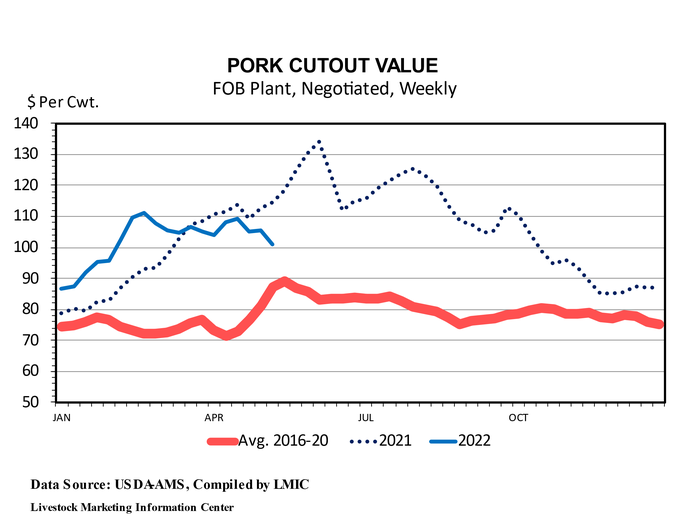

The uptrend in hog prices is made possible by a similar rally in pork cutout values. Higher pork prices mean packers are willing to pay more for hogs. July is typically the peak month for pork cutout value as it is for hog prices.

As the chart shows, this year pork cutout value peaked in March and since then has declined slightly. This year, both hog prices and cutout value have averaged a little different in March, April, and May.

Packer margin—the spread between cutout value and hog price—is typically widest when there are lots of hogs to slaughter, i.e. the fourth quarter of most years. Packer margins are usually tight when slaughter hogs are scarce, i.e. late spring and summer.

In recent weeks, lagging cutout value has decreased packer margins and thus hog prices. At times, negotiated hog carcass prices have exceeded pork cutout value. That has left packer margins deep in the red.

With pork cutout spending between $100/cwt. and $110/cwt. for most of the spring, it has not been possible for hog prices to rally to the highs of last summer, even with reduced slaughter. The negotiated hog price has spent the spring between $100/cwt. and $105/cwt.

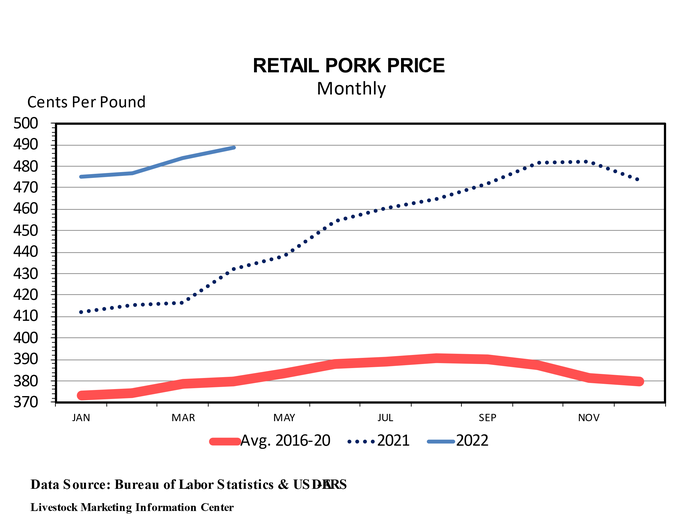

The lag this spring in pork cutout has not been due to weak retail prices. In April, the average retail price of pork was a record $4.885 per pound (lb.), up 56.2 cents from a year earlier, and up 4.9 cents from the old record set just the month before. Since the seasonal peak in retail pork prices typically comes in late summer or fall, more retail pork price records are likely. Hopefully this will also bring higher cutout value and hog prices.

The cash price for 51-52% lean hogs averaged $73.47/cwt. in April, down 15 cents from March, down $2.12 since April 2021 and $21.70/cwt. short of the record. The record high for the 51-52% lean price series is $95.17/cwt. set in July 2014.

Inflation is expected to continue pushing prices higher. In April, the cost of living was 8.3% higher than last year. That is the second biggest year-over-year increase in 40 years. I expect inflation to continue at a similar pace through the rest of this year.

The futures market is indicating lower hog prices this summer than last. The futures market is implying a summer hog price peak of $110/cwt. of carcass and a peak next summer of $100/cwt.

Domestic pork demand has been up for eight consecutive months.

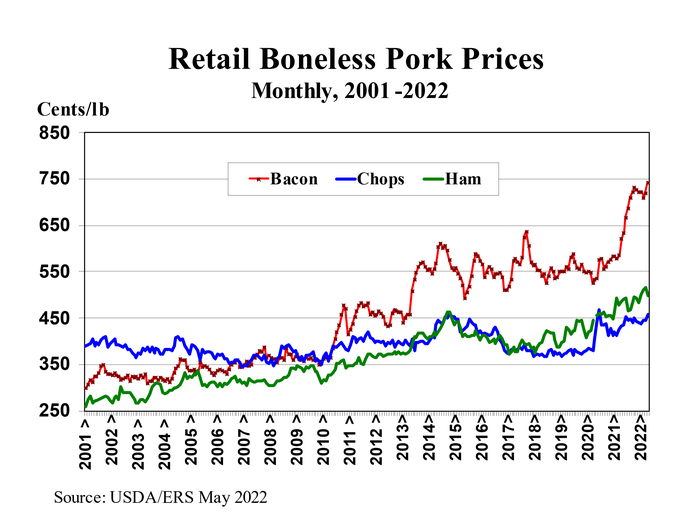

Pork prices are staying ahead of inflation. Over the past 12 months, inflation has been up 8.3%, but pork prices have increased 13.0%. Much of the strength in retail pork prices is due to strong demand for bacon. The average retail price of sliced bacon was up 19.4% in April. Boneless ham prices were up 5.7% and boneless pork chops were up a slim 2.7% compared to a year earlier. Prices for these latter two cuts are up less than the rate of inflation.

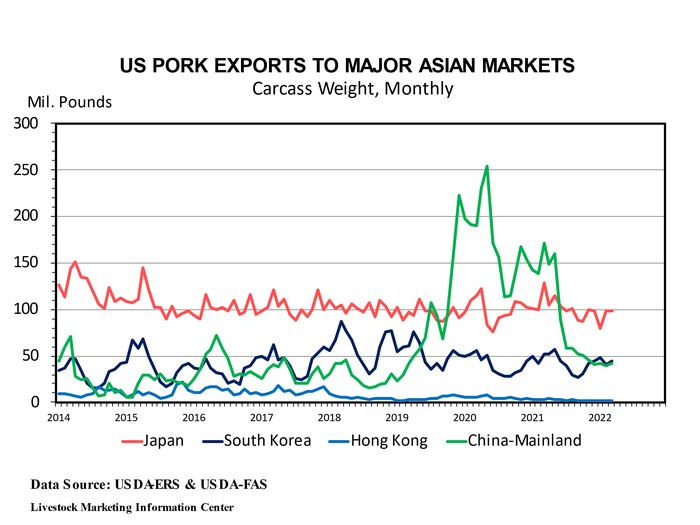

One of the biggest drags on hog prices is weak exports. The demand for pork exports has weakened each month thus far in 2022. Given the big drop in Chinese pork imports, export demand is likely to continue to be weak.

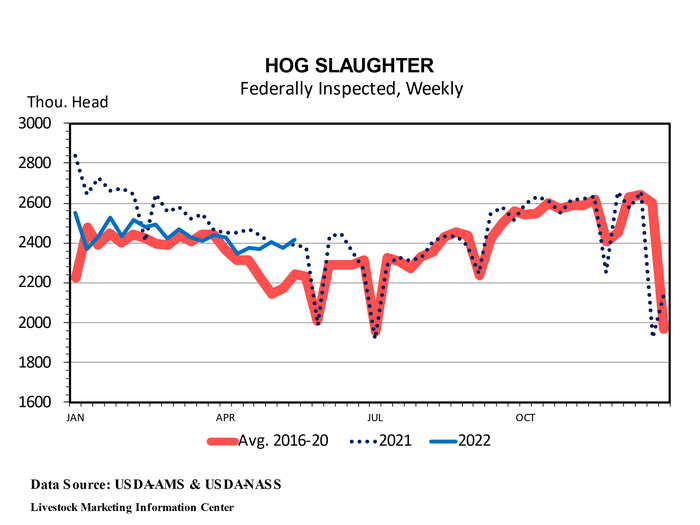

Over the last 12 weeks, hog slaughter has been down 2.6% compared to the same period last year. That compares to an expected slaughter decline of 3.5% indicated by the market hog inventory in the March “Hogs & Pigs” report. This is a small miss. Hog slaughter over the next 14 weeks will be down 1.3% if slaughter continues to line up with the market hog inventory.

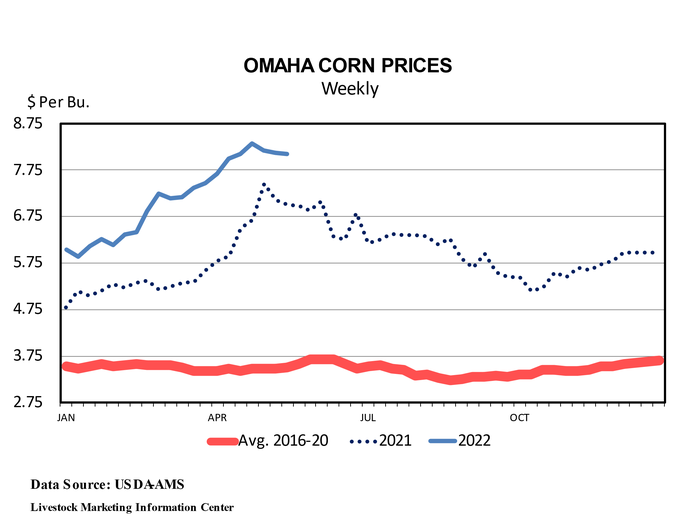

Despite corn prices occasionally exceeding $8.00/bushel in recent weeks, corn prices are moderating. The futures market is predicting a slow decline in corn prices until the end of the year then stable prices until the summer of 2023. The pattern is expected to repeat next year.

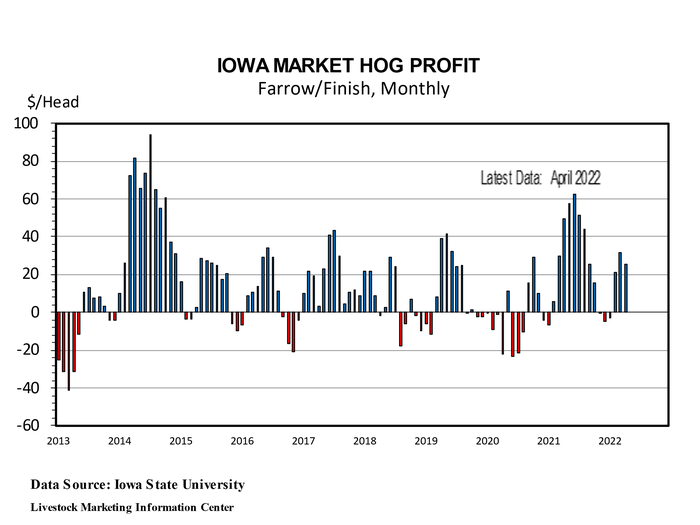

Calculations by Lee Schulz at Iowa State University indicate hog profits in April were $25.75 per hog marketed. Dr. Schulz estimated April cost of production at $93.62/cwt. of carcass, the highest cost since August 2013.

U.S. pork exports during the first quarter of 2022 were down 20%, or 386 million pounds. Shipments to China were down 329 million pounds, to Japan down 53 million pounds and Philippines down 53 million pounds. Pork exports to Mexico were up 179 million pounds, the only large increase.

During the first quarter, U.S. pork imports were up 45%, or 111 million pounds, with Canada shipping us 66 million pounds more pork, Mexico 11 million pounds more, and Denmark 9 million pounds more than in January-March 2021.

U.S. live hog imports during the first quarter were up 3%, or 46,778 head.

Today, USDA will release the “Cold Storage” stocks report for April 30 and the “Crop Progress” report for May 22.

About the Author(s)

You May Also Like