Outlook: Cloudy or a monsoon?

Pork producers have been saved by the U.S. consumer this year.

June 18, 2015

It has been an exciting and sometimes terrifying ride on the pork industry roller coaster the past few years. From the ethanol-fueled cost increases of the late 2000s to 2009’s H2N1 influenza crisis to the first real Midwest drought in 24 years to the heights of record prices in 2014, and now back to losses in the first quarter of 2015, the pork industry has seen just about everything. Or has it? Here are factors to watch for in the coming 18 months.

Large and growing pig numbers

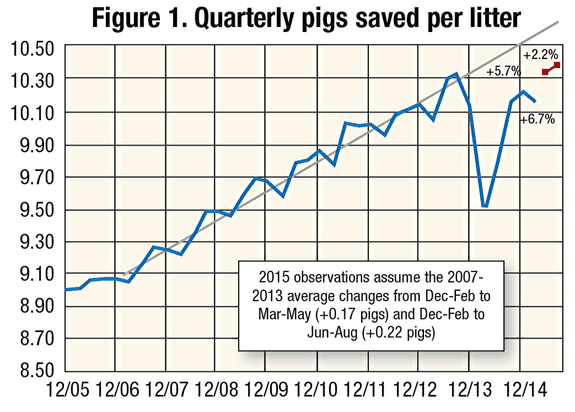

The USDA’s March Hogs and Pigs report indicated that market hog numbers were 7.2% larger than one year ago, and the breeding herd was up 2.2% for March 2014. The report also pointed to significantly more litters in third-quarter 2015 and a return to normal litter sizes (see Figure 1). This rebound in pigs saved per litter from the porcine epidemic diarrhea virus-driven shortfalls of 2014 could be a huge factor in 2016, especially if it portends a return to the near 2% growth trend of 2007-13.

No one knows exactly how PEDV will behave in the coming winter. Producers and their veterinarians know much more about fighting the disease, but just how much of this past winter’s success was due to management practices, vaccines or immunities established by outbreaks in the winter of 2013-14?

Until proven wrong, I am inclined to assume that PEDV will remain under control as it has since last summer. That would be a “worst-case” scenario for 2016 pig supplies. A close watch on the USDA case accession and University of Minnesota sow herd break numbers is definitely warranted.

Moderating slaughter weights?

I made some headlines a few years back when I said the only sure bets in life were death, taxes and 4% more broilers. The first two survive, but the broiler growth rate has slowed in recent years. I should have added “2% heavier hogs” to the list, but even that trend has been less stable in the face of higher costs and erratic hog prices. Weights increased sharply last year as integrated producers back-filled for PEDV pig losses and independent producers took advantage of rising prices and extra finishing space by feeding pigs longer, adding pounds and enhancing profits. Just the opposite has happened this year as weights have fallen by 5 pounds since Jan. 1 and are now 2.2% lower than one year ago.

This reduction has not even gotten the industry back down to the long-term trend in hog weight growth —and it will probably not do so. While I think weights will take as much as 2% off production this year versus last year, that conclusion is much more a function of the last year’s monster hogs. The moderating influence of hog weights will be short-lived. Look for them to add to production in 2016, provided costs remain at current levels.

Reasonable production costs

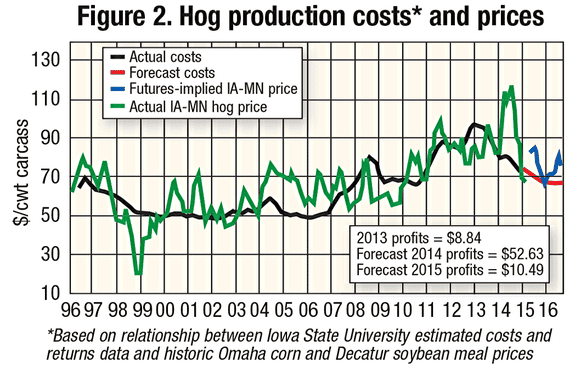

I say “reasonable” because I cannot bring myself to say that costs in the upper $60s per hundred pounds of carcass weight are “low.” But that is where current corn and soybean meal futures prices have costs pegged through October 2016 according to our model of average farrow-to-finish producers.

Highly efficient producers will be $4-$6 per cwt better than that. Much could still go wrong with the 2015 corn and soybean crops, but they have been planted at a reasonable pace and are in generally good condition. Soil moisture conditions have improved, and world supply conditions suggest that prices will remain well in hand. When compared to current Lean Hogs futures prices, these cost levels will see producer profits in every month from here to October 2016, the most distant month for which the Lean Hogs futures contract is currently offered. See Figure 2. This is an expansion scenario — so hog numbers are likely to continue growing.

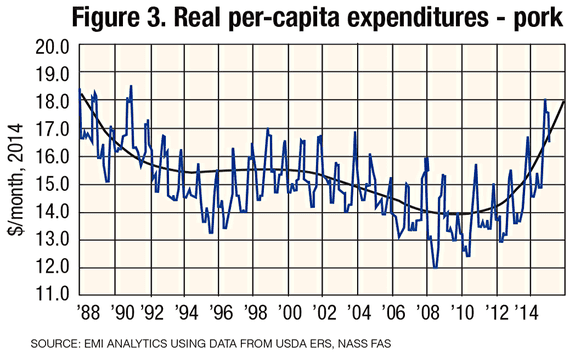

Robust consumer demand

Pork producers have been saved by the U.S. consumer this year. This year’s robust growth is the continuation of a trend that is now in its fifth year. See Figure 3. While the trend began in 2011, it has gotten red hot in the past two years with real per-capita expenditures for pork gaining 5.5% and 7.6%. The trend has gotten even hotter this year with RPCE exceeding year-ago levels by more than 12% each month through March, the latest month for which complete data are available. Year-to-date, 2014 pork RPCE is up 14.3% from 2013. The primary driver of this growth is the level of retail prices paid for pork by consumers, though per-capita pork consumption was a major factor in March when domestic pork availability was increased by much higher production and lower exports.

Export challenges

Those lower exports (down 13.4% year-to-date through March) were a major issue in this spring’s wholesale and hog price declines. While the loss of export sales due to higher relative U.S. prices and the West Coast port labor dispute were important, the most critical impact was to put pork buyers in the driver’s seat of the wholesale market. Buyers could wait for prices to “come to them,” knowing that packers were in a bad position with more hogs coming in the backdoor and slow movement out the front door.

While the port situation has been rectified, U.S. pork exports still face some substantial headwinds. The biggest is the value of the dollar, which increased roughly 25% versus the International Commodities Exchange’s Dollar Index between early July 2014 and mid-March. It has dropped about 5% since then, but remains at its highest level since July 2003. The Index value change is reflected by individual currencies. Canada’s dollar, the Brazilian real and the euro have all declined in value, making their pork products cheaper relative to U.S. product. In addition, the fall of the Canadian dollar, Japan’s yen and Mexico’s peso have made U.S. product relatively more expensive than product produced in those major customer countries. Korea’s won has fallen but not by nearly as much as have other customers’ currencies, helping make Korea one of the few growing markets for U.S. pork this year. China’s renminbi is pegged to the dollar, so there is no price advantage for its domestic product. A stronger dollar relative to other suppliers’ currencies means a stronger renminbi relative to those same currencies, thus providing competitors an advantage in China. Then there is China’s ractopamine policy. Only ractopamine-free pork is allowed into China, and the country has now moved to closely control the flow of the product through Hong Kong as well. There is no sign that the policy will change, so future growth will only happen when sufficient U.S. production and packing capacity meet the standards set by this, a huge potential customer.

Click for Meyer’s thoughts on mandatory country-of-origin labeling.

Packing capacity

The recent announcements of new plants in Michigan and Iowa may have everyone breathing a sigh of relief, but be careful; the cavalry may not arrive in time to prevent a massacre.

The plants are welcome additions and are necessary if the industry is to grow beyond the current record annual slaughter of 116.452 million head in 2008 or the current record quarterly slaughter of 30.433 million head in the fourth quarter of 2012. But neither will be here by fourth-quarter 2016 when the increased output from a growing, more-productive breeding herd may hit the market.

The Coldwater, Mich., plant will be built by Clemens Food Group and several large eastern Corn Belt producers. I have not seen capacity figures quoted, but I am told it will be a state-of-the-art plant, so I believe it will be capable of single-shift operations at 8,000 to 10,000 head per day. Double-shifting a pork plant always helps on unit costs, but Clemens has no history of double-shift operations. Hog supplies are not likely sufficient for two shifts at present, but a resolution to the COOL situation would make more Ontario hogs feasible, and I believe the eastern Corn Belt will see significant hog production gains over the next decade.

The Sioux City plant will be the second for the successful Triumph Foods-Seaboard Foods partnership. The plant is near a large supply of hogs and will have access to more animals from the Prairie Provinces when COOL is resolved. The companies have only discussed single-shift operations at 12,500 per day thus far, but I would expect this plant to move to double-shift operations if hogs and customers become available. The St. Joseph plant was double-shifted in its second year of operations.

Neither of these plants will be operating until 2017, and hog supplies could become burdensome in 2016. They are welcome but not likely sufficiently timed additions to capacity.

So what is the bottom line? Producers need to monitor growing conditions carefully this summer to decide on whether and when they should take price protection on feed ingredients. It’s simply the usual weather market in May and June. Be patient, but you should be ready to price one-third to one-half of new crop ingredients if the market shows signs of bottoming. I still expect hog prices to remain profitable this summer and, quite possibly, leave average producers in the black this fall. All of the futures prices through year-end are at or beyond the top side of my forecast range based on March 1 inventories and intentions, so I think producers should be pricing a high proportion of 2015 output at this time.

We have little data regarding 2016 supplies yet, but I’m concerned about 2016 prices and am especially fearful about the third and fourth quarters. Hedging decisions should always be made based on your financial and psychological ability to handle/withstand risk, and this time is no different. Any cash rallies between now and 2016 will likely be reflected in 2016 Lean Hogs futures prices, but so will any cash price declines. I am a risk-averse person so I would be taking some coverage for 2016 with a mind to perhaps roll the positions into options when the options’ time values get smaller and liquidity increases. I still fear that late-2016 could be a big problem as hog supplies exceed available slaughter capacity.

About the Author(s)

You May Also Like