New dynamic in pork demand is emerging

While food represents a small percentage of the average American's expenditures, meat in general and pork in particular are still sensitive to income levels.

December 13, 2022

The U.S. pork industry's two primary demand drivers, exports and domestic consumers, have tugged in opposite directions for most of 2022. Exports have been notoriously soft relative to 2021 when China was a major customer. Domestic demand has been outstanding for the past two-plus years, underpinning wholesale and hog values to a degree not seen in many years. A new dynamic is emerging, however, and it is worrisome.

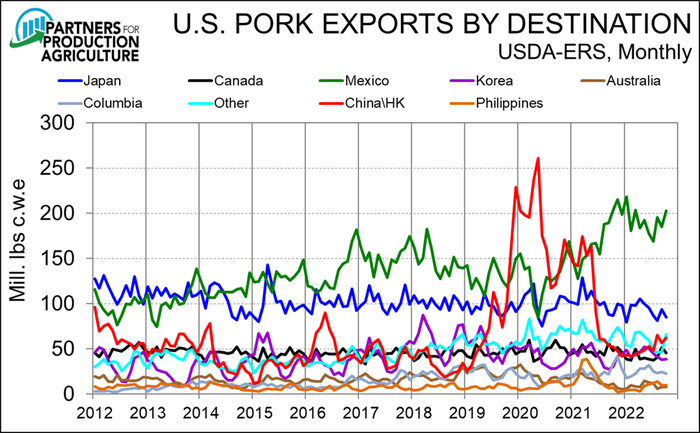

Exports continue to languish at levels well below those of 2020 and the first half of 2021. China's lower purchases (down 54% vs. '21 through October) are the reason for that lag but growth of exports to Mexico (+16% yr/yr through October) have made the picture much better than it might have been (see Figure 1). All other markets in Figure 1 are more or less within their historical ranges 2021. A notable growth market this year is Dominican Republic where African swine fever-driven needs have pushed exports up 38% for the year. Dominican Republic is, at least for the moment, the seventh largest market for U.S. pork.

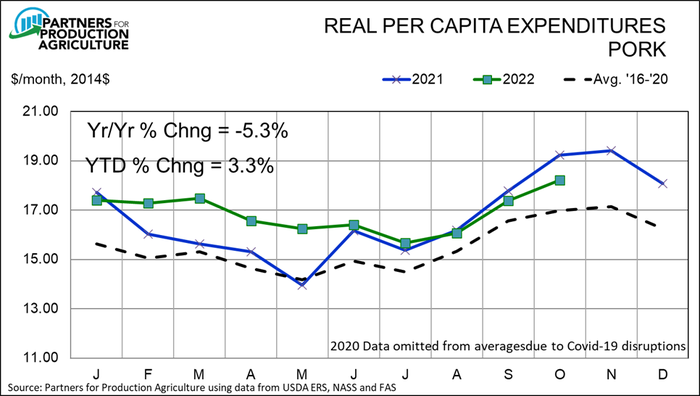

The worrisome part is domestic pork demand. Demand surged during and after the onset of the Covid pandemic as consumers switched buying habits to favor retail purchases and more at-home meal preparation. Real per capita expenditures for pork surged in last 2020, set a new record in 2021 and is poised to complete another record in 2022 as year-to-date RPCE through October is 3.3% higher than one year ago (see Figure 2).

The trouble is that those year-on-year changes are getting more negative as we progress to the end of 2022. I'm not too troubled that October pork RPCE was 5.3% lower than last year since October 2022 was the highest October on record. November 2022 was the highest non-Covid influenced month ever so I won't be surprised by a yr/yr decline in pork RPCE for this month. Final data for those computations will not be available until the first week of January.

But the trend is troubling, especially against a backdrop of clearly softer wholesale and hog demand over the past two months. I have stated many times that the fly in our pork demand ointment is likely to be inflation; not inflation of pork prices since that has primarily been caused by strong pork demand, but the impact of inflation on the purchasing power of consumers' incomes.

Higher prices across the economy simply erode the amount of dollars "left over" for any individual item. While consumers will still eat and food represents a very small percentage of the average American's expenditures, meat in general and pork in particular are still sensitive to income levels. My fear – which I think we are seeing come to fruition – is that inflation will eventually begin to impact consumers' meat purchases.

As evidence I would offer what its happening in beef and chicken. Beef RPCE has gotten progressively more negative relative to 2021 as the year has progressed and October beef RPCE was 9.9% lower than one year ago. YTD beef RPCE is down 3.3%. Chicken on the other hand has seen robust growth with October being 15.5% higher and YTD RPCE being up 9.4%.

If incomes and purchasing power are a challenge, one would expect beef, the highest priced product, to be hit the most negatively and chicken, the lowest priced product, to fare best. The data to date bear out that impact.

So what is in store? That largely depends on the inflation rates. There are some signs of it slowing but even lower inflation is still higher than we've been accustomed to. More importantly, higher interest rates slow the inflation rate by making the general business climate less attractive and lowering employment levels. Fewer jobs will be lower aggregate wages and, at least, slower-growing nominal income levels. The impact of slower growing or falling nominal income levels is the same as high inflation rates: lower real consumer incomes.

USDA will publish its quarterly Hogs and Pigs report on Dec. 23. I expect it to look very, very similar to the past two reports that showed little change in the breeding herd and a slightly smaller market herd. If that is true, supplies should be quite manageable the first half of 2023. But lower demand may leave pork and hog values significantly lower than the past two summers. Any growth in hog numbers the second half of '23 could be problematic relative to both demand and packing capacity given the looming closure of Smithfield's Los Angeles plant. Most observers believe that productivity growth will quickly make up for the reduction of Smithfield's western U.S. operations leading to a net gain in packer utilization ratio as early as Q4 2023.

Source: Steve Meyer, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like