Making your own bed

Remember that the times when the cash discovery is the "worst" is when the cutout is high relative to the cash market.

November 23, 2020

As of this writing, we have been trading the pork cutout contract for a little more than two weeks. The first few days of trade were nothing stellar as far as volume is concerned, but we have been slowly picking up transactions since the inauspicious start of the contract.

In my opinion, the production community owes it to itself to embrace this new contract as it has the potential to turn the power of price discovery to a more balanced scale. I see no chance for the Iowa-southern Minnesota, the western Corn Belt or any other cash-derived price discovery to save us from ourselves.

To be sure, it is imperative that we stop being our own worst enemy. First, before we address any other inequities in price discovery, we have to either stop producing more pigs than there is available shackle space, or we need to add capacity prior to another round of expansion.

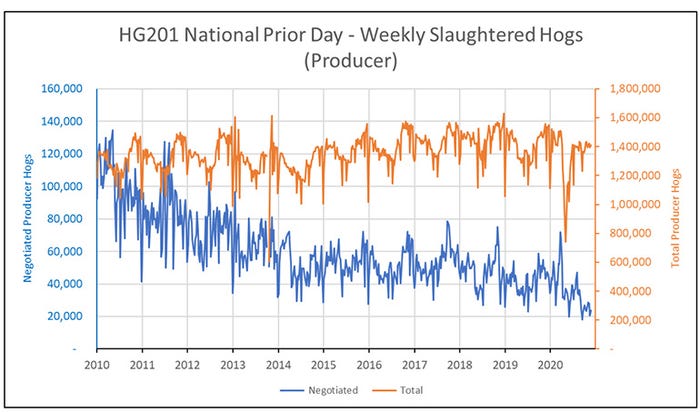

The volume of animals negotiated in the spot market has been declining for several years, reaching a pathetic 0.67%, (yes that's point six seven) on Nov. 12. This number is well below the threshold required to statistically represent a viable sample to determine prices. We have ridden this horse into the ground, and it is time to dismount. One vehicle is negotiation using the cutout as our base, not a raw dollar value and this is where the new contract comes into play.

One avenue would be if we, as a production community, would negotiate animal values in reference to a percentage or dollar relation to the cutout the printing of the western Corn Belt would be impossible and this drag on the index would mathematically go away (ostensibly turning the current index-settled into a cutout derivate). I am an advocate of this practice as a good start to owning our own future.

The other seemingly obvious path for producers would be the negotiation of long-term agreements in relationship to the cutout in whole, or at a bare minimum, as a large component of price discovery. This is not something that every packer wants to do. We have had demonstrated success in moving this direction from nearly every packer. The percentage relative to the cutout that the producer receives will likely not be as big as in the past. This is understandable, in my opinion, as packer efficiencies have come down with reduced runs and expenses are up to keep labor in the plant and provide COVID protections. With wean pigs being tight in the present, I believe we have a window to lean this direction and manifest some progress.

This leads me to the two current offerings from the CME and how every producer has a vested interest in the success of the pork cutout contract and has every reason to use this tool. If you have a cutout-based price discovery metric, the answer is a bit more clear with your motivation as you have a 1:1 direct hedge. Fair enough. What about someone with a less-favorable WCB price discovery method?

You, too, need to be hedging with the new contract, but not in the same manner. We have long derided the wide basis between the index settlement and the cash price when we are flush with pigs and the packer has them falling in his lap. The relationship between the cutout contract and the index-based contract could help mitigate some of that pain.

Remember that the times when the cash discovery is the "worst" is when the cutout is high relative to the cash market. A producer in this scenario may benefit by buying the cutout contract and selling the index as a basis hedge. It is not perfect on account of the index being influenced by the cash and the cutout, but it could certainly help ease the pain off convergence to some degree.

Either way, our collective vested interest is benefitted by added volume and viability in the cutout contract, let's use it.

Grain markets have been juiced in the past several weeks which has caught many people with less coverage than optimal and confused about how they missed the signals. If you are in this camp, I want to offer you some solace and encouragement.

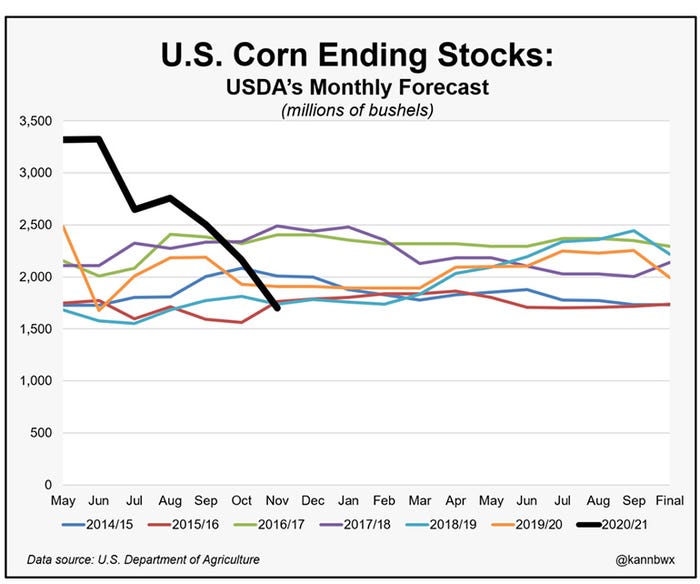

The attached chart, from Reuter's Karen Braun, depicts the carryout projections this year with the solid black line. Notice how in prior years, we are relatively stable from month to month and the lines are more or less horizontal. Not so this year. We went from a summer projection of thinking we were going to have way too much corn into a hot August that ushered in a yield-limiting Derecho.

Perhaps you have said to yourself, "I should have known." Maybe. But the USDA threw you a curve ball by increasing the carryout projections from July to August, giving you a tremendous head-fake, before continuing the compression of ending stocks projections.

From here on out, I believe the focus of the market will fall squarely on weather forecasts of the South American growing season. Everything else will be window dressing. From a technical perspective, it looks like beans want to test the Fibonacci retracement just shy of $13 and would likely drag corn with it as we set up an acreage battle for next spring.

Comments in this column are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like