Livestock price insurance: Do's and don'ts

LRP has been a godsend for pork producers of all sizes during what has been a very difficult time for pig farmers.

January 29, 2024

.jpg?width=850&auto=webp&quality=95&format=jpg&disable=upscale)

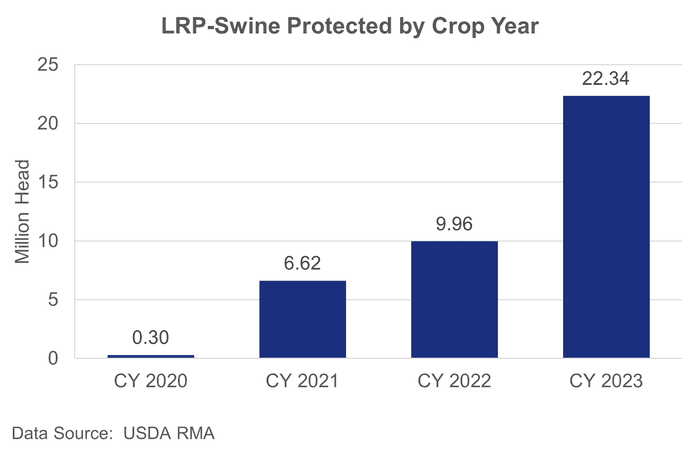

As we have written many times in this space, Livestock Risk Protection has become an integral part of many livestock producers’ risk management toolbox in recent years. The program is intended to protect farmers from unexpected price declines in the CME Lean Hog Index with customizable end dates, coverage levels and number of animals per endorsement. The reasons behind the dramatic uptick in LRP participation are straightforward.

Modifications over the past several years to increase head limits, increase subsidy levels and change the premium due date to help with cash flow needs have all been made with the producers’ best interests in mind. We have witnessed increased participation from producers, both large and small, over the past four crop years.

The LRP crop year runs from July 1 through June 30 and this uptick can be viewed over the past four completed crop years below:

Figure 1. LRP-Swine Participation by Crop Year.

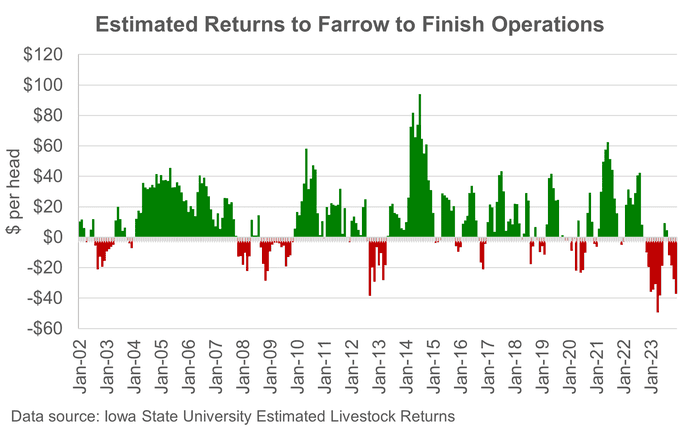

Through attending industry events and engaging with producers from around the country, one theme has been very clear—LRP has been a godsend for producers of all sizes during what has been a very difficult time for pig farmers. The level and duration of losses in the pork sector are unlike anything we have experienced since 1998 (and by some measures, it has been worse). According to Iowa State University’s Estimated Livestock Returns, returns for the 12-month period ending in December 2023 for farrow-to-finish operations were the worst since at least 2002.

Figure 2. Estimated Livestock Returns to Farrow to Finish Operations.

LRP is available up to 52 weeks in advance of hogs being marketed. Many producers of all sizes are receiving indemnity payments today when the lean hog index is below the cost of production because they were able to implement LRP coverage up to a year ago when available expected ending values and coverage prices were much higher. Without access to subsidized price protection, the margin environment over the past year would have been much tougher to stomach. It is not hyperbole to suggest LRP has helped some producers stay in business over this period, preventing the ripple effects of economic hardship throughout the rural communities where they are located.

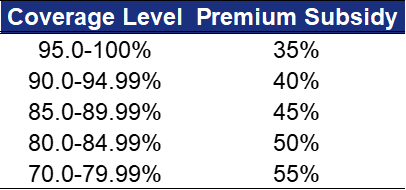

Oftentimes, LRP is thought of as similar to an exchange-traded put option. A put option provides a price floor while allowing for the retention of upside opportunity. While both LRP and put options provide a form of price protection, they are fundamentally different products with different mechanics. At times, LRP premiums (the amount a producer must pay for the protection) may be less expensive than put options at similar coverage levels and coverage length because the of the premium subsidy.

Rumors exist of a handful of producers and their insurance agents and/or commodity brokers engaging in a tactic to attempt to capture this difference in premium between LRP and a put option. This tactic is often referred to as subsidy harvesting. Subsidy harvesting is not only an ill-advised strategy that threatens the financial viability of the producer, it is an affront to the integrity of the program and should be avoided at all costs.

Subsidy harvesting overview

The process of subsidy harvesting involves the purchase of LRP and the simultaneous sale of the closest strike price exchange-traded put. The idea (albeit flawed for the reasons outlined below) is that by purchasing a subsidized LRP and selling a put, the producer captures the difference in premiums as a credit. There is also the belief the two cancel each other out without any associated risks.

While this may appear to be true at first, there are many hidden risks and consequences which may be deliberately not well-explained or factored in for those who choose to participate in this practice. Below are four primary reasons to avoid this practice at all costs.

The process of subsidy harvesting contains significant risk with limited upside. The maximum that can be gained by such a strategy is the difference in premium between LRP and the put option. It is important to note, however, that this is before consideration of financing costs and capital requirements, which would erode any expected return. This is especially true in high interest environments like we are operating in today.

From a cash flow perspective, there is serious risk to the operation in a down market. In reality, this is when the producer needs protection the most. Margin requirements would need to be maintained on the short put at all times. The cost of meeting these margin requirements becomes even higher in high interest rate environments, decreasing the supposed benefit of this strategy. Cash flows are generally strained when markets are falling and a producer could realize a substantial loss if their position had to be liquidated before the end date.

Engaging in this practice carries no risk management application and is purely a speculative trade. As such, lender-secured hedge accounts would not allow such actions to be taken with those funds. Using a non-secured spec account for the short put further drives up the cost of capital and makes the expected return even more negative. For a more detailed calculation on the expected negative return, see this communication we sent out to industry participants last month.

Federal crop insurance programs are designed to equip producers with the ability to weather market downturns. Because subsidy harvesting carries no risk management application, it is wasteful and an abuse of taxpayer dollars. It does not make sense from a risk/reward standpoint, nor does it align with the stated purpose of government-subsidized insurance products, which is to create a sound system of crop insurance and to prevent fraud, waste, or abuse of its programs.

CIH has been very clear on its stance against subsidy harvesting for years. Part of this has included industry education through speaking engagements on best practices around LRP, articles in industry publications on the merits of modifications to the program, white papers on the dangers of subsidy harvesting, as well as an educational seminar for lenders highlighting the risks of such actions to all parties involved.

Internal CIH policy prevents producers from engaging in any attempt to capture the differential in value between LRP and similar exchange equivalents. While the company and its affiliated brokerage entity have not seen its insured attempt this due to significant educational efforts, compliance staff reviews endorsements and corresponding brokerage accounts on a routine basis to ensure the practice is not taking place. It is our belief that a similar approach can and should be taken by all LRP stakeholders.

LRP opportunities

Looking at forward margins, hope may be on the horizon. Feed costs have come down and lean hog futures have bounced off lows established earlier in the month. Looking at our Demonstration Hog Operation model, profit margins over the next year are at or near the 75th percentile of historical profitability. While every farm and its cost of production varies and should be evaluated based on its own unique inputs and pricing mechanism, LRP could be a viable cash flow friendly, flexible tool to employ today to protect favorable CME Lean Hog Index values.

For many producers, the CME Lean Hog Index (which LRP settles against) more closely tracks their specific packer contracts and can therefore reduce basis risk. Also, because LRP is offered most days, producers can select coverage end dates that address periods during the year which have notoriously weak basis (late December and early January for example).

Since premium costs are established by the federal government and uniform across insurance providers, service becomes the differentiating factor that sets agencies apart. Contact us to learn more about how to optimize the use of this valuable insurance tool as part of a comprehensive risk management strategy for your hog operation.

Trading futures and options carries a risk of loss. Past performance is not indicative of future results. Insurance coverage cannot be bound or changed via phone or email. CIH is an equal opportunity employer and provider. © 2024 CIH. All rights reserved.

About the Author(s)

You May Also Like