Is the sky falling?

The negotiated market remains stubbornly high and shows no signs of caving in.

August 22, 2022

Hog futures have taken a thumping for the past several trading sessions. The price movement on the CME is not translating into a drop in the cash value of negotiated hogs – that is a good thing for pork producers. So we are left with a nagging question for the would-be bulls as the fundamentals are not bearish at all – are we wrong or is our timing off?

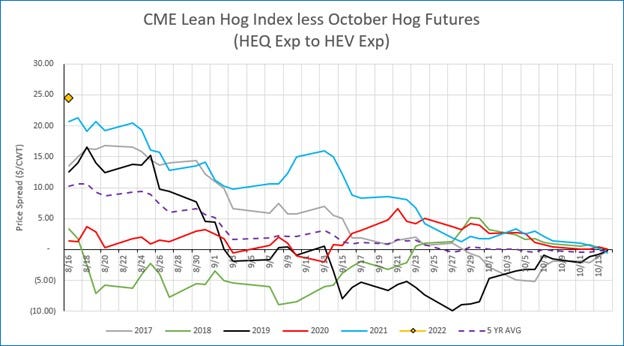

I would contend that the evidence points to higher markets in the future. Consider the attached graph depicting the discount that the the October futures are trading relative to the index, a record large spread. Something has to give. Either the cash market is about to witness a historic slide to meet the futures or the October board has been overly compressed and is due to rebound. I take the latter as more likely.

Consider this:

Domestic demand – as measured by disappearance at a price – has been fantastic for the pork market. Exports have been lagging given the pronounced absence of China this year as compared to last, but that year-over-year comparison is about to get a lot tighter as we start to compare the balance of 2022 numbers against more moderate shipments against the same period in 2021. A notable exception to the weaker exports has been Mexico, our biggest trade partner is stepping up with big purchases that seem likely to continue.

Weights are ebbing which would indicate the availability of market-ready hogs is current. The negotiated market remains stubbornly high and shows no signs of caving in. We are at a point where the seasonal increase in available hogs will weigh on the market, but I anticiapte this will be a glide slope rather than a crash. Our sources would identify steady packer demand and a limited supply of uncommitted animals. This is not bearish.

Packer capacity for the fall just got a little looser with an additional plant recieving a waiver for faster line speeds. What was anticiapted to be an acceptable situation with shackle space relative to hog numbers just got a little easier to manage. We should not see a severe imbalance coming into the holiday season.

Things are not too rosy in the rest of the world. China is suffering a record-breaking heat wave that is impacting people, industry and livestock. Similar situation in Europe as the heat and high (and likely going to get higher) energy prices squeeze producer margins. The dependency of Europe on the fickle hand of Putin twisting the valve on the Nord pipeline is evident. Our export competition is not knocking it out of the park.

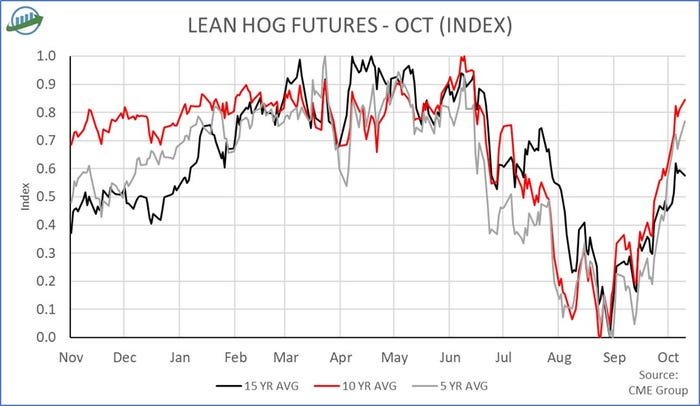

Consider the strong seasonal for October hogs to rally after Labor Day weekend. Our current swoon would be consistent with this pattern with an expectation of a strong rebound if history is any indication. It would seem that this seasonal tendency is overwhelming the otherwise-bullish factors in the market.

The bottom line of this market seems to be that the current pressure is consistent with the seasonal pattern and the fundamental market looks poised to support the October contract in the near future.

On the grain front, the ProFarmer tour kicks off this week and should provide some market information regarding the damage (or lack thereof) to the developing crop. The current forecast is in the realm of decent with moderating temperatures and the opportunity for rain across much of the belt for the next two weeks. December corn seems to have magnetic pull around the $6.20 mark, this is roughly in the middle of the range of the technical picture and until we find something to rock the boat I suspect we will hover in this area.

Soybean meal could get interesting in the winter months if Europe is deficit BTUs and the energy that would normally go to industry ends up heating homes. I am patient with soybean meal basis right now and would look to extend coverage on a seasonal break.

Comments in this article are market commentary and are not to be construed as market advice. Trading is risky and not suitable for all individuals. Click here to contact the author.

Source: Joseph Kerns, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

About the Author(s)

You May Also Like