Is the hog market overly optimistic?

U.S. pork production is expected to be record high in 2020 for the sixth consecutive year. Yet, hog prices are forecast to remain profitable this year and next.

USDA is forecasting record U.S. pork production and a domestic per capita supply that is the highest since 1981. They are also forecasting the highest hog prices since 2014. That is not a likely combination. None the less, the futures market is more optimistic than USDA.

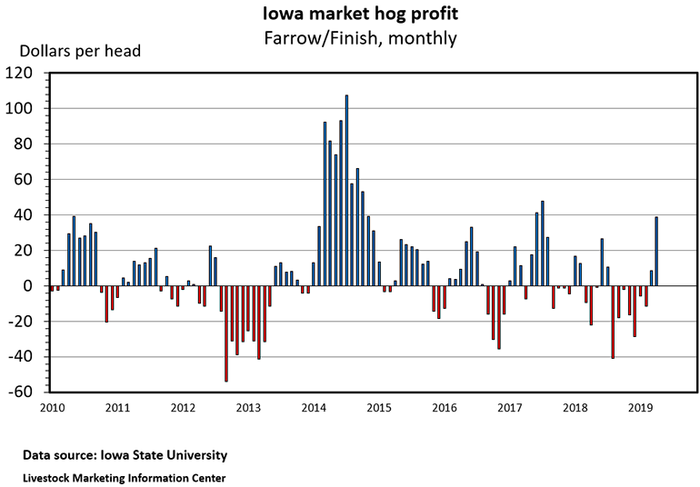

Calculations by Lee Schulz at Iowa State University indicate a typical Iowa farrow-to-finish operation earned $38.81 for each hog marketed in April. That makes April the most profitable month since July 2017 and only the second profitable month since last July. Schulz estimates cost of production for hogs marketed during April at $45.78 per hundredweight of live weight. Cost of production has been between $45 per hundredweight and $46 per hundredweight for each of the last nine months.

U.S. pork production is expected to be record high in 2020 for the sixth consecutive year. Yet, hog prices are forecast to remain profitable this year and next. Record production and profitable prices will require strong demand.

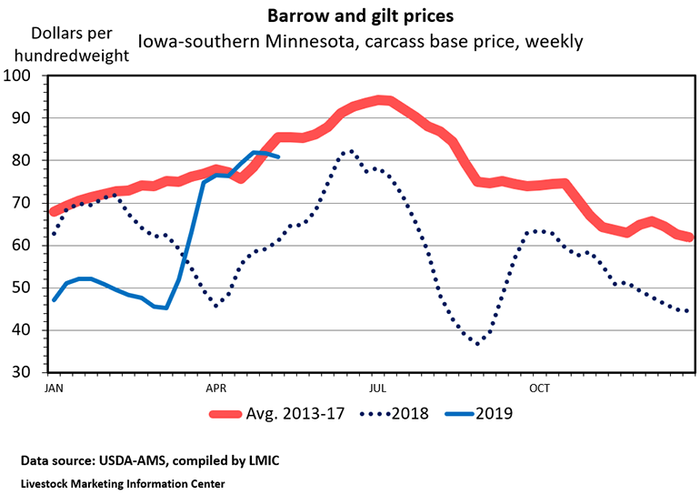

The average live weight price for 51-52% lean hogs in 2018 was $45.93 per hundredweight, down $4.55 per hundredweight from a year earlier. USDA is forecasting an average live weight price for barrows and gilts this year of $54.50 per hundredweight which will be the highest since the record year of 2014. USDA is predicting live hog prices in 2020 will average $60 per hundredweight.

The futures market is even more optimistic. The lean hog futures contracts imply carcass hog prices will average near $88.50 per hundredweight (roughly $64.75 per hundredweight live) for the rest of this year and around $85 per hundredweight ($62 per hundredweight live) in 2020.

USDA’s April World Agricultural Supply and Demand Estimates forecast put 2019 pork production at 3.8% more than last year with 2020 production up another 3.5%. With population growth under 1%, demand must remain strong to support expected hog prices.

U.S. pork exports were record high the last two years and are expected to increase even more this year and next. USDA has upped 2019 pork exports to 6.4% more than last year with 2020 U.S. exports up 6.9% from this year.

Last year, U.S. exports of pork muscle meat equaled 22.3% of production. That was down from the record of 23.2% exported in 2012. USDA is forecasting a similar level for this year — exports at 22.8% of production. Their latest projection has U.S. pork exports at 23.6% of production in 2020, a new record.

The growth in exports is not enough to stop the domestic supply from increasing. The U.S. per capita pork supply last year was 50.9 pounds per person. This year it is expected to be 52.1 pounds per person. In 2020, 52.9 pounds per person is expected. That will be the largest supply per American since 1981. It is hard to confidently predict high hog prices when per capita supply is increasing.

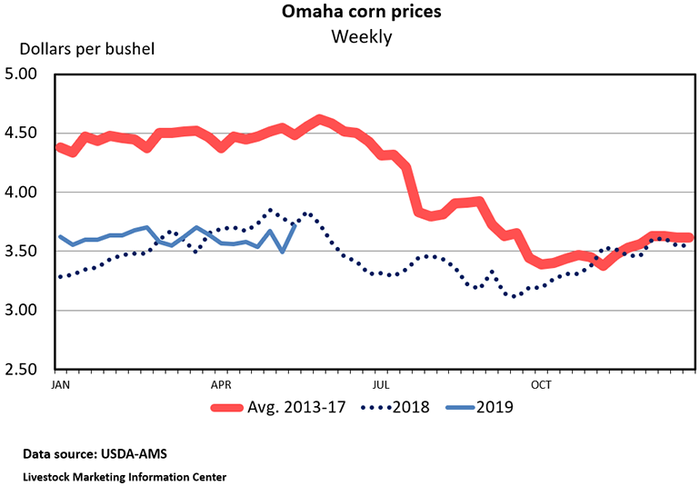

Feed prices have been low for the last several years. The first WASDE forecasts for the 2019-20 crop marketing year came out earlier this month. USDA is predicting more corn acres than last year and a 15-billion-bushel corn harvest for only the second time ever. This caused them to forecast the average price of a bushel of corn at $3.30, down 20 cents from last year. The soybean harvest is projected to be nearly 400 million bushels smaller than last year. Despite a smaller bean crop, USDA’s initial forecast has soybean prices at $8.10 per bushel, 45 cents per bushel lower than for last year’s crop.

USDA’s production forecasts for corn and soybean are beginning to look optimistic. Because of wet weather this spring, acres planted to corn and soybeans have been lagging well back of the average planting rates.

The average retail price of pork in grocery stores during April was $3.787 per pound, down 1.2 cents from the month before, but up 3.5 cents from a year ago. Both packer margins and retailer margins shrunk from the month before.

Hog prices and pork cutout value each increased in April. The live price of 51-52% lean hogs averaged $57.68 per hundredweight in April, up $15.22 from March, up $17.80 from last April, and the highest monthly average hog price since August 2017.

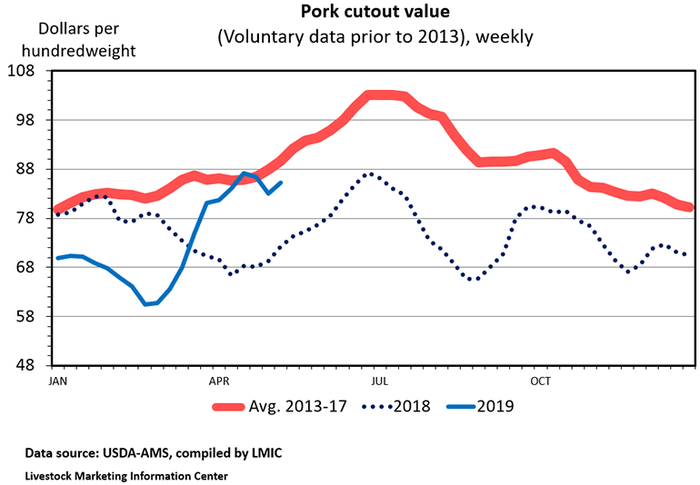

The pork cutout value during April averaged $84.69 per hundredweight, up $13.29 per hundredweight from March, up $16.59 per hundredweight from a year earlier, and the highest month since August 2017.

The expectation of record pork exports has been the driving force behind the runup in hog prices this spring. African swine fever in China has dramatically reduced Chinese pork production causing the market to expect very strong U.S. pork exports. But, that has yet to show up in the monthly trade data. U.S. pork exports during the first quarter were down 70 million pounds (4.6%). Most of the decline was due to a 69.5 million pounds drop in shipments to Mexico. Pork exports to South Korea and Japan were also sharply lower. Despite ASF, China purchased 18 million pounds less U.S. pork and Hong Kong purchased 14 million pounds less U.S. pork than in the first quarter of 2018.

The weekly data on exports of fresh, chilled or frozen pork muscle cuts show much larger shipments to China during April and early May.

U.S. pork imports during January-March was down 7.2% due to a big drop in imports from Canada. Australia, Colombia, Chile, Canada and Taiwan each bought at least 10 million pounds more U.S. pork in the first quarter than they did last year.

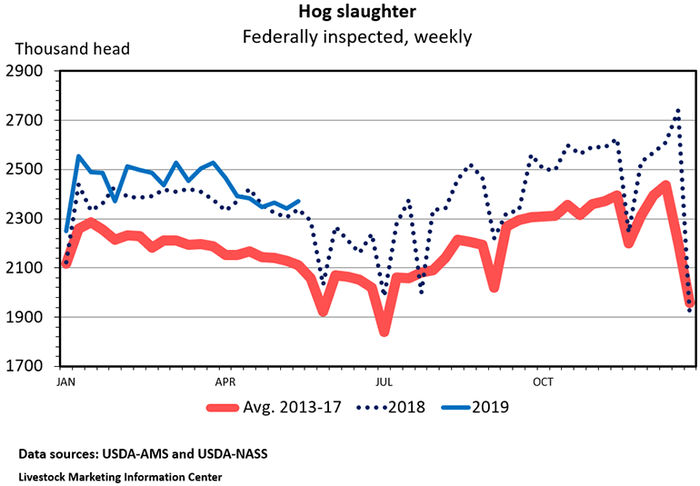

Recent hog slaughter has been higher than indicated by the March Hogs and Pigs Report. Since the first of March, federally inspected hog slaughter has been up 2.3%. This compares to an increase of 1.7% implied by the March market hog inventory. Hog slaughter during June-August should be up 2.4% year-over-year if the March hog inventory numbers were correct.

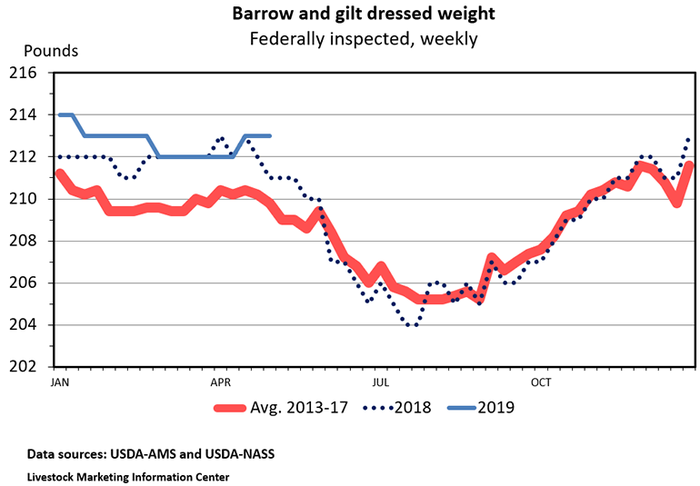

Slaughter weights in 2019 have been slightly higher than a year ago, pushing up pork production. Thus far in 2019, hog slaughter has been up 2.2%, but pork production is up 2.4%.

This afternoon USDA will release their weekly crop progress report. The monthly Cold Storage report comes out on Wednesday afternoon. The Livestock Slaughter report for April will be released Thursday. Preliminary data indicate April hog slaughter was up 6% year-over-year, with one more slaughter day this April than last. Daily hog slaughter appears to have been up a fraction over 1% in April, which is a bit less than implied by the March Hogs and Pigs report. USDA will release the April Cattle on Feed report on Friday afternoon.

Source: Ron Plain, who is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like